Category: RETIREMENT PLANNING

Everybody likes regular income. When it is applicable to the senior citizen or early retirees, it has become more meaningful. There are so many investment plans for regular or …

The Government has launched one pension plan, Pradhan Mantri Vaya Vandana Yojana (PMVVY) for senior citizens which give fixed rate of interest. The Government has set LIC to operate …

National Pension Scheme (NPS) is a financial product you can use for your retirement planning. It is not much popular among the investors as it is less liquid and …

PPF is a good investment for the long term with the tax benefit. Generally, PPF is used as an investment avenue to reach retirement corpus. It is not advisable …

Are you facing a dilemma over the products in which you should invest for your retirement? Financial Planning for retirement is the most important financial goal to achieve for …

Atal Pension Yojana was announced by Government of India to assure the social security to its citizens at the old age. Finance Minister has announced this Atal Pension Yojana(APY) …

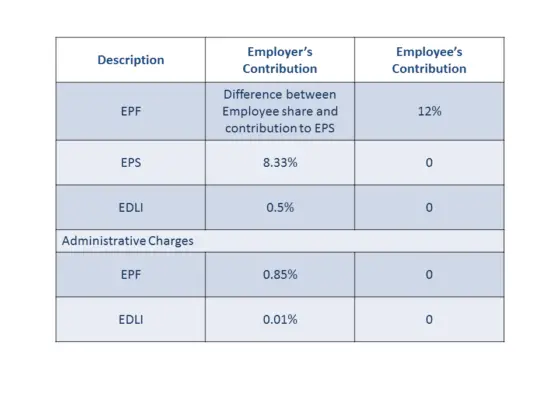

Employee Provident Fund (EPF) is one of the best products for retirement savings which is applicable for a large portion of salaried individuals in India. The EPF is regulated …

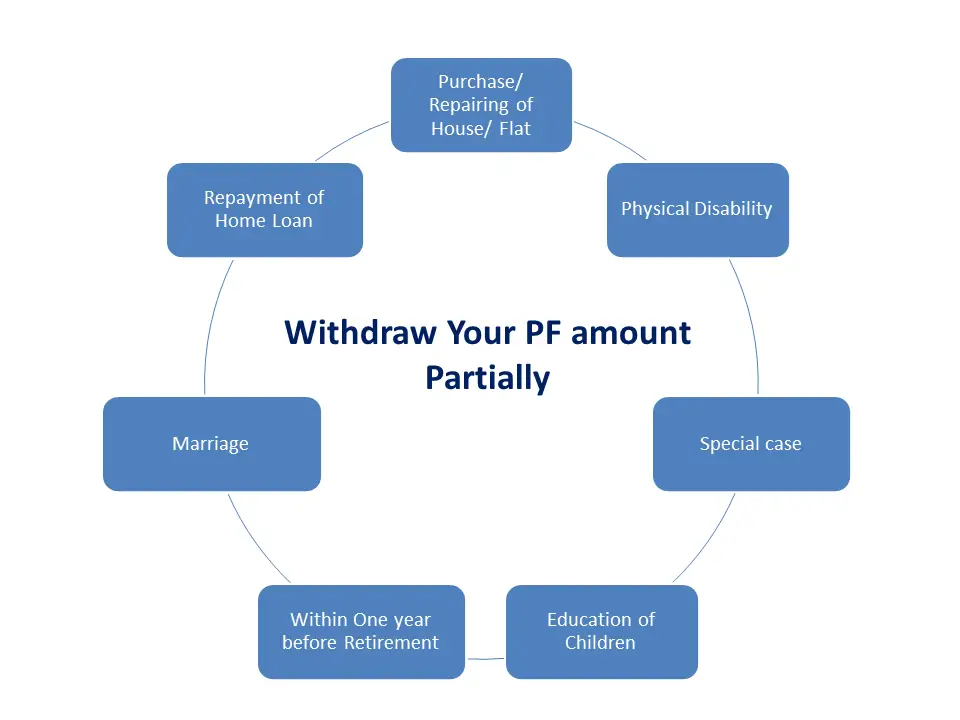

Provident Fund (PF) is the most powerful source of retirement corpus of salaried individuals. We all know that we get PF only after our retirement. Suppose, you have requirement …