Features and Benefits:

The Atal Pension Yojana has multiple feature and benefits as per the followings:

- Any bank account holder with AADHAAR can open an account under Atal pension Yojana scheme. The bank account should be linked with AADHAAR number.

- Those who are working in unorganized sector and not an income tax payer are eligible for government benefits. Other than those persons, all are having regular benefits of Atal Pension Yojana.

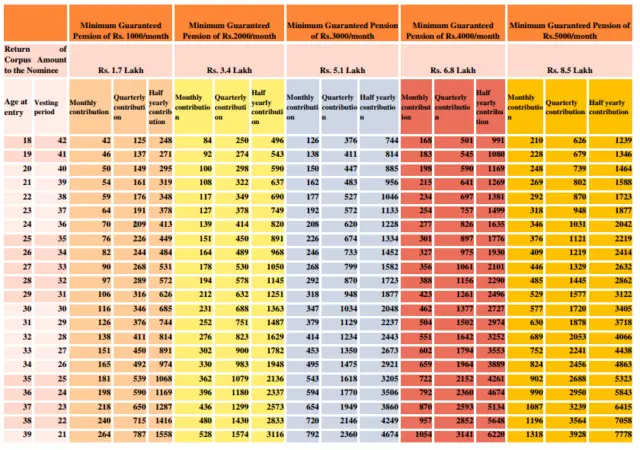

- The most important point is Government is giving a guarantee of monthly pension of Rs 1000, Rs 2000, Rs 3000, Rs 4000 or Rs 5000 per month as per the contribution. It means under this scheme you will get at least Rs 1000 as pension per month.

- The 50% of contribution or Rs 1000 per year which is minimum will be given by Government for 5 years, who started the investment between 1st June 2015 and 31st December, 2015.The government will contribute a maximum of 5 years.

- The minimum duration of contribution to this scheme is 20 years. So, it’s a long term product.

- You can pay the premium monthly, quarterly and half yearly. You can also increase the contribution by intimating the bank.

- The invested amount will attract the monthly pension when you touch the age of 60 years.

- In case of death or terminal disease, you can withdraw the full amount before the age of 60 years.

- If you want to withdraw the money before 60 years of age, you will not get the government’s contribution and its interest earned.

- The contribution to Atal pension yojana is eligible for Tax deduction under the section 80CCD.

- Those who are under the following social security schemes cannot take the advantage of co-contribution from Government of India upon enrolling in APY. But they can enroll for the scheme without government’s contribution.

- Employees’ Provident Fund and Miscellaneous Provision Act, 1952.

- The Coal Mines Provident Fund and Miscellaneous Provision Act, 1948. 3

- Assam Tea Plantation Provident Fund and Miscellaneous Provision, 1955.

- Seamens’ Provident Fund Act, 1966.

- Jammu Kashmir Employees’ Provident Fund and Miscellaneous Provision Act, 1961.

- Nomination is mandatory to open an account under APY scheme.

- The savings bank account should be sufficiently balanced so that the money can be deducted from the bank account to the APY account on the specified date. If you are a defaulter to pay the amount, the bank will charge you fine. The fine structure is as per the followings.

- If the contribution is Rs 100 per month and below, the fine is Rs 1 per month

- Rs two per month if the contribution is Rs 101 to rs 500 per month

- Rs 5 per month for the contribution of Rs 501 to rs 1000 per month

- Rs 10 per month for the contribution of more than Rs 1000 per month

If you are not paying to the already opened account of APY for 6 successive months the account will be frozen. The account will be deactivated while you don’t pay for 12 months and the account gets closed if you don’t pay for 24 months to the account.

Here is the chart for approximate contribution for the different value of pension.

You can also calculate pension by using the calculator in the NPS Trust website.

If you want to know about other avenues by which you can get the pension without taking the risk, read Four Best Investment Plan for Monthly Income.

How to you apply Atal Pension Yojana online?

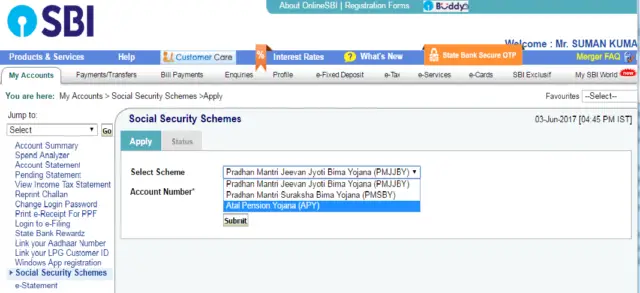

The Atal Pension Yojana can be done online through online banking. You have to have the e-banking facility with your savings bank account. Suppose you have an SBI savings bank account and you have also the facility of online banking.

- Log in to onlinesbi.com

- Go to the my accounts section.

- Click on Social Security Schemes.

- Under the social security schemes, click on Atal Pension Yojana and submit.

- And if you don’t have online banking facility, you have to download the form.

- It’s one page and very simple form. You have to fill up the form with details such as name, address, mobile number etc. and submit the form to your bank where you have a savings account.

Difference between APY and NPS?

The Atal Pension Yojana and NPS both are principally same. But the feature wise the scheme has some differences. For Atal Pension Yojana, maximum age to enter to the scheme is 40 years whereas you can enter NPS till 60 years of age. The pension amount is fixed for APY scheme. And for NPS, the pension depends on the contribution you made.

Only resident Indians can invest into APY whereas resident Indians and Non-resident Indians both can invest to NPS.

You can allocate your equity and debt in case of NPS but you cannot do for Atal Pension Yojana scheme. The pension amount is fixed for APY scheme such as Rs 1000, Rs 2000, Rs 3000, Rs 4000 and Rs 5000. But the NPS has no limit in the pension amount.It depends on your amount of contribution.

Also Read: NPS: Should you Invest or Not?

NPS Vs PPF: What Should You Select for Retirement Planning

NPS Subscriber can enroll for APY?

Yes, you can enroll for both Atal Pension Yojana and NPS. But you remember the difference between APY and NPS before investing in one of them or both

Conclusion:

The Atal Pension Yojana is the account for a pension of an individual after sixty years of age. The return from the scheme is very less than other products. Moreover, the co-contribution is for the workers from unorganized sector and those who are not EPF members. Hence, a large chunk of investors are already out of the facility.

The pension is taxable when you attain 60 year age and get the pension. You cannot withdraw the money which is the biggest disadvantage and you have to buy an annuity and cannot get some of the money as a lump sum. Therefore, in my view, it is not an attractive scheme to consider for investing.

Share the article.