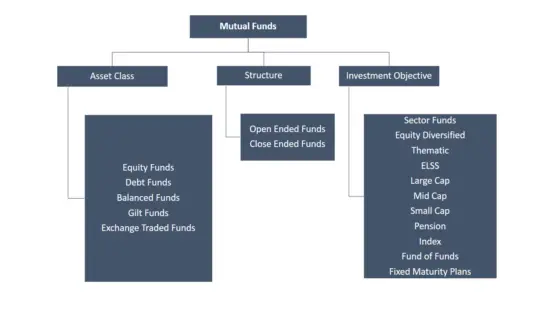

The mutual fund is a well-known investment method now. There are different types of mutual funds in which you can invest. You can select a mutual fund virtually on …

Gold is always a very attractive investment for Indian households. India is the biggest consumer of world’s gold. India imports significant amount of gold every year. During the festive …

Recently I read a book called ‘Zen: The Art of Simple Living’. I am an avid reader and love to read books on investing, trading business, economics, psychology, behavioral …

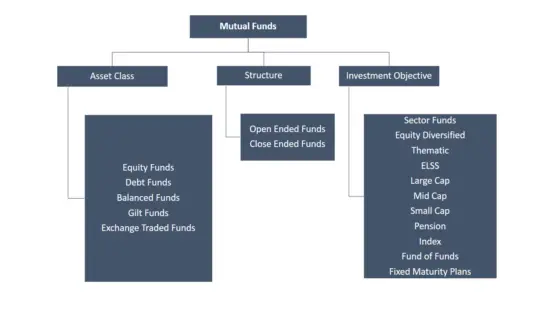

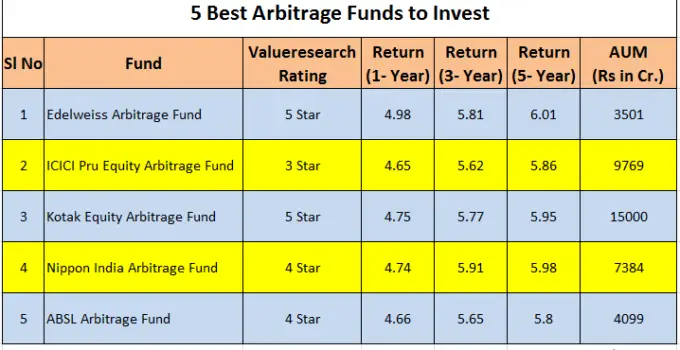

Arbitrage fund is a type of mutual fund which generates value for the investor with the differences of price across the markets. Typically an equity mutual fund buys a …

Many investors are getting interested to invest in the US stock market. How to invest in US stock market from India? I am facing such questions in and around …

Aadhaar card has become one of the fundamental documents in a person’s life in India. In all legal functions, we need the Aadhaar card for verification. It provides personal …

Investing in Mutual Fund is where a Fund Manager brings your money into functions. Equity Mutual Fund is one of the kinds of Mutual Fund where consumers invest their …

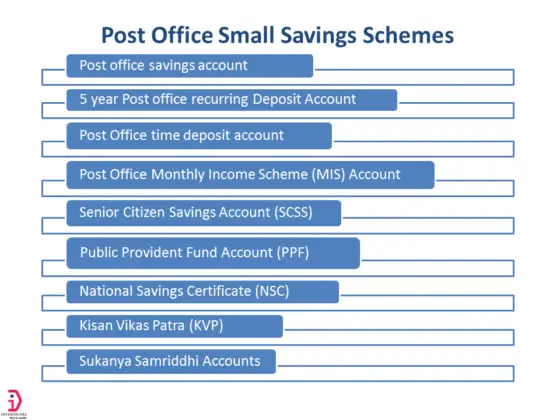

India Post offers various small savings scheme for citizens. They offer low risk, fixed return products. Some of the popular small savings schemes are National Savings Certificate (NSC), Kishan …