As the tax season came, you are busy to explore the various investments by which you can save tax. Though there are numbers of tax saving options are available in the financial market, one of the attractive schemes is Rajiv Gandhi Equity Savings Scheme or in short RGESS.

Rajiv Gandhi Equity Savings Scheme or RGESS is an equity tax advantage savings scheme for equity investors in India, with the objective of “encouraging the savings of the small investors in the domestic capital markets.” It was approved by The Union Finance Minister, Shri. P. Chidambaram on September 21, 2012.

Also Read: Five tips for saving tax which you miss.

Eligibility for Rajiv Gandhi Equity Savings Scheme

This Scheme is applicable for all New Retail Investors who have gross total income less than or equal to Rs. 12 lakh. Here, remember the word ‘new’ before the retail investor. So who is the new retail investor? The definition of a new retail investor is as per the following:

- individual (Not Applicable for NRIs, HUF, corporates/ trusts etc.)

Don’t have a Demat account and thus didn’t do any trading in the equity/ derivative segment of capital markets till RGESS account opening date or the first day of the ‘initial year’ in which he or she invested in RGESS, whichever is later. - Opened a Demat account but did not make any transaction in equity/ derivative segment till RGESS account opening date or the first day of the ‘initial year’ in which he or she invested in RGESS, whichever is later.

For taking the benefits under RGESS, the new investor has to submit a declaration, as in Form ‘A’, to the Depository Participant (DP) at the time of account opening.

Eligible securities, which are in RGESS account, will be automatically subject to lock-in up to a value of Rs. 50,000, unless the investor specifies otherwise by filling up the Form ‘B’.

How to Invest in Rajiv Gandhi Equity Savings Scheme

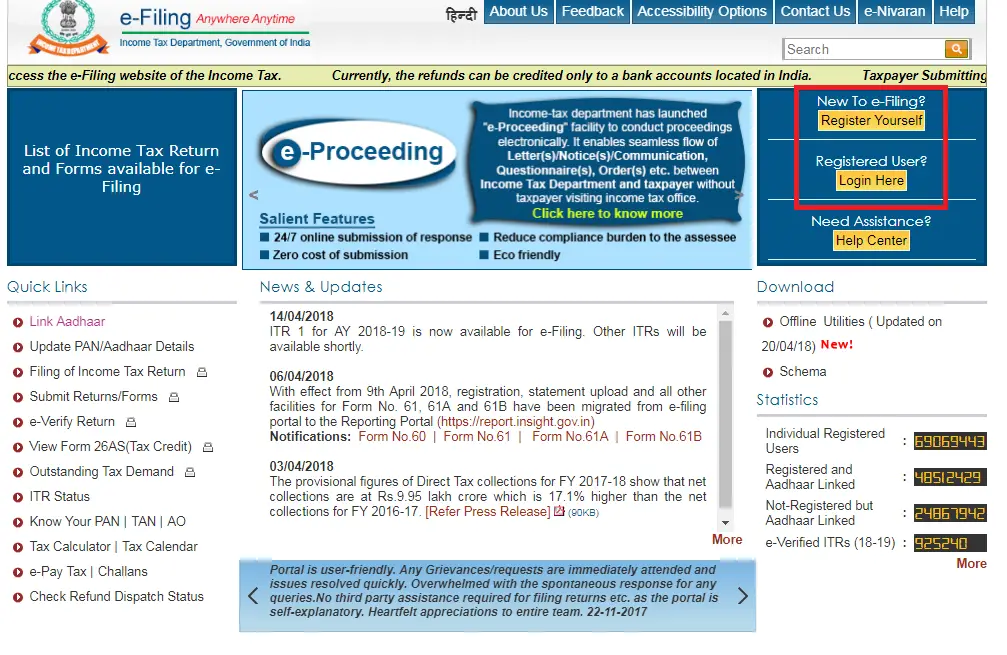

You have to open a Demat account to invest in RGESS and you have to also submit ‘Form A’ which is available with brokerage houses. You can invest in any of the eligible mutual funds or stocks in lump sum or in installments during the year in which the deduction is to be claimed.

The investments under the scheme would automatically be subject to lock-in during the first year. From second year onwards, you can sell the units of securities if you maintain the minimum amount for which you have claimed income tax benefit. If you don’t maintain the minimum amount, you have to reverse the tax benefit what you have availed earlier.

- The top 100 stocks at NSE and BSE i.e., CNX-100 / BSE -100 (This does not mean that one has to trade through NSE or BSE only. If the securities constituting BSE 100 or CNX 100 are listed and traded in any new stock exchange that may come up on a later day, the same will be eligible for RGESS.)

- Equity shares of public sector enterprises which are categorized by the Government as Maharatna, Navaratna and MiniratnaUnits of Exchange Traded Funds (ETFs) or Mutual Fund (MF) schemes with RGESS eligible securities as mentioned in (a) and / or (b) as underlying, provided they are listed and traded on a stock exchange and settled through a depository mechanism)

- Units of Exchange Traded Funds (ETFs) or Mutual Fund (MF) schemes with RGESS eligible securities as mentioned in (a) and / or (b) as underlying, provided they are listed and traded on a stock exchange and settled through a depository mechanism)

- Follow-on Public Offers (FPOs) of (a) and (b)

- New Fund Offers (NFOs) of (c) above

- Initial Public Offers (IPOs) of PSUs, which are scheduled to get listed in the relevant financial year and where the government holding is at least 51% and whose annual turnover is not less than Rs. 4000 cr for each of the immediate past three years.

Here is the eligible Mutual Funds and ETFs.

Also Read: 1. Basics of Mutual Funds in India

2. How to Judge a Mutual Fund Performance

Tax Benefit

You will be eligible to get tax deduction u/s 80 CCG of the Income Tax Act, on 50% of the amount invested subject to a limit of Rs. 50,000 as the investment in any financial year. This is over and above the Rs 1.5 lakh limit under Section 80 C. If you invest Rs.50,000 under RGESS, the amount eligible for tax deduction will be Rs.25,000 from your taxable income.

Those who are in the 10% income tax bracket, savings from tax liability for investments up to Rs. 50, 000 under RGESS is Rs. 2500 (plus cess as applicable) and for those who are in the 20% income tax bracket, savings from tax liability is Rs. 5000/-(plus cess as applicable). This deduction can be claimed for three consecutive years.

One can invest in non-RGESS stocks and mutual funds through the same Demat account and those investments would not be subject to conditions such as the lock-in of the scheme. If you invest on the last trading day of the financial year, you get a three-day grace period so that the securities get credited in the Demat account and you can avail tax benefit under the scheme.

So those who are busy in tax planning and searching for a solution, they may invest in Rajiv Gandhi Equity Savings Scheme, save tax and start their exposure to equity.

From financial year 2017-18, the fresh investment to RGESS is not eligible for tax saving. However, those who have already invested for the first year, can continue for another two years for tax saving.

Also Read: How a 25-year old should invest