“I have credit card debt of 3 lac on 4 credit cards (Tata/Citi/Scb/Indus) & after all my expenses I left with ₹15000/-. How can I come out of my debts?”

This type of question, you can easily found out on Quora and so true for many people. A credit card is a bad product when you use it recklessly. In the other way, it is a good product when you use it disciplined way. The 20-30 years age group persons are the target customers for the credit card who has high disposable income and can be lured for even more spending. If you cannot pay off credit card debt for a long time, it can be a curse in your life. Hence, before applying for a credit card know all the pros and cons.

If you are in the credit card debt trap, here are how to pay off credit card debt.

# Pay the Lowest Interest

As I have mentioned the above example, the guy has four credit cards. All the credit cards have the different interest rate. Generally, credit card interests are as high as 35% to 60%. The credit card with relatively lower interest rate attracts less interest whereas the credit card with high-interest rate attracts high interest and thus higher payment. Most of the people are unaware of the interest rate.

Most of the users are ignorant about the hidden charges of the credit card. It becomes easy to get into a cyclic credit card debt when you don’t know the actual cost of borrowing. Hence, my suggestion to credit card users that know the interest rate of all the credit cards where balances are outstanding and start repaying the outstanding amount of that credit card which attracts more interest.

Also Read: Best Credit Card with no annual fee

# Take from Relatives and Friends

This could be one of the great ways to pay the credit card debt. Borrow from relatives and friends to pay the outstanding amount of the credit card and you repay it in some installments.

Though it is very difficult to ask a friend or relative for money because of relationship it would be great if you have a close friend whom you can share your financial position and ask for money.

Don’t deviate from your commitment of repaying which will help you to take money from them in future also.

# Take Personal Loan

Taking a personal loan from a bank is a very good option one can think upon. Though it attracts some cost or interest it is very less than the credit card debt. The personal loans attract interest rate as low as 12%-18% which is far below than the credit card interest rate of 35%. A minor processing fee is also applicable for the personal loan. Considering all these personal loans is cheaper than the credit card debt. Hence you are shifting your costly debt from credit card to relatively cheaper personal loan.

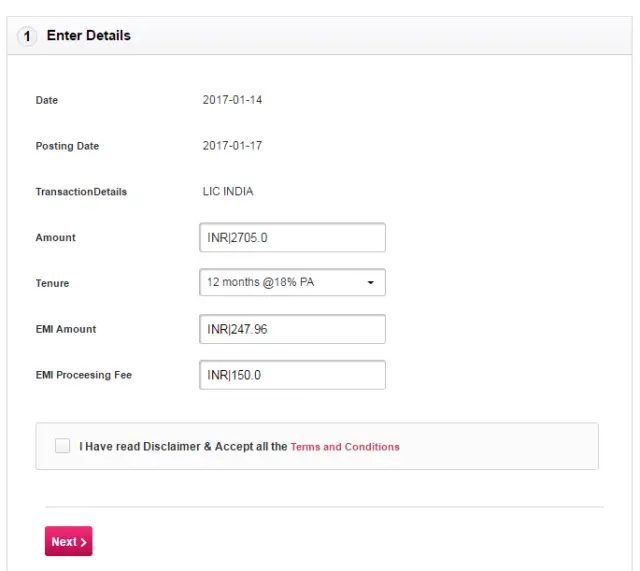

# Convert into EMI

Most of the credit card companies have the option of EMI or monthly installments. It has an option of 14%-18% interest rate and the tenure you can set from 3 months to 24 months. The tenure and interest rate depends on the credit card issuer or bank. For HDFC bank customers there is an option of Dial an EMI. You just call to customer care and ask for EMI and they will tell the various options with tenure and interest.

For AXIS bank customers, you log in your credit card account and besides the transactions, there are options as ‘Convert to EMI’. From the options available you can choose according to your requirement.

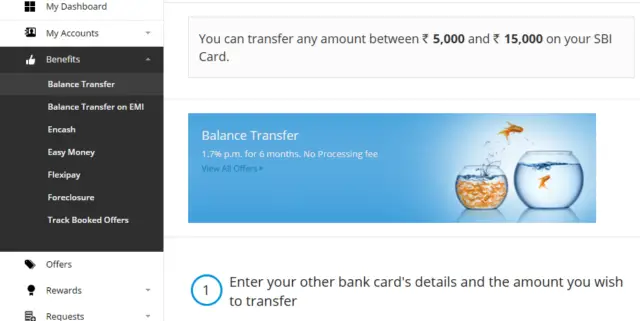

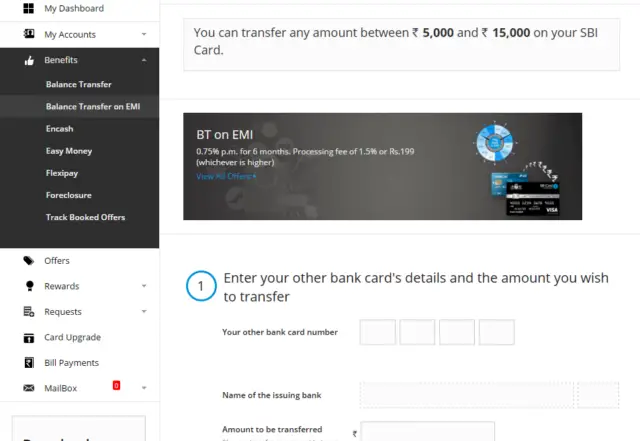

# Balance Transfer

You can transfer your outstanding credit card balance to another credit card. Some of the credit cards are giving 60 days free credit when you are shifting your outstanding balance of other credit cards. But be aware of processing fee and other charges. Also, know the charges after the interest-free period and try to repay the entire balance within that period.

The SBI credit card is asking 1.75% per month interest on balance transfer for 6 months with no processing fee.

In another offer, SBI credit card is asking for 0.75% interest and Processing fee as Rs 199.

Effective way of using Credit Card

I have covered the above points to pay off your credit card debt but it is always a good option not enter into a credit card debt. The credit card can also ruin your entire financial planning and you have to protect it by optimal use. You can also follow the below-mentioned tips.

- Don’t do high-value transactions with the credit card which are difficult to repay in one time.

- Set a reminder of the bill well above in time; so that you can get enough time to pay the bill.

- Carry a Debit Card instead of a credit card and inculcate the habit of using a debit card instead of a credit card.

- Pay through credit card when it is really urgent and necessary.

If you have any more thoughts, comments on this article I am happy to hear that.

Follow me on Quora to read various answers on Personal finance.