The time has come to file the income tax return for the Assessment Year 2017-18. But do you know whether you have to file income tax return or not? Many of us think that I have paid the taxes, so I need not bother about filing the income tax return? Someone is not a taxpayer as the income is below the specified limit. Is it mandatory to file income tax return for them? If someone has more than one income which ITR form to file for return? These are the common questions which are coming to taxpayers mind very often. Hence, I have taken this topic to clarify the readers.

What is Income Tax Return (ITR)?

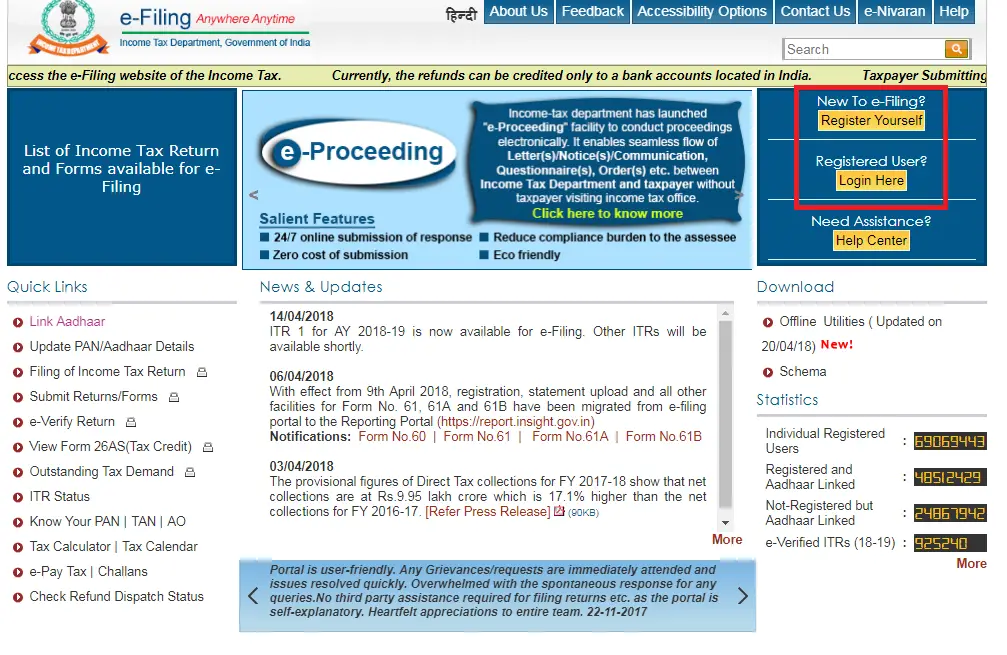

Income Tax return is a document about the income and tax details that you submit the Government concerned tax authority. Indian Citizens have to file income tax return to the Income Tax Department of the Government of India. If you pay more than the money you should actually pay for income tax, you will get the return to your bank account.

Is it necessary to file Income Tax Return?

As It has been discussed earlier that many of us think that the income tax return is not mandatory to file when the TDS has been deducted from the account. It is not the correct statement. If the gross taxable income exceeds the basic exemption limit you must have to file income tax return.

The basic exemption limit is different for different categories. Rs 2.5 lakh is the basic exemption limit for Individual/ HUF taxpayers. Senior citizens (above 60 yrs age) have the limit of Rs 3 lakh and the senior citizens with 80 years old have the limit of Rs 5 lakhs. Now, what is the gross total income? The gross total income is the total income minus your basic exemption such as medical, conveyance, HRA. It is the income before deducting the savings which are tax exempted.

Also Read: Five Tips for Saving Tax by Which You can save lakh

Advantages of Filing Income Tax Return:

The advantages of income tax return filing which I can see are as per the followings:

- The first requirement which I have seen is during the home loan application. Banks and NBFCs want the last two to three years IT return for processing the home loan. It is also applicable for other loans such as car loans, personal loans etc.

- ITR filing is required to apply for a credit card. Sometimes credit card companies deny issuing the credit card if you did not file ITR for last two years.

- It can be shown as a proof of income if you require establishing a proof of income to any government department for any other purpose.

- It is mandatory for VISA processing of some countries.

- You can also add up your business losses to carry forward to the subsequent year if you file income tax return every year.

- If you avoid the filing of income tax return (even if you have paid the complete income tax ), the department may impose a penalty on you.

What are to be kept handy to file IT return?

The following things need to be kept with you while filing the IT return:

- Form -16: This document is having the salary details and the TDS deducted by your employer. You will get it from your employer. If your employer has not given till now, you specifically ask the HR or concerned department to issue the Form-16.

- Form-16A: This is the statement from the different organization who has deducted tax from you such as banks, financial institutions etc.

- Bank account Details: You should be ready with all the bank account details you have. If you have more than one account, you need to furnish the details all the bank accounts. So be ready with account numbers, IFSC Code, Branch etc.

- Proof of Investments: The documents for investments and purchase/sale of property need to be kept with you for record purpose. These documents need not be submitted with ITR but in the case of verification from Income Tax Department, you need to show all the documents.

Which ITR should you use?

There are seven forms available on the Income Tax website for filing return. You should know what is applicable to you before filing the return. Many taxpayers omit their capital gains or any other income while filing the return to avoid complicacy or hiding the information. This is not at all desirable from taxpayers.

Here are the following tax return forms and when to use it:

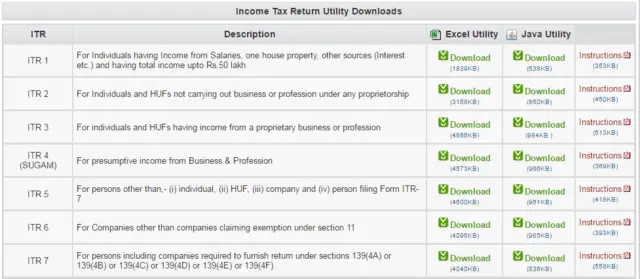

ITR-1:

This form is for individuals who have income from salaries, one house property and other sources such as interests, dividends etc. This form is applicable for the total income of Up to Rs 50 lacs.

It cannot be used for the following cases:

- Income from more than one house property.

- Income from lottery or horse race

- Capital gains, if any

- Agricultural income of more than Rs 5000

- Income from Business

- Income from source which is outside India

- If the total income exceeds Rs 50 lakhs

ITR-2:

If your income is more than Rs 50 lacs, you have to use the ITR-2 for income tax return filing. This for is applicable in case you have capital gains, foreign income and agricultural income of more than Rs 5000. If you are a partner in a farm and do not have any income by means of salary, interest etc., you have to fill up ITR-2 for return filing.

You cannot file ITR-2 if you have any income from business/ profession under any proprietorship.

ITR-3:

The individual/ HUF who has proprietary business or profession fill up this ITR.

ITR-4 (Sugam):

This form can be used by Individuals/HUF and partnership firms for the assessment year 2017-18. This is applicable for the following cases:

- Business or Profession Income

- Income from Salary/ Pension/ One house property

- Income from other sources excluding the income from lottery or race courses

When you cannot fill up the ITR-4S:

- You have income from more than one house property

- Income from lottery or race course

- Agricultural income of more than RS 5000

- You have capital gains from the sale of property, Mutual Funds, Stocks

- Income from agency business/ income through commission for brokerage

- Having an asset located outside India/ having income from any source outside India.

ITR-5:

This form is for LLPs, AOPs (Associated of Persons) and Body of Individuals.

ITR-6:

This for is applicable for companies which are claiming exemption under section 11 of income tax rule.

ITR-7:

This form is to be used by the companies or trusts such as research organisation, news agency, educational institution, hospital etc.

Apart from the above, remember the following points while filling up ITR:

- If you deposited more than Rs 2 lakh cash during demonetisation, you should report in the income tax return.

- Show the interest received in the savings accounts and fixed deposit. Maximum taxpayers don’t show the interest income as it is very less or tax-free. The interest earned in savings account more than Rs 10,000 is taxable and the interest from fixed deposit is taxable. You should be ready with the TDS certificates while filling up the ITR.

- If you have any foreign assets and income disclose it and fill up the proper ITR which is applicable to you.

- ADHAAR is now mandatory for the tax return. If you have valid ADHAAR card or number, don’t forget to link it up with PAN and quote in the ITR as well.

- If you have changed your job last year and your form-16 from the present employer does not reflect the income from the previous employer, you should add that income at your own and filed the ITR accordingly.

- Pay the self-assessment tax or balance income tax via challan 280 if you found that you have paid less tax.

Conclusion:

It would be great to submit the income tax return within the due date i.e. 31st July. For businesses, the last date of filing return is 30th September. You can also revise the IT return up to the next financial year. Further, don’t hide any information related to income and tax, because everything is mapped with the PAN number, so it may trouble you if there is any information gap between your return and actual income. If you have paid more income tax and about to get the refund from the income tax department, file the return quickly. By this way, you will beat the rush of last hour and get the early bird advantage to have your return quickly in your bank account.

Liked the article, share it with others. 🙂