The maximum benefit of savings early in life is the power of compounding. If you understand this principle and apply in your life it would be considered that you can manage your finances easily. Compound interest is the interest on the principal as well as on earlier accumulated interest.

Compound Interest – The eighth wonder of the World as said Albert Einstein (1/n)

— Investdunia (@investdunia1) June 19, 2020

The power of compounding can be best illustrated as by following examples.

Example 1:

Suppose, Mr. A and Mr. B is working in the same office. The age of Mr. A is 30 years and Mr. B is 35 years. They are planning to save for their retirement. Based on the requirement, they have come to a conclusion that Rs 1 crore will be enough for their retirement corpus respectively. The retirement age is 60 years, in this case.

Now, for Mr. A Rs 1 crore is to be accumulated after 30 years.

Mr. B has only 25 years’ time to accumulate the retirement corpus i.e. Rs 1 Crore

If we consider 10% as the annual interest rate Mr. A has to save Rs. 4423 per month whereas Mr. B has to save Rs. 7537 per month.

Hence, Mr. B has to save Rs. 3000 per month more than Mr. A to achieve the same goal because he has set the target 5 years later.

|

Mr. A |

Mr. B |

|

| Goal to be Achieved |

Rs 1 Crore |

Rs 1 Crore |

|

Time to achieve |

30 years |

25 years |

|

Interest rate |

10% |

10% |

| Amount to save per month |

Rs 4423 |

Rs 7537 |

Example 2:

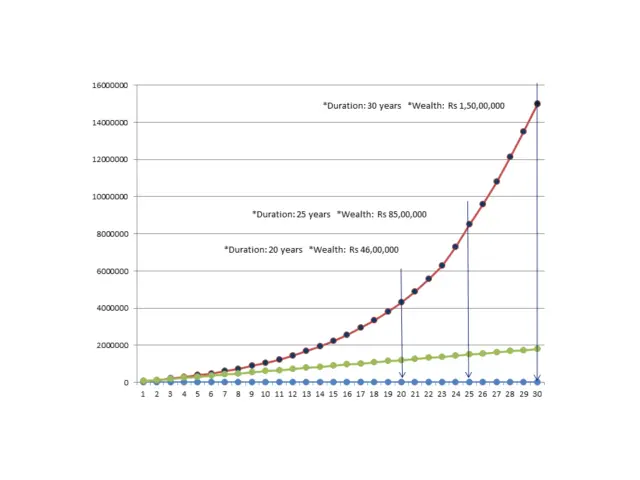

Let’s consider a person of 20 years old wants to save Rs 5000 per month. The investment is growing at 12% per year. After, 20 years the value of accumulated investment is approx. Rs 46 lakhs. If the person continues to invest for another 5 years, the wealth would be Rs 85 lakhs. And at the end of 30 years, the value of the total investment is Rs 1.5 crore.

From the above example and graph, you can easily follow the difference between initial years and last few years of investment. In the last five years of your investment, the investment is grown by almost Rs 65 lakhs. Hence, start investing from today. If you take the investment decision late, the wealth creation will be harder and harder.

The PPF is the classic example where we get the benefit of it. If you save Rs 12000 every month in PPF, considering the average return of 8.5%, you will get Rs 42.5 lakhs. Moreover, you will also get the advantage of saving income tax in PPF.

Also Read: Tax Planning: Various Ways of Saving Income Tax

Conclusion:

From above, I am sure that you have felt the importance of saving early. You can also feel that how 5 years of saving at the start of your career will make a big difference. It is advised by the experts that try to save from the first salary for your retirement

Know More: Best Pension Plans in India and What Should you Choose for Your Retirement

We do not foresee our distant future and thus not feeling that saving is important for future and also spend a lot than invest. We think this is too early to invest and think about the future.

Yeah