Do you want to start investing in the stock market? The first step for investing in a stock market is opening a Demat and Trading account. Read the full list of Demat and Trading Account service providers and choose the best Demat and trading account in India which serves your requirement. If you have decided to invest in stocks and kind of confused what to do, I am sure the article ‘Step by Step Guide on How to Start Investing in Stock Market in India’ will help you in a big way.

There are two types of Demat service providers, one is full-service brokers and another is discount brokers. The brokers which provide you the share tips, research reports etc. with the trading platform is called as full-service brokers. ICICI Direct, Axis Direct, SBI Cap Securities are some of the full-service brokers. The brokers which provide only trading platform is called as discount brokers. The examples of discount brokers are Zerodha, Upstox etc. Know all the differences between full-service brokers and discount brokers.

What is Demat and Trading Account?

A Demat account is an account where shares and securities are held electronically and investors may not have the possession of physical certificates. It minimizes the risk of mishandling, theft etc. A Demat account has annual maintenance charges for storing the shares and securities.

A trading account is an account by which you can trade stocks in the stock market. This is linked to the Demat account. The brokerage charge is applicable for buying and selling the shares.

Also Read: How to Invest in US Stocks from India

What are the factors to be considered while opening a Demat account?

1. Trading Platform

The trading platform is the most important thing to consider for every investor. The technology is fast changing and the platform should be upgraded time to time to make it fast. The user interface should be easy to use. The trading platform should be present on desktop, Web and mobile or app version so that you can use it anytime according to your convenience.

2. Customer Support

Customer support is an important factor to consider. Many Demat service providers have poor customer service which can lead to late fixation of the problem and you can miss an opportunity in investing.

3. Brokerage

Brokerage is the commission of trading account Service provider for buying and selling of shares. It depends on the traded value; the more you trade the brokerage is more. Some brokers charge a flat fee on unlimited trading.

4. Annual Maintenance Charge (AMC)

Annual Maintenance Charge (AMC) is taken by brokers for the Demat account. The AMC varies from Rs 300 to Rs 1500 depending on the service providers. Many brokers take account opening charges also.

5. Transparency/ Reliability

The service providers should be transparent in charging the customers and handling the securities. The periodical statement to customers stating the traded and holding securities will obviously boost the investor’s confidence in service providers.

Considering the above factors, here is the detailed review and comparison of 15 best Demat and Trading Account in India 2020.

- Zerodha

- Angel Broking Demat and Trading Account

- IIFL Demat and Trading Account

- Kotak Securities Demat and Trading Account

- Upstox Demat Account

- Religare Demat Account

- Choice Demat Account

- Sharekhan Demat and Trading Account

- Motilal Oswal Demat Account

- Aditya Birla Money Demat Account

- ICICI Direct Demat and Trading Account

- Axis Direct Demat account

- SBICAP Securities Demat Account

- HDFC Securities Demat Account

- Yes Securities Demat Account

Best Demat account in India for Beginners

#1. Zerodha

Zerodha is one of the first brokers in India who has started the discount brokerage service. Now it is the largest broker in India. Zerodha has now 17 lakh+ active clients which contributes more than15% of daily retail trading volume across NSE, BSE, MCX.

Zerodha offers trading services in stocks, futures and options in equity, commodity and currency derivatives.

The brokerage of Zerodha is very small. There is no minimum brokerage charge per trade. The brokerage rate is Rs 20 or 0.01% whichever is lower per executed order on intraday trades across all segments on all exchanges. There is no brokerage on all your equity delivery investments across the exchanges. You can calculate Zerodha brokerage for different trades across the segments.

As it is a discount brokerage firm it does not give any research report or recommendation call to its customers. Zerodha has great content in the form of Zerodha Varsity which covers all the fundamental and technical analysis. It is extremely useful to the new entrants to the stock market.

Features & Benefits:

- No Brokerage for Delivery. Delivery trading is totally free

- No minimum charges per transaction.

- Maximum charge per transaction is Rs 20 whereas brokers fixed the minimum charges.

- Margin of 3 to 14 times for intraday trading.

Trading Platforms:

- Kite Web – Kite Web is a web-based light weight and fast trading platform by Zerodha. It has hundreds of indicators, studies and tools on a powerful and customizable charting interface.

- Kite APP (Android/ IOS) – This trading platform is app based and available on Android and IOS. It’s very simple and easy to use.

- Zerodha Coin – It is a direct mutual fund investment platform

- Zerodha Pi – Pi is an installable trading platform with advanced charting, algos, strategies etc.

- Call & Trade – You can call & trade via this option by Zerodha with Rs 20 per order.

Zerodha Demat Account Charges:

- Demat Account Opening Charges (One time) – Rs 300

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 300 per year at the starting of the year.

- Trading Account Annual Maintenance Charge: NIL

Zerodha brokerage Charges:

- Equity Intraday – 0.01% or Rs 20 per trade which is lower

- Equity delivery – NIL

- Equity Future – 0.01% or Rs 20 per trade which is lower

- Equity Options – 0.01% or Rs 20 per trade which is lower

- Currency Futures – 0.01% or Rs 20 per trade which is lower

- Currency Options – 0.01% or Rs 20 per trade which is lower

- Commodity – 0.01% or Rs 20 per trade which is lower

Open a Zerodha Account now and save brokerage.

#2. Angel Broking Demat and Trading Account:

Angel Broking is one of the best Demat service providers in India. It is a member of BSE, NSE, MCX and NCDEX. Angel Broking offers very good support services to its customers.

It is also registered as a depository participant with CDSL. Angel Broking is also offering Investment advisory, portfolio management services, wealth management services etc.

Features & Benefits:

- Lifetime free Demat and Trading Account

- Flat 20% off on Online Trading Brokerage

- Open Demat account and start trading within 1 hour

- Get access to latest research reports

- Take margin up to 10 times of the deposited amount

Trading Platforms:

Angel Broking App – Angel broking is a comprehensive app with latest news, reports and real time updates. The cutting edge technology will help you to track your portfolio and give you personalized recommendations.

Angel Broking Trade – It is an web-based platform by which you can manage your portfolio and trade efficiently. You can also watch real-time updates with report and timely alerts.

Angel Speed Pro – Angel Speed Pro is an installable trading platform with 30 days intraday and 20 years historical data with 70+ studies.

Angel Broking Demat Account Charges:

Opening Charge for Demat and Trading Account – NIL

Annual Maintenance charges

Angel Classic (Initial Investment – Rs 10,000 to Rs 24,999) – Rs 450 per year

Angel Preferred (Initial Investment – Rs 25000 to 49,999) – Rs 450 from second year onwards

Angel Premier – (Initial Investment – Rs 50,000 to 99,999) – Rs 450 from second year onwards

Angel Elite (initial Investment – Rs 1 Lakh and above) – Rs 450 from second year onwards

Angel Broking Brokerage Charges:

| Trading | Angel Classic | Angel Preferred | Angel Premier | Angel Elite |

| Equity Intraday Trade/ Futures (Online) | 0.032% | 0.0176% | ||

| Equity Intraday Trade/ Futures (Offline) | 0.04% | |||

| Equity Trading (Online) | 0.32% | 0.224% | 0.176% | |

| Equity Trading (Offline) | 0.4% | 0.280% |

Angel Broking Demat Account Advantages:

- User-friendly web based/ application based trading platform

- Comprehensive daily, weekly, and specialized research reports.

- Trade across all devices- desktops, tablets, smartphones

- Automatic square off at 3.15 and investor can take margin up to 4 times the value in the account.

- Strong offline presence over 900+ cities

Disadvantages:

- Angel Broking does not offer 3 in 1 account.

#3. IIFL Demat and Trading Account:

IIFL (India Infoline) Demat and trading account offers industry’s best trading platforms and personalized portfolio analysis with award-winning research over 500+ stocks. IIFL is one of the few brokers which provide Demat services of both CDSL and NSDL.

You can view your entire portfolio, trade in equities, commodities etc. at single login option across all market segments of BSE, NSE, MCX and NCDEX.

Real-time data and speed of order execution across the different platforms ensure easy execution of a order at the desired level without any glitch.

Key Features & Benefits:

- Zero Account Opening Fee

- Zero First year AMC

- Exclusive Research on 500+ stocks

- 4% to 60% of the stock value as margin depending on the stock volatility

- Easy to use interface designed for optimal performance

Trading Platforms:

IIFL has three trading platforms to suit the different customers

TTWEB: It is a web based platform. You can access it from anywhere through internet.

TTEXE: It is an installable application for fastest trading. You have to install the application on your computer.

IIFL Markets: The mobile application which provides access to all information on a single screen and delivers a good trading experience.

IIFL Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 400 per year for Regular Account (FIrst Year free)

- Trading Account Annual Maintenance Charge: NIL

IIFL Brokerage Charges:

IIFL has different types of brokerage plans for the different type of investors. They have variable brokerage plan based on traded volume, Flat brokerage plan for active traders and Value-added subscription plan.

Variable Brokerage Plan

| Trading | Monthly Volume (Lacs) | Brokerage Rate (%) |

| Equity Intraday | <20 | 0.05 |

| 20-100 | 0.04 | |

| 100-500 | 0.03 | |

| >500 | 0.02 | |

| Equity Delivery | <1 | 0.60 |

| 1-5 | 0.55 | |

| 5-10 | 0.45 | |

| 10-20 | 0.35 | |

| 20-60 | 0.25 | |

| 60-200 | 0.20 | |

| >200 | 0.15 |

Flat Brokerage Plan

| Trading | Rate |

| Equity Intraday | 0.05% |

| Equity Delivery | 0.50% |

| Future Trading | 0.05% |

| Option trading | 1% of Premium or Rs.100/- per lot whichever is higher |

| Min Brokerage per share | Rs 0.05 |

Value added Subscription Plan

| Subscription Plans | Default | 2500 VAS | 5000 VAS | 10K VAS | 15K VAS |

| Value added Subscription Value | NIL | Rs 2500+GST | Rs 5000+GST | Rs 10,000+GST | Rs 15,000+GST |

| Equity Intraday | 0.05% | 0.04% | 0.03% | 0.03% | 0.02% |

| Equity Delivery | 0.5% | 0.35% | 0.3% | 0.25% | 0.2% |

| Future Trading | 0.05% | 0.04% | 0.03% | 0.03% | 0.02% |

| Option trading | 1% of Premium or Rs.100/- per lot whichever is higher | 1% of Premium or Rs.90/- per lot whichever is higher | 1% of Premium or Rs.80/- per lot whichever is higher | 1% of Premium or Rs.70/- per lot whichever is higher | 1% of Premium or Rs.60/- per lot whichever is higher |

There are more VAS plans up to Rs 1 Lac. Since this is a list of best Demat account for beginners, I have included only subscription plans up to Rs 15,000. If you are interested visit the full list of plans here.

#4. Kotak Securities Demat and Trading Account:

Kotak securities offer stock broking services and distributes financial products in India. You can trade in equity, IPO, mutual fund, ETF, Tax-free bonds, Derivatives etc. through a single login at one place.

Kotak securities provide in-depth stock market analysis and research reports besides the stock broking service. It is a depository participant of CDSL as well as NSDL.

Kotak securities offer a 3 in 1 account which includes a savings bank account. You need to block the amount from savings bank for trading. The money gets automatically deducted or credited in the savings account when you trade. You can also open a Demat and trading account only with Kotak Securities. In this case, the savings bank account is to be linked with this Demat account.

Features & Benefits:

- Seamless, Zero hassle trading

- Margin facilities available for intraday trades

- Can place an order even after market hours

- Get SMS alerts about the latest stock market, news, tips and movements

Trading Platforms:

Kotak Securities has different trading platforms to meet the customers’ requirement.

Web Based: It can be accessed through the web browser from anywhere. Kotak also offers a light trading website ‘Xtralite’ for the slow speed internet users.

Stock Trader App: It is a mobile application on which you can trade, check portfolio, see charts etc.

Trading Softwares (KEATProX and FASTLANE): KEATProX is an instable application for faster trading experience. You can install it on your PC or laptop. The FASTLANE is a java based application which gives you the same experience without any installation on your computer.

Call & Trade: Kotak also offers trading facility through its 1400+ branches and through call centers using call & trade facility.

Kotak Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – Rs 750

- Demat Account Annual Maintenance Charge (AMC) – Rs 50 per month for resident Indians and Rs 75 per month for NRIs

- Trading Account Annual Maintenance Charge: NIL

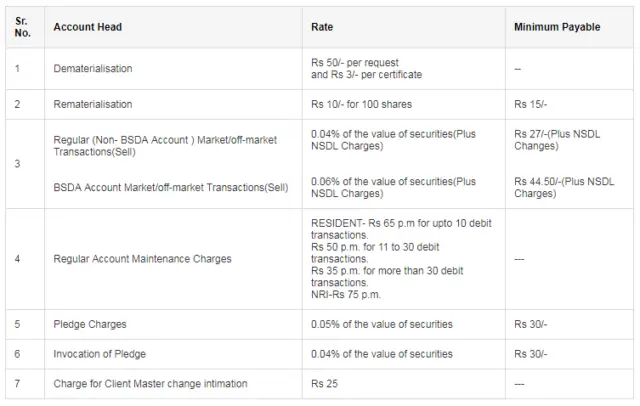

Other Charges

Kotak securities offer different brokerage plans

Kotak Securities Brokerage Fees:

Dynamic brokerage plan

| Trading | Monthly Volume (Lacs) | Brokerage Rate (%) |

| Equity Intraday | <25 | 0.06 |

| >25 | 0.05 | |

| Equity Delivery | <1 | 0.59 |

| 1-5 | 0.55 | |

| 5-10 | 0.5 | |

| 10-25 | 0.45 | |

| 25-50 | 0.35 | |

| >50 | 0.30 |

Fixed Brokerage Plan

| Trading | Rate |

| Equity Intraday | 0.49% |

| Equity Delivery | 0.049% |

| Future Trading | 0.049% |

| Option trading | Rs 300 per lot |

| Min Brokerage per share | 4 paise for delivery and 3 paise for intraday and future orders |

Kotak Securities Demat Account Advantages:

- Seamless transfer of cash and share. Get higher interest rate of savings bank account till you invest.

- Kotak securities offers wide range of investment products in single platform.

- It provides SMS alerts, market pointers and periodical research on various stocks and sectors.

- Customer gets offline support from strong network of 1400+ branches along with online trading facility.

Disadvantages:

Being a full broker Kotak securities offer higher brokerages than discount brokerage firms.

#5. Upstox Demat Account

Upstox is a trading platform offered by RKSV, a popular discount broker. It offers trading on equity, commodity and currency derivatives at BSE, NSE and MCX.

Upstox trading platform offers trading, analysis, charting and many more features on its website. Uostox offers free trading account and free trading in equity delivery segment. Margin facility is available for Upstox account.

Trading Platforms:

Upstox offers website and mobile based trading. They have built the website with many features which allows traders to buy and sell easy and analysing the sticks technically with different charts.

Upstox Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – Rs 150

- Demat Account Annual Maintenance Charge (AMC) – Rs 150 per year

- Trading Account Annual Maintenance Charge: NIL

Upstox brokerage Charges:

- Equity Intraday – 0.01% or Rs 20 per trade which is lower

- Equity delivery – NIL

- Equity Future – 0.01% or Rs 20 per trade which is lower

- Equity Options – Rs 20 per trade

- Currency Futures – 0.01% or Rs 20 per trade which is lower

- Currency Options – Rs 20 per trade

- Commodity – 0.01% or Rs 20 per trade which is lower

Best Demat account for small investors in India

#6. Religare Demat Account:

Religare securities Ltd. (RSL) is a subsidiary of Religare enterprise Ltd which is a diversified financial group. Religare Securities offers stock broking, depository services and other investment services. It has presence in over 500 cities through its branches and sub-brokers.

Religare offers trading at BSE, NSE, MCX and NCDEX. It offers Demat Account services through both NSDL and CDSL.

Trading Platforms:

Religareonline.com – This is a web based trading platform. It also offers an exclusive research enabled trading platform for derivative customers.

Religare ODDIN DIET – This is an installable software in your computer for trading in cash, derivatives, mutual funds, IPOs etc. It is packed with useful features like advanced portfolio tracker, live market watch, stock screener etc.

Trade on the go – Mobile trading app gives you the facility to trade anytime anywhere across all segments.

Religare Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 500 per year(First year free)

- Trading Account Annual Maintenance Charge: NIL

Religare Brokerage Charges:

- Equity Intraday & Futures -0.05%

- Equity Delivery – 0.5%

- Options- Rs 100 per Lot

Advantages:

- Zero Account opening charges

- 1 Paise brokerage for all segments

- Enjoy margin facility to trade on existing Demat holding

- Keeps a track of all investments – equity, mutual funds, Gold ETFs etc.

- AMC can be waived off with payment of Rs 2500 upfront.

Disadvantages:

- Rs 10 shall be deducted per executed order for offline trading as administrative charges.

Know more about Religare Demat Account

#7. Choice Demat Account:

Choice started its operation as a SEBI registered full service stock broker in 2010. The Choice is a registered member of BSE and NSE and offers trading and investing across all the segments such as Equity, Derivatives, Commodity and Currency.

The benefits you can enjoy with opening an Demat account with Choice are as follows:

- Free Research and Advisory Services

- Dedicated Relationship Manager

- Advanced Trading Platform

- In-app Research Advisory

- Local Branch Support

Choice Account Opening and Brokerage Charges

- Free Demat Account Opening

- No AMC Charges for First Year (Rs. 200 afterwards)

- Intraday Charges – 0.02%

- DP Charges on delivery trades (Rs.10 only)

Documents Required to open a Demat Account with Choice

- PAN Card

- Cancelled Cheque (that captures the MICR Code)

- Passport Size Photograph

- Aadhaar Card

How to Open A Demat Account with Choice

Visit the official website for opening an demat account with Choice.

#8. Sharekhan Demat and Trading Account

Sharekhan is the 3rd largest stock broker in India. Sharekhan provides brokerage service via online and offline through its trading website and 2600 offices including branches and franchises. It offers services to all kind of customers including individual investors, traders, corporates etc.

Sharekhan is registered with NSE and BSE for capital market, futures and options and currency segments and CDSL and NSDL for depository services.

Trading platforms:

TradeTiger: This is very popular trade terminal among the traders. Those who are interested about regular trading can use this installable software.

Sharekhan Website: You can invest via Sharekhan web portal, share market news, research reports, stock quotes, fundamental and statistical analysis.

Sharekhan App: The new Sharekhan app offers extensive features for traders as well as investors. You can trade anywhere anytime from your mobile phone on thego. You can also track your portfolio at one place.

Sharekhan Mini: This is low bandwidth website. You can use it on smartphone with low speed internet connection.

Dial n Trade: Call dedicated numbers for trading and execute your order with simple hassle free T PIN number.

Sharekhan Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account Opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 750 per year(Adjustable with brokerage for first 6 months )

- Trading Account Annual Maintenance Charge: NIL

Sharekhan Brokerage Charges:

- Equity Intraday & Futures -0.1% (Min 5 Paise/share)

- Equity Delivery – 0.5% (Min 10 Paise/share)

- Options- Rs 100 per Lot or 2.5% of the premium per lot whichever is higher

Sharekhan Demat Account Advantages:

- Brokerage is adjusted with AMC in the first year which can save up to 70% of the AMC.

- Free call n trade facility

- Sharekhan offers different brokerage plan to different customers. Higher you trade lower your brokerage. You can negotiate with brokerage plans during the opening of Demat account.

- You can take the facility of margin from Sharekhan account

Disadvantages:

- Minimum charges per share can pinch more for small value trading.

- You cannot place after market orders.

#9. Motilal Oswal Demat Account

Motilal Oswal is one of the oldest and renowned stock brokers in India. It is a diversified financial services company offering range of products and services such as broking, asset management, investment banking, currency broking etc.

Motilal Oswal is a firm believer of solid research. They have a very good dedicated research analyst team. You can view fundamental, technical and derivative research reposrts across different sectors and companies.

Trading Platforms:

Motilal Oswal has powerful, fast and secure technology across all platforms- mobile, tablet, desktop and web. You can trade, invest, track and review through a single log in. They also have call n trade facility at no additional cost.

Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 500 per year(First year free )

- Trading Account Annual Maintenance Charge: NIL

Brokerage Charges:

- Equity Intraday -0.05%

- Equity Delivery – 0.5%

- Equity Futures – 0.05%

- Options- Rs 75 per Lot

#10. Aditya Birla Money Demat Account:

Aditya Birla Money is broking and Distribution Company offering equity and derivatives trading through NSE, BSE and currency derivatives on MCX-SX. It is also offering services like IPO bidding, distribution of mutual funds and insurance.

Key Benefits:

- One platform to trade in all segments such as equity, derivatives, commodities and currency

- Transacting easily on multiple platforms-online, mobile, trade through branch and central desk.

- Research assistance for portfolio creation and restructuring

- Customized risk policies for traders, trading in high volumes.

- Dedicated relationship managers.

Trading platform:

Express Trade: Express trade is an advanced online trading platform for active traders. It is designed to enhance the trading experience with advanced charting, keyboard shortcuts and smart screens etc.

Mobile Invest: This is a mobile app by which you can trade and track equities and derivatives. It also sends you alerts and updates of stock markets.

ABTrade: ABTrade is a web based platform which offers a comprehensive analytical solution that has been built to address the limitation of users finding relevant insight from the financial markets in time. You can track all your trade in the portfolio instantly any time.

Aditya Birla Money Demat Account Charges:

- Demat Account Opening Charges (One time) – Rs 750

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) –NIL(for 5 years)

- Trading Account Annual Maintenance Charge: NIL

Brokerage Charges:

- Equity Intraday -0.03%

- Equity Delivery – 0.3%

- Equity Futures – 0.03%

- Equity Options- Rs 50 per Lot

Best 3 in 1 Demat Account in India

#11. ICICI Direct Demat and Trading Account:

ICICI Securities is the largest retail stock broker firm in India. It offers wide range of investment options to retail as well as institutional customers. ICICI securities offer its online trading and investment services to over 20 lakhs customers through ICICI Direct platform.

ICICI direct offers a unique 3 in 1 online Demat and trading account.

Key benefits of ICICI direct Demat and Trading account:

- Seamless trading with security

- Share trading in both BSE and NSE

- Margin Facility available

- Award winning research

- Portfolio tracker and watch list along with SMS alerts will keep you updated.

Trading Platforms:

ICICI direct has website based trading facility, app based trading and terminal. The Trade Racer (trading terminal) is for traders who pay a brokerage of more than Rs 750 in a month. For others ICICI charges Rs 75 per month for using Trade Racer.

ICICI Direct Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 700 per year

- Trading Account Annual Maintenance Charge: NIL

ICICI Direct Brokerage Charges:

ICICI Direct has 3 types of brokerage accounts

I Saver Plan

I saver Plan is a variable percentage of brokerage charged on the basis of trading volumes

| Quarterly Volume | Intraday Brokerage (%) | Delivery Brokerage (%) |

| <25 Lacs | 0.375 | 0.75 |

| 25 – 50 Lacs | 0.275 | 0.55 |

| 50 Lacs- 1 Cr | 0.225 | 0.45 |

| 1 Cr- 2CR | 0.175 | 0.35 |

| 2 cr – 5 Cr | 0.15 | 0.30 |

| > 5 Cr | 0.125 | 0.25 |

I Secure Plan

This is a fixed brokerage plan irrespective of trading volume. I recommend beginners to take this plan.

| Quarterly Volume | Intraday Brokerage (%) | Delivery Brokerage (%) |

| Any Value | 0.275 | 0.55 |

Prepaid Brokerage Plan

This plan is for active traders with high trading volume.

| Prepaid Value (Rs) excluding GST | Intraday Brokerage (%) | Delivery Brokerage (%) |

| 10,000 | 0.045 | 0.45 |

| 25,000 | 0.035 | 0.35 |

| 50,000 | 0.030 | 0.30 |

| 75,000 | 0.025 | 0.25 |

| 100,000 | 0.02 | 0.20 |

| 200,000 | 0.015 | 0.15 |

| 300,000 | 0.012 | 0.12 |

#12. Axis Direct Demat Account

Axis Securities is a subsidiary of Axis Bank offers stock broking service and financial product distribution to retail customers in India. It offers a single account to invest in equities, mutual funds, SIPs, IPOs, bonds, NCDs, ETFs etc.

Axis Direct offers integrated Demat, Trading and bank account which allows seamless movement of shares and funds. It becomes easy and secure for investors and beginners in the stock market.

Trading Platforms:

Axis Direct offers multiple trading platforms as Axis Direct Mobile APP, web portal, Swift Trade (web based). It also offers a desktop application for trading called ‘Direct Trade’. The subscription of DirectTrade is Rs 2999 for 3 months (Free for 12 months with Now or Never plan).

Axis Direct Demat Account (3 in 1) Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 650 per year (first year free)

- Trading Account Annual Maintenance Charge: NIL

Axis Direct Brokerage Charges:

- Equity Intraday – 0.03%

- Equity Delivery – 0.25%

- Equity Futures – 0.03%

- Equity Options – Rs 10/Lot

#13. SBICAP Securities Demat Account:

SBICAP securities the broking arm of State bank group offers equity, derivatives, and broking depository services to the investors. The portal allows resident Indians as well as NRIs to invest.

SBICAP Securities offer 3 in 1 account (Saving-Demat and Trading). You can transfer fund or share instantly to trade easily. They have low bandwidth option for accessing the portal who have slow internet connection.

Trading Platforms:

SBISmart Xpress: It is high speed trading terminal installable in your desktop or laptop. This has features like liver streaming of stock market new, on screen alerts, charting tools, lien and unlien of funds for a good trading experience.

SBISmart Mobile Trading app is available for smart phone and tablet in android and IOS.

You can also trade through branches and with Dial & trade facility.

SBICap Securities Demat Account (3 in 1) Charges:

- Demat Account Opening Charges (One time) – Rs 850 +KRA Charges

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 500 per year

- Trading Account Annual Maintenance Charge: NIL

SBICap Securities Brokerage Charges:

- Equity Intraday – 0.075% (Min 5 paise per share)

- Equity Delivery – 0.5%

- Equity Futures – 0.03 – 0.05%

- Equity Options – Rs 50/Lot –Rs 100/ Lot

#14. HDFC Securities Demat Account:

HDFC Securities is the equity trading service provider of HDFC bank. HDFC securities provide 3 in 1 account which integrates with HDFC bank savings account and Demat & trading account from HDFC Securities.

HDFC securities provide cash n carry on both BSE and NSE, trades on futures and options and online IPO investment.

Key Benefits:

- Seamless transaction by integrating all accounts which ensures minimum time to transfer fund and shares

- Offers highest level of safety and security

- Dedicated numbers for call and trade facility

- Instant email after execution of order

- Margin facility available

Trading Platforms:

HDFC securities has a website, mobile app for trading. They also have terminal called BLINK as an installable platform on your computer. This allows fast transaction with real-time monitoring.

HDFC Securities Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 500 per year (for no transaction and Rs 250 (1 minimum transaction)

- Trading Account Annual Maintenance Charge: NIL

HDFC Securities Brokerage Charges:

- Equity Intraday – 0. 1% (Min Rs 25)

- Equity Delivery – 0.5%

#15. Yes securities Demat Account:

Yes Securities is a wholly owned subsidiary of Yes Bank. Yes securities has been started recently and they offer trading/ investment in equity and other financial products.

Yes securities provide 3 in 1 account with Yes bank savings account and Demat & trading account with Yes securities. You don’t have to transfer the money to trading account. Hence you can get interest of 6% on yes bank savings account till the money has been invested.

Trading Platforms:

Yes securities has website based trading facility. They also have an application for smartphone users. You can also invest in mutual funds and IPOs through this platform.

Yes Securities Demat Account Charges:

- Demat Account Opening Charges (One time) – NIL

- Trading Account opening Charges (One Time) – NIL

- Demat Account Annual Maintenance Charge (AMC) – Rs 500 per year

- Trading Account Annual Maintenance Charge: NIL

Yes Securities Brokerage Charges:

- Equity Intraday – 0. 05%

- Equity Delivery – 0.45%

- Equity Futures – 0.05%

- Equity Options – Rs 75 per Lot

Which account you Should Open and Why?

Are you puzzled reading over features and benefits of all the Demat accounts? Don’t worry.

Open an account in Zerodha as it is the largest brokerage house in India. Moreover, I am a great fan of DIY investing without being biased by various calls from brokerage houses.

Also Read: Best Demat and Trading account with Lowest Brokerage in India

You can also select Any 3 in 1 Demat and trading account as it has the seamless transfer of fund and share. You get savings bank interest till you invest in the stock. Zerodha has partnered with IDFC First Bank for 3 in 1 account. Hence, Zerodha is the perfect choice to open a Demat and Tarding account.

You may be interested how to get the highest interest rate on savings bank account.

At last, learning is the key for stock market investing. I would recommend you to read Best books on stock markets for beginners.

Share the article with others.

The best demat account are those which allows you to sleep peacefully. Old stock brokers are quite reputed and have a lot of goodwill attached to their name, So one should also keep this in mind.