Whenever my credit card bill enters into my inbox, my heartbeat goes up, fearing that will I be able to pay the bill this month. This happened regularly when I started using a credit card. When we go for an outing or to meet with friends in a mall or shopping complex to accompany him or her, we ultimately end up buying some items for us. We buy something even if we don’t have any cash in pocket and the item is not so necessary.

Credit card offers with merchants make this deal sweeter for us. Somebody can check this habit throughout the time and somebody don’t and they fall in a big loop of credit card debt. Hence, I decided to write about how to manage credit card and protect it from misuse.

If you are going to apply for a credit card you must know some of the important things before applying for a credit card.

If you care the following points, you may be successful to manage the credit card effectively

-

Spend wisely

It is most often seen that those who have credit cards spend much. The plastic money cannot give you the feel of real money which you are spending. Whenever we go to departmental stores and shopping malls we buy some extra things with necessary items. The bundling of products and marketing is so that it quickly lures the customer and they are also not very comfortable to calculate very easily how much they benefited after buying and ultimately at the end they buy so many extra products. When we pay the money we don’t have a feel also because of a credit card.

[Tweet “I haven’t reported my missing credit card to the police because whoever stole it is spending less than my wife.” – Ilie Nastase”] 🙂

Those who cannot control the temptation of buying extra things, it is suggested to carry enough cash when you go to stores for buying something. Prepare a list of items which are to be bought before going and follow the list strictly. Now a day online shopping and heavy discounts from various e-commerce platforms have made the situation worse as the individual are buying more products to grab the deal. Please make a habit of deferring the plan to buy any costly item.

Suppose you want to buy a mobile handset worth Rs 10000, don’t buy immediately through credit card. Try to save as much as possible for next couple of months to finance the product and at the same time analyze the real requirement. Only after that, if you really feel the requirement then you go to buy the product. Another suggestion, I want to give that if you are facing difficulties, how to manage credit card wisely then make a habit of not using the credit card unless if it is really necessary or emergency.

Build a contingency fund of six months expense and not to use the credit card when you are fired from your organisation or during some medical emergency. I know many of my colleagues and friends who are really benefited adopting this method. Hence don’t use the credit card for buying of unnecessary items and become surprised to see the bills and ultimately shortage in investments.

Also Read: How to Become Rich – Six must things to practice

Five Best Expense Tracker App for Money Management

-

Late fee

When you have bought so many things and bills are so high and moreover, you have the time of twenty days in your hand to repay the bill, what you will do. We don’t pay any attention to the bill and before one or two days of the due date, we suddenly wake up and pay the minimum amount to avoid the late fee. The balance amount is again added to the next month’s bill.

The credit card debt has the highest interest rate in the market. It has the interest as high as 40% per annum which means approximately 3% per month. Even If you are able to pay more than minimum amount but not the full amount, the interest will be on the full amount for the next month’s bill.

For example, you have a credit card bill of Rs 60000 and you are able to pay only Rs 40000 this month, but you have to pay the interest on the whole amount i.e. Rs 60000. So paying the minimum amount you can only save the late fee, nothing more than that. To avoid this situation, try to arrange the interest-free fund from relatives and friends to correct the mistake. You can also ask the credit card company for an easy EMI which normally bears an interest of 12-18% to minimize the financial burden.

-

Annual maintenance fees for the second year

When a sales agent comes to sell a credit card, he or she hides drawbacks of that card like its opening fee or annual maintenance charges etc. They are busy in telling the benefits for the card. We are also not so informed customer that we will ask and get to know the charges.

As a matter of fact, we become surprised to see this type of component when the bill reaches to us. Opening fee or activation fee comes in the first month’s bill. Presently, maximum credit card offers the free opening and maintenance charge is waived off for the first year. But from second year onwards, some cards are not charging this fee, if you transact or rather buy products worth of some minimum fixed amount say Rs 20000.

Always compare the benefit what you can avail from credit card and the charges you are giving. If it is beneficial to you only after that you select the credit card to apply. Never believe the sales agents fully. Do your own research and analysis before applying for the credit card.

-

Wrong product with credit card

Sometimes, the banks try to sell you some of other financial products like insurance, personal loans etc.  They will call you over mobile and tries to sell you some costly products stating very limited information rather some very good benefits.

They will call you over mobile and tries to sell you some costly products stating very limited information rather some very good benefits.

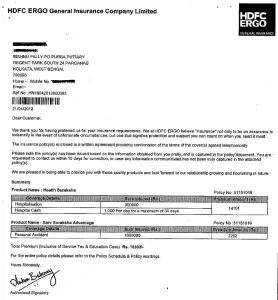

They are using the catchy words to lure the customers and add the product cost in the credit card bill. One of my colleagues has experienced such thing once when a person from HDFC was able to sell him a costly health insurance. He had added the premium to the credit card bill.

One person has called from HDFC ERGO to sell the insurance as they have the details of credit cardholders. Without knowing anything, the card holder said yes and they have issued the policy according to the information provided verbally.

Moreover, they took the information first and then they told that they are issuing a policy. So, please be aware of all the telemarketing calls. Don’t accept the offers if you are not convinced properly. You can ask to send some agent to have more discussion face to face. You can also ask for an email stating the benefits, study the benefits when you will get time and then decide.

-

Payment of lump sum with credit card

Make a rule of yourself that you will use the credit card when you have to pay a minimum of Rs 10000 or so according to your capacity. At the same time, fix a maximum limit which is well below the actual credit limit in your mind.

Don’t go for the purchase, if you don’t have the money to pay the credit card bill after 30-50 days. It is always advisable to buy something with the credit card when you have the same amount of money in your savings account to pay the credit card bill. This method will help you to earn some extra bucks through the interest earned from the savings account and also by some reward points from the credit card issuer bank.

But above all, you have to remember that the effective management of both credit card and cash is not very easy. Hence, practice, discipline, and stick to your budgets are very much required to reach to your investment goal.

For more information you can also read the following book:

Know your Banking – II Credit Cards

So, the credit card should be used when you have the cash in the savings account. Don’t buy unnecessary things with the credit card and get trapped in the high-cost credit card debt. It may be used for the extreme case of urgency i.e. medical emergency.

Share the article.