Many investors are getting interested to invest in the US stock market. How to invest in US stock market from India? I am facing such questions in and around me very often. The recent bull run of FAANG (Facebook, Apple, Amazon, Netflix, Google) stocks in the US stock market increases the interests among the investors community. The new entrant in this community is Tesla. Many people are searching how they can invest in those FAANGT stocks in US market. Can we invest in the US stocks directly or is there any mutual fund in India which invests the money into those stocks in US market. Let’s try to find the ways how you can invest in the US stock market.

Should you invest in US Stock Market?

First of all let us know why people want to invest in US stock market.

- Many global companies are located in USA and they are listed on US stock market such as Apple, Facebook, Alphabet (Google) etc.

- As the value of INR is decreasing with respect to USD one can have some exposure in USD if he/she has a plan to move US or plan to spend in USD later. This will hedge the currency risk.

- Investor can diversify the investments geographically by investing in the US stock market.

- By entering into US market you will have opportunity to invest in many disruptive, innovative companies such as Uber, Zoom, Tesla etc.

- You can invest directly to the parent companies instead of investing to the Indian subsidiaries such as 3M, Nestle etc.

Also Read: Best Demat and Trading Account in India

Best Demat and Trading Account with Lowest Brokerages

Rules & Regulations:

The reserve Bank of India has prepared a guideline under the Liberalized Remittance Scheme (LRS) that says Resident Indians can invest up to USD 250000 in a financial year (April-March). The remittance can be in the form of current or capital account transactions or combination of both.

This scheme is available only for resident individuals and not applicable for Corporates, HUFs, Partnership firms, Trusts etc.

The capital account transactions which are permitted under LRS are:

- Opening of foreign currency account abroad with a bank

- Purchase of property abroad

- Making investments in listed or unlisted companies

- Setting up wholly owned subsidiaries

- Extending loans to NRI relatives in INR

Check details of LRS in RBI website.

How to Invest in US stock Market from India

There are active as well as passive ways of investing in the US stock market.

You can open an account in any International brokerage firm which allows you to invest in US stocks. This gives you ultimate flexibility in terms of remittance cost and trading frequency. Let us look on some international platforms which allow investing in US stock market.

1. Interactive Brokers:

This is a discount broker in US and also listed in NASDAQ. Interactive Brokers facilitates to invest/trade in NSE as well as international markets for Resident Indians. PAN Card, Address Proof, Cheque Leaf are required to open an account.

Web verification will be done to open the account. The account will be effective only for cash market for international and margin is available for NSE. Minimum brokerage fees per month for oversees trading is USD 10.

Know more details

2. Vested:

Vested is a SEC registered investment advisors. You can invest in the US stock market by opening an account with Vested. It has partnership with DriveWealth in US. There is no minimum balance requirement and you can withdraw money anytime. It also claims that investor can invest in fractional shares.

There are other stock broker such as Charles Shwab, TD AmeriTrade etc.

Indian Stock Brokers:

HDFC Securities:

HDFC Securities has a tie up with Stockal. They also tied up with DriveWealth for brokerage account and clearing services. Once the account is opened you can transfer money into the account and start trading. But the transfer of money is a cumbersome process. You need to fill Form A2 along with declaration form as per FEMA every time you send the money.

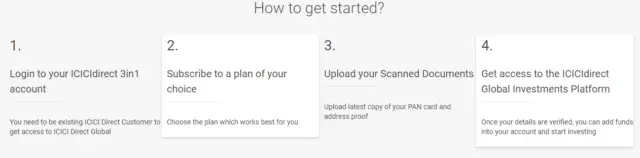

ICICI Direct:

You can open a foreign brokerage account online through ICICI Direct without any physical document. Here also no requirement of minimum balance. You will have access of global research report. Investing in fractional shares are also allowed.

They have 2 types of subscription package. One is Global Starter and another is Global Advantage. Global starter has subscription fee of Rs 999 per year and Global Advantage plan having subscription fee of Rs 9,999 per year.

Axis Securities:

Signing up in Axis Securities for Global Investing is completely digital and hassle free process. This is a zero brokerage account which means no brokers fee for any amount of trading. Fund transfer is very easy and also fractional investing is allowed.

All leading Demat and Trading account service providers are having a tie up with foreign brokerage service provider. You can check with your Demat service provider about this service.

Recently came across a news that Zerodha will offer US stocks in its platform for retail investors. This will have no minimum investment criteria. If this happens this will be a huge development for Indian investors.

Mutual Funds:

You can invest in some Indian mutual funds which invests money in the US stock market through stocks and ETFs.

Some mutual funds are fully focused to US stocks and ETFs. They are

- ICICI Prudential US Bluechip Equity Fund

- DSP US Flexible Equity Fund

- Franklin India Feeder Franklin US opportunities Fund

- Motilal Oswal NASDAQ 100 ETF

- Nippon India US Equity Opportunities Fund

- DHFL Pramerica Global Equity Opportunities Fund

- Kotak Global Opportunities Fund

Some funds are having Indian Stocks and significant exposure to US stocks as well. In this category the most popular fund is PPFAS Long Term Equity Fund. It invests in Amazon, Alphabet (Parent company of Google), Facebook and Microsoft along with many Indian stocks. The portfolio of PPFAS Long Term Equity Fund shows that they have 8.5% allocation towards Amazon as the highest allocation.

Taxation:

The taxation part cannot be ignored while investing in the US stocks and ETFs directly. Capital gains from foreign funds and ETFs are taxed same as debt mutual funds in India. If the holding period is less than 3 years it is considered as short term gain and for more than 3 year holding is considered as long term gain.

Short term gain is taxed as per individual’s tax bracket and 20% is taxed for long term gain. However, indexation benefit can be considered while calculating the long term capital gain tax. 2 years is considered as threshold for long term for stocks.

Dividends are taxed as per slab. If the tax is deducted at source that can be claimed as US and India is having Double Tax Avoidance Agreement.

Final Words:

Considering the process, taxation etc. I feel retail investors would not put too much effort to invest in US stock market. Those who wants some hedging against currency risk may allocate some portion of portfolio in US stocks. Otherwise the investor with limited capital may concentrate on Indian equity market which is having huge opportunities.

Liked the article. Share it with others. 🙂