If you have some cash in your hand and you need the money in another 3 to 6 months, a liquid mutual fund is probably the best investment avenue. Investors prefer liquid mutual funds for steady return with low risk of capital. The liquid mutual funds invest their money in the various financial instruments such as Bank fixed deposits, Treasury Bills, Commercial paper and debt securities.

These funds give your low return but there is a limited risk as the funds are investing in various debt instruments. The biggest advantage of a liquid fund is its liquidity. If you are interested to include liquid funds in your portfolio, here is the list of top 6 best liquid mutual funds to invest in 2019.

What is Liquid Fund?

The mutual fund which can be withdrawn within a very short period of time 24 hours on business days is called as liquid fund. Liquid funds invest the corpus in Bank fixed deposits, Treasury Bills, Commercial paper and various debt securities which have maturities up to 90 days.

The money is invested as soon as you transfer it into the folio. If you invest before 2 pm the money is invested based on previous day NAV and same day NAV is applicable when you invest the money after 2 pm is any business day. The NAV of a liquid mutual fund is calculated based on 365 days in a year. The other debt mutual funds are calculated based on the business days only.

Are you interested more on mutual fund? Read the shortlisted books and know all about mutual funds.

When you should invest in a Liquid Mutual Fund?

As the liquidity funds are giving liquidity with descent return (More than Savings Bank Interest) you can consider this as an option to deposit your idle money. Generally, a savings bank account provides you 4% interest whereas a liquid fund can provide you 7-8% interest. Moreover, you can exit the fund without any exit load and receive your funds next day.

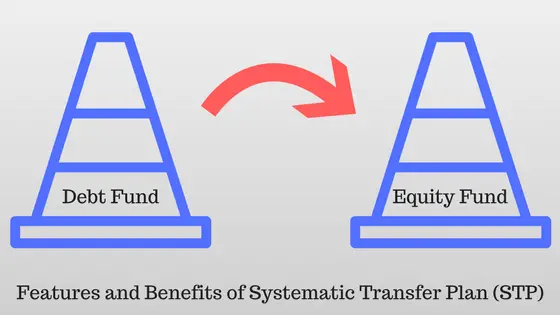

Experts suggest the investment to equity fund through a systematic route. You invest in an equity SIP from your regular income. But when you get lumpsum or performance bonus you can also invest the bonus money to a liquid fund at one go and switch the fund to an equity fund through a SIP.

Also Read: Top 10 Mutual Funds SIP to invest now.

Liquid Fund Taxation:

The taxation of liquid fund seems to be disadvantageous when you are in the higher tax bracket. The liquid fund is considered as debt fund and the capital gain tax is applicable according to your redemption of the investment. If you redeem the fund within 3 years the gain is termed as short-term capital gain. The gain is added to your income a taxed as per your income tax slab.

If you redeem the investment after 3 years the gain is called as Long-term capital gain and it is taxed as 20% after indexation.

Here our intention of choosing a liquid mutual fund to invest for a shorter period of time. So the short-term capital gain tax will be applicable for most of the investment. But there is an option of handling the tax in a better way is to select the dividend-reinvested option. The dividend is paid after paying dividend distribution tax and dividend reinvest is considered as a fresh investment. The NAV is fixed according to the structure. In this case, you have very little capital gain which results a lower capital gain tax.

Selection Criteria:

The following criteria, I have used to screen the best liquid mutual funds.

- Asset under Management (AUM) size is to be more than 500 cr as higher the AUM means it has gained the investors’ confidence to put the money in those funds.

- Presence of at least 5 years in the market. A 5 years presence in the market signifies that it is time-tested across various market situations.

- Past annual return of more than 7% for 1 year. It means the fund is performing well.

- At least 3 star rating from valueresearchonline. A higher rating indicates that the funds can perform well with respect to the others.

- I have taken the data for direct plans for easy comparison. As you are already aware, investing in the direct plan of these funds gives you a better return than regular funds.

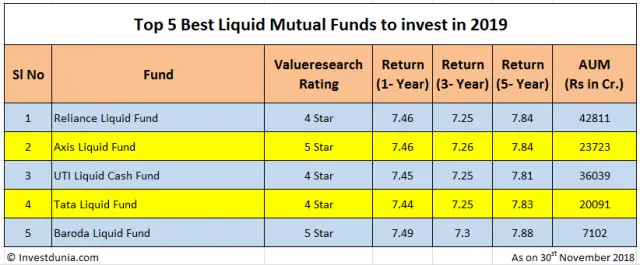

Top 5 best Liquid Mutual Funds to invest in 2019

1. Reliance Liquid Fund:

Reliance Liquid Fund is one of the best funds in liquid fund category. It has invested the money in debt instruments such as NTPC 90D Commercial Paper, Axis Bank Fixed Deposit, Indusind Bank Fixed Deposit, Chennai Petroleum Commercial paper etc.

The fund was launched in Jan 2013 and it is able to grow its asset size to Rs 42,811 Crore in 5 years’ time. The fund has given excellent return of 7.54% in 1 year and 7.92% in 5 years. The benchmark index of this fund is CRISIL Liquid fund index and the fund has continuously beaten the benchmark in terms of return.

It has very low expense ratio of 0.15% for direct funds. The fund manager is experienced and he has good track record of managing good performing funds.

You can start investing with as minimum as Rs 100 and withdraw Rs 100. As the fund is investing is debt and money market instruments the risk to be born is very low.

2. Axis Liquid Fund:

Axis Liquid Fund has been launched in 2009 and since then it has grown significantly. It also generated a 7.84% return since last 5 years to the investors. The fund has a very low expense ratio of 0.11%. The total Asset size of the fund is Rs 23,713 Cr as on 30th November. 2018.

You can invest lump sum as well as through SIP in this fund.

The fund has approx. average 100-120 numbers of securities in its holding.

The benchmark of this fund is Nifty Liquid Fund TRI. The trailing return shows that it is continuously front runner in its category. The fund manager has vast experience managing different type of debt funds.

3. UTI Liquid Cash Fund:

UTI Liquid Cash fund has objective of steady and reasonable income with low risk and high level of liquidity from a portfolio of debt and money market instruments. The fund has generated a return of 7.81% over the last 5 years. It has generated 7.74% for last 10 years. This fund invest in the various commercial papers and bank fixed deposit . The total asset size of the fund is close to Rs 36,039 Cr as on 30th November 2018.

The expense ratio for the fund is very low 0.12%.

CRISIL Liquid Fund Index is the benchmark of this fund and the fund has continuously beaten the benchmark in terms of return to the investors.

The fund has alpha ratio of 1.65 and beta ratio of 0.43 (Read- How to judge mutual fund performance). The fund manager of this fund has good amount of experience and he has managed various debt funds.

4. Tata Liquid Fund:

Tata Liquid fund has been started to provide reasonable returns with high liquidity to the unit holders.

The fund has set CRISIL money market index as the benchmark.

It has alpha ratio of 1.65 and beta ratio of 0.42 which indicate lower volatility than the benchmark. The fund has total asset of Rs 20,091 Cr as on 30th November 2018 and low expense ratio of 0.13%. The Tata Liquid fund has very good fund managers who have also managed the high performing funds such as Tata Money Market Fund and Tata Corporate Bond Fund.

5. Baroda Liquid Fund:

Baroda Liquid fund has the same objective as other liquid cap fund which is to create regular income by investing in different money market and debt instruments. It is one of the high performing funds in this category. The fund has generated a 7.88% return over the last 5 years.

The benchmark is CRISIL Liquid Index and the fund has continuously beaten the benchmark.

You can invest lump sum as well as through SIP in this fund. The minimum investment is Rs 1000 for both the cases. The fund has alpha ratio of 1.86 and beta ratio of 0.52. The expense ratio of the fund is 0.12%

Conclusion:

All the above Liquid mutual funds have generated a continuous return over the years. But the return is not the only factor what you will take care before investing in a Liquid fund. You should choose a fund which is performing well. You should take care of expense ratio and above all the fund criteria meet your financial plan and goal. Here the liquid funds provide you the best return for the short term investment with much liquidity.

Liked the article. Share it with others.

It’s an awesome article designed for all the web viewers; they

will obtain advantage from it I am sure.