As the name suggests the advance tax means the income tax which is to be paid in advance. If you have income tax liability of Rs 10000 or more in a financial year, you have to pay advance tax before the stipulated dates as set by the income tax department. Those who are liable to pay the advance tax cannot wait to pay the entire tax at the end of the financial year.

The reason behind the collection of income tax from the starting of the year is to have the steady cash flow of the Government.

Due Dates of Advance Tax Payment:

The due dates for the payment of advance tax in FY 2016-17

|

Sl No |

Amount Payable (Rs) |

Due Date |

|

1 |

15% of Income Tax | On or before 15th June |

|

2 |

45% of Income Tax |

On or before 15th September |

|

3 |

75% of Income Tax |

On or before 15th December |

| 4 | 100% of Income Tax |

On or before 15th March |

For the businessman who has taken presumptive taxation scheme for them 31st March is the last date for paying income tax.

Who should pay Advance Tax?

The income is calculated by the employer for the salaried individuals and the employer deducts the applicable tax. But if there is any extra income other than salary, he or she needs to pay the advance tax on that amount. Else, if your employer has the option of updating the other income in their database, they can calculate the tax for you and deduct the calculated.

Advance tax is to be paid by the all the income tax payers from salaried individuals to businessman and freelancer etc.

The following people are exempted from paying advance tax

- Senior Citizens of 60 years and above age who don’t have any business.

- The taxpayers who show presumptive schemes for the income tax payment where business income is taken as 8% of the turnover of the business. The businesses should be with more than Rs 2 crores turnover.

- The presumptive income is considered as 50% of sales for professionals such as architect, lawyers, doctors with a turnover of less than Rs 2 crores per year. For transporters, the profit is considered as Rs 7500 per vehicle per month.

Also Read: Tax Planning: Various Ways of Saving Income Tax

Advance Tax Calculation:

You can calculate the advance tax in the following way:

- Calculate the yearly income except for the salary because the advance tax from salary is taken care by the employer. Add the expected earnings on that financial year such as income from freelancing, rent from property etc.

- Deduct the possible expenses such as travel expense, rent for office for freelancing work.

- Add the other income such as interest from fixed deposit, recurring deposit etc.

- If the total tax is coming more than Rs 10,000 from above calculation, you have to pay advance tax according to the rules (see Table above).

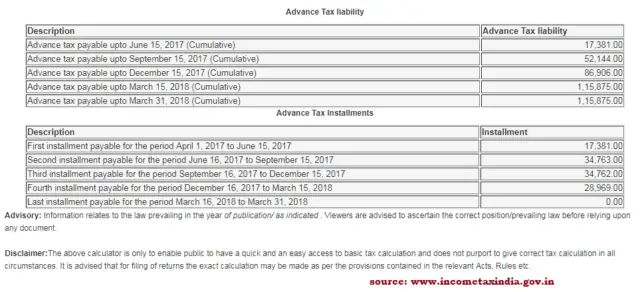

You can also take the help of calculator provided in the Income Tax India website. A screenshot of result has been shown below.

How to pay Advance Tax Online:

The payment of advance tax is same as the payment of self-assessment tax through challan 280. You can pay advance tax online in the following steps:

- Go to the Tax information Network page of NSDL.

- Select the Challan No. 280

- Fill up the form with details such as PAN, address, Assessment year etc. Select on (100) Advance Tax under ‘type of Payment’. Click on proceed.

- Check all the details including PAN and associated name.

- Once you submit the details, you will be redirected to banks online banking page to complete the payment. It can be paid by using a debit card also.

- You will receive an acknowledgment of payment of advance tax.

You can also pay it offline by fillip up the challan 280 and submit to the nearest bank branch.

Penalty for paying late:

There is a provision of penalty (section 234B and section 234C) if you are late in payment of advance tax to the income tax department.

According to section 234B, if you do not pay 90% of the tax payable or less than that before the end of the financial year, you have to pay 1% penalty on the unpaid tax.

According to section 234C, if you do not pay the advance tax as per the above schedule, you have to pay 1% per month as a penalty for the deferment of paying advance tax.

Refund of Advance Tax:

If you have paid income tax more than the actual, you will be given return at the end of the financial year. While filing the income tax return, you calculate the tax paid and if there is any balance, you can claim the return while filing Income tax return. The income tax department will process your return and pay you the extra tax which you have paid.

Conclusion:

The payment advance tax in time is good for the individuals. If you are paying tax regularly, you don’t have to be in trouble to manage the cash flows. Moreover, if you don’t pay, the government may impose the penalty to you. Hope, you are able to understand the advance tax from the above article If you have any query, please do comment below.