It is known by every taxpayer in India that a new taxation system has been introduced before the financial year 2020 – 2021. The nitty-gritty details of the new system have also been released, and from then onward, one of the most discussed topics is which method is beneficial for a citizen. On this note, it should be mentioned that the administration has encouraged every taxpayer to evaluate the differences between the two and select the system which they find befitting considering their revenue and expenditure. Here we will Compare New Tax regime vs Old Tax Regime and try to figure out which is beneficial.

What is the Income Tax?

For the new taxpayers it is necessary to convey what is Income Tax and why do we need to pay it. After that, the comparison between the old and new system would be explained so one can select the system with ease.

In simple words, in India, the income tax is a kind of payment to the government from your revenue or profit, for the benefit of the country. There are two kinds of taxes, such as direct tax and indirect tax. Your income tax is a form of direct tax, whereas GST is an indirect tax.

Furthermore, every individual is supposed to pay his or her tax according to the tax slabs, prescribed by the government. It is needless to say that, with a higher income, the amount of tax also increases. Other than that, there are three categories, which also affect the slabs. The categories are as follows –

- Individuals who are below 60 years old (resident or non-resident)

- The category of senior citizens, who fall within the age bracket of 60 to 80 years (resident)

- Super senior citizens, who are above 80 years old (resident)

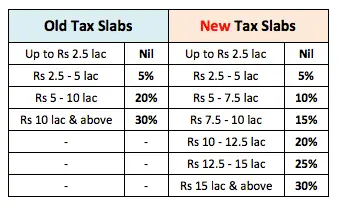

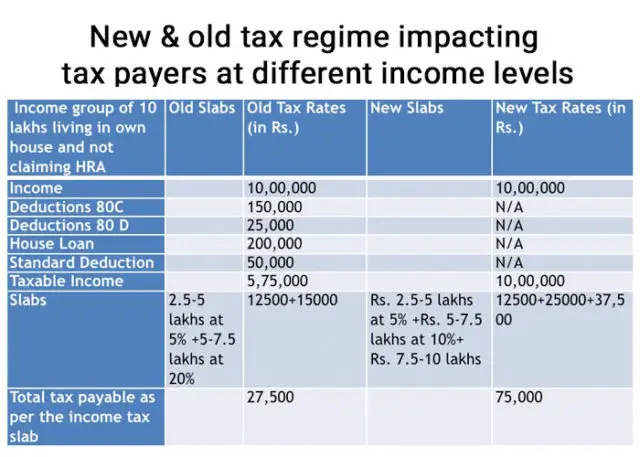

After understanding the basics of income tax, it is necessary to understand the difference between the old and new system so that one can select one. Although the authority is encouraging one’s free will to apply while selecting, it is better to get an overview nonetheless. Before, proceeding any further, it should be said that the main point of difference lies within the slabs.

If one goes through the above table, he or she may assume that the old system is not beneficial for anyone. However, one should understand that there are pros and cons to everything. The pros and cons of the different systems should provide you with enough insight regarding which one a taxpayer should opt for.

Positive Aspects of the New Tax Regime:

A few of the positive aspects of the new regime are as follows –

1. Reduced rate of tax and compliance:

One of the primary pros of this system is that the deductions and exemptions are not available. Hence it requires fewer documents to file tax. Other than that it renders concessional tax rates. If you are taking a service from professional to calculate and file your income tax return that will be Nil by opting the new tax regime.

Read More: How to file Income Tax Return Online

2. An investor may not prefer for lock-in funds for a specified period:

While pondering over the matter of new tax regime vs old tax regime, it should be mentioned that under the new system, every taxpayer does not have to worry about the benefits of deductions as such options are not criteria to avail tax exemptions. This new feature can be helpful for individuals who do not involve in any specified investments because most of the investments are based on the lock-in period. In a lock-in period, a taxpayer can’t withdraw before a specific time-frame.

Such investors can opt for open-ended policies, mutual funds, deposits, fixed deposits, etc. according to their requirement. Such modes of investments usually render better returns and are flexible in the matter of withdrawal.

3. Flexibility regarding the choice of investment:

Under the old regime, many restrictions have been applied over the matter of investment. This, in turn, does not allow one to opt for an investment befitting for him or her. However, according to the new system renders every taxpayer to customize their choice of investments, as it does not include the previously applied restrictions.

People are investing insurance policies, ELSS mutual funds etc. for tax benefit only without knowing the investing benefit and associated risk.

4. Increased liquidity for every taxpayer:

The reduced rate of tax would provide a higher level of disposable income, which can be used by every taxpayer. The millenials want flexibility and money in the pocket for spending, not as in investment. This rule will also become good for those persons who have just started earning. In my initial years of career was struggling to complete the 80C limit as the in hand salary was less. So the usual preference was to pay small amount as tax rather investing a handsome amount.

The negative aspects of the new regime :

As a taxpayer, if you are pondering over the matter of new tax regime vs old tax regime, then it is better to know about the cons of the new regime as well. As this system does not allow the taxpayers to avail a few of the exemptions, which can be a problem in the long run. You cannot get the income tax benefits for the following expenditures as follows.

- Leave Travel Allowance.

- House Rent Allowance

- Clause (14), a few of the exclusive benefits included in Rule 2BB, such as children education allowance, travel allowance, uniform allowance, hostel allowance, per diem allowance, etc.

- Clause (32) allowances for clubbing of the income of a minor

- Deduction for entertainment allowances, and employment, standard deductions, professional tax as contained under the Section 16.

- Depreciation under the Section of 32(1) (iia)

- Interest under section 24 for vacant or self-occupied property

- Finally, the deductions, under the chapter VI-A (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc.).

After going through the pros and cons of the new regime, it is better to understand the positive and negative aspects of the old system. Now, let us discuss the topic old tax regime vs new tax regime with a simple example.

From the above comparison it is clear that old tax regime is beneficial who can take the benefit of all tax savings. But if you are not taking the benefit of deductions you can switch to new tax regime as the old regime will attract more tax compare to new rules.

Positive aspects of the old rule:

There are a few positive aspects of the former taxations system, for which the government enforced it. The pros of this rule are as follows –

- One of the primary positive sides of this regime was that it helped to make the country’s gross savings rate, approximately 30% in March 2019. Further, it should be mentioned that the domestic savings rate was one of the most important contributors in this aspect. If taxpayers opt for the new rule, the gross savings rate will decrease. However, the consumption and demand cycle would be revived.

- Due to the old rule of taxation, most individuals invested over specified tax-saving modes. This, in turn, helped such individuals to be prepared for future expenditure, such as higher, education, buying a new property, marriage, etc.

Negative aspect of the old regime:

The negative aspects of this rule would also help you to select which one is beneficial according to your income. The negative aspects of the old system are as follows –

- According to the previously applied rule, assessments for proceedings, before the tax authorities, an individual was required to retain his or her documents, proof of investments, etc. This method may not have been included in the current rule.

- One of the cons of this system was that it embargoed the investors to opt for better instruments, other than the prescribed one. Such lock-in investments weren’t able to render better returns, over the availed time-frame.

- Under the previous rule, a few benefits have been included on investments. However, such investments were developed based on the prescribed lock-in procedure, which had a time-frame of three to five years. Such a system may sound beneficial for a middle-aged person, but it is not the case for the younger population, as well as the senior citizens. While the newly employed people like to spend more, and the seniors like to hold liquidity of cash, it will not be befitting for such age brackets.

New Tax Regime vs Old Tax Regime: Make your own choice

It is safe to say that by going through the above-stated pros and cons of the rules, it becomes much easier for a taxpayer to select his or her option. If an individual wish to invest in a flexible instrument and not in a specified, and locked-in instrument, he or she should opt for the currently introduced system. However, one should not forget that by choosing this regime, an individual has to let go of various other exemptions and deductions.

One of the most beneficial aspects of the taxation system is that even if you choose one of the rules, you can exercise it in every financial year. However, this option is not rendered to the taxpayers whose sources of incomes are profession, business. In simple words, taxpayers, who are involved in the profession, or business won’t be capable of switching between the rules in every financial year. Therefore, it is necessary to know about the rules and evaluate which one is beneficial for you, your income and according to your expenditure.

Furthermore, even if you are confused regarding which one to opt for, you can visit the official website of the Income Tax Department of India, wherein you’d find a tax comparison tool. This simple tool would enable you to which would be better for you.

In light of the matter being new tax regime vs old tax regime, there have been a few frequently asked question by various taxpayers. If you too have the same quarries, you can go through the following Section of FAQs.

Frequently Asked Question:

The FAQs regarding the taxation systems are as follows –

1. How do I know which slab applies to my income?

Ans. The total amount of tax is calculated on one’s net taxable income, which falls under a particular slab. If your income increases, it will be taxed accordingly, and you would have to pay your tax according to the prescribed slab.

2. If I select the new income tax regime and my total income in FY 2020-21 is Rs 4.90 lakh. Do I have to pay tax on it?

Ans. The new system renders a maximum tax rebate of Rs. 12500. This rebate falls under Section 87A, of the Income Tax Act. Hence, an individual does not require to pay tax up to Rs. 5 lakh if you opt for the new rule of taxation.

3. Is there any deduction that can be claimed under the new tax regime?

Ans. Yes, indeed, a lot of the deduction and exemptions are not applicable in the new regime. However, it allows a deduction under Section 80CCD. The nature of this Section is that the deduction will be applicable only when an employer contributes to an employee’s NPS account. Under this deduction, an employee can claim up to 10% of salary.

4. How can an individual arrive at their net taxable income?

Ans. To arrive at the nettaxable income, an individual is required to calculate his or her total taxable income. Further, an individual is required to calculate the total of the deductions; he or she is allowed to claim. The final step is to deduct the total amount of deductions, one claim from the total taxable income. This will help taxpayers to arrive at their net taxable income.

5. Does the new tax regime offer a higher tax-exemption limit on income based on age?

Ans. To put it simply, unlike the previous taxation system, the new regime does not render senior citizens, and super senior citizens to avail high-tax exemption on income.

6. Can explain the difference between the old and new rule of taxation in a nutshell?

Ans. In simple words, it can be said that, while availing the old rule an individual does not have to worry about any changes, he or she can continue paying their previous amount of taxes. However, in the case of the new regime, an individual has to pay less tax, but he or she has to decline the deductions, they have availed before.

To conclude, it should be said that the topic of new tax regime vs old tax regime can be confusing, and one should understand the rules beforehand. After that, a taxpayer should be mindful about their selection. In case, it is necessary; the authority has rendered the option to choose another one on the next financial year.

If you like the article share it with others. Please do comment below if you have any query.