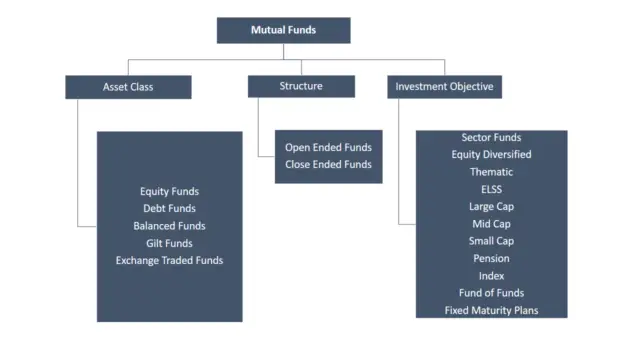

The mutual fund is a well-known investment method now. There are different types of mutual funds in which you can invest. You can select a mutual fund virtually on every requirement and on every tenure you need. The mutual fund can be classified on the basis of structures, asset class, objective etc. You have to select the fund according to your requirement and tenure.

First, we will discuss the types of the mutual fund based on asset class.

1. Equity Funds:

These funds invest on the shares/stocks of companies listed in the stock market. NSE and BSE are the recognized popular stock markets in India and funds are investing in the companies which are being traded in the market. These funds are the most attractive due to their high return. They are also riskier than other asset classes. The biggest advantage for an equity fund is that there is no long-term capital gain tax.

Also Read: Top 10 Mutual Funds for SIP to Invest Now

2. Debt Funds:

These funds invest in government bonds and securities and other fixed-income assets. The debt funds are less risky as it invests in the fixed income assets. It earns less interest also. If you have less than 3 years in your hand, invest the money in a debt fund. The tax is applicable for both short term and long term capital gain for debt funds.

Also Read: Debt Fund Vs Fixed Deposit: What Should You Prefer for Investment

3. Balanced Funds:

Balanced funds are the composition of investment in equity as well as debt. Equity is for long tenure and risky whereas debt is less risky and for short term. The mix of an asset class in the balanced fund makes it the medium-term investment with moderately risky. Equity and Debt allocation varies from fund to fund such as 80-20 i.e. 80% in equity and 20% in debt instruments.

4. Liquid Fund:

These funds invest in the money market instruments which can be easily liquidated. These are for short term and return is also less. Those who interest to invest for short term without taking any risk can invest in these type of funds.

5. Gilt Funds:

Gilt funds invest in the government securities and bonds and thus it is almost risk-free. If you to invest without risk and happy with 8-10% return can invest in these funds.

6. Exchange Traded Funds (ETFs):

ETFs are based on a commodity or a basket of assets which is traded like stocks in the market. ETFs are based on precious metals like gold, silver etc. and currencies of the different country. These are traded throughout the day in the market.

Based on the structure, mutual funds are mainly of two types:

1. Open-Ended Funds

You can purchase or redeem on any business days for Open-ended mutual funds. The entry and exit to the mutual funds depend on you. There is no limitation of tenure through which you have to remain invested. Those who want the investment with liquidity invest in these type of funds. But, in some cases funds are charging an exit load if you want to redeem your fund within specified time period after investment.

2. Close Ended Funds:

Close ended funds are open to being invested during the offer period only and it can be redeemed at the maturity. You cannot redeem the fund in between from the fund house. You can redeem it by selling in the market as per market rate.

Based on investment objective, the mutual funds are the following types.

- Sector Funds: These funds invest the money into a specific sector such as software, pharmaceuticals etc. As it invests in a specific sector the risk is high.

- Equity Diversified: These funds invest in a variety of stocks in the market. It is not dependent on a specific sector. The risk is low compared to the sector funds as investment goes to a variety of stocks.

- Thematic Funds: These funds invest in a particular theme such as service, product, export etc.

ICICI Pru Infrstructure Fund can be called as thematic fund as it invests in infrastructure companies across the sectors such as cement, ferrous metals, banks etc. - ELSS: Equity-linked Savings Scheme (ELSS) is a type of fund meant for tax saving purposes. You can claim tax benefit under section 80C of income tax act for the investment under ELSS. The investment shall be locked for a period of 3 years from the date of investment.Also Read: ELSS vs PPF – Where to Invest for Tax Saving

- Large Cap: These funds invest in the large cap stocks or blue-chip stocks only. The risk and volatility are less for large cap funds. Some of the large-cap funds are Birla Sunlife Frontline Equity, SBI Bluechip, ICICI Prudential Focused Bluechip etc.

- Mid Cap: Mid-cap funds are investing the money into the stock whose market capitalization is below than the large cap stocks. Mid-cap funds are riskier than the large cap stocks and past returns are also higher compare to the large cap stocks.

- Small Cap: These funds invest in small cap stocks which can grow in future. These are highly risky and volatile in nature.

- Capital Protection Funds: These funds’ objective is to growing the investment while protecting the invested money at least. It is also one kind of balanced fund. The money is invested in such a way that debt portion of your investment protects the capital when equity portion is invested for capital appreciation. Even if the capital loss id happened for equity portion, the debt portion will ensure the protection of invested capital.

- Pension Funds: pension funds are also balanced funds and invest in equity as well as debt markets. The investment is for longer terms. You can redeem the fund at one step or you can opt for monthly pension or a mix of both the options.

- Index Funds: These funds are based on the index of a stock market such as BSE 100, Nifty 50 etc. the objective of these funds are to give you a return of more than the index which is set as the benchmark of the fund.

- Fund of Funds: A fund can be a composition of other funds also. These funds are less risky as it comprises of other funds which are also managed by professionals.

- Fixed Maturity Plans: Fixed maturity plans are the investment in debt funds which have fixed maturity period.

- International Funds: These funds invest in the companies outside the country. The investment shall be in the stocks listed in New York stock exchange or other stock exchanges of any country.

Update (9th Nov 2020):

14. Multi Cap Fund: A Multi cap fund has to invest a minimum of 25% in large caps, 25% in mid-caps and 25% in small caps. The remaining 25% is at fund manager’s discretion/strategy and can be invested across large-caps and/or mid-caps and/or small caps.

15. Flexi Cap Fund: Flexi Cap Mutual Fund can invest in 65% money in equity across any categories or without any market cap wise allocations.

Conclusion:

Out of so many above options, it is really tough to select a fund for your requirement. First set your goal, fix your monthly investment considering a feasible return in your mind. Consider your risk taking capability and tenure by which you can remain invested.

If you have short term goal then go for the debt based mutual fund and if you want wealth creation over the long tenure, you can invest in a diversified equity fund. Also read the post about growth or dividend paying mutual funds – what you should choose?

Share the article.