Everybody must have noticed the real estate advertisement in the hoardings or Newspaper with ‘NO EMI TILL POSSESSION’ and ‘Book Now Pay Later’. You must be thinking that this …

When Atanu is all set to buy his dream home and enquired a loan from a leading Non-banking Financial companies, he became depressed after getting the reply from the …

Investment in real estate is always a priority for Indians. According to a survey, 60% of individuals want to invest in real estate and many investors have invested in …

Every time I wonder when my friends say that they have done profit of so much of amount by selling such and such stock. I wonder because I make …

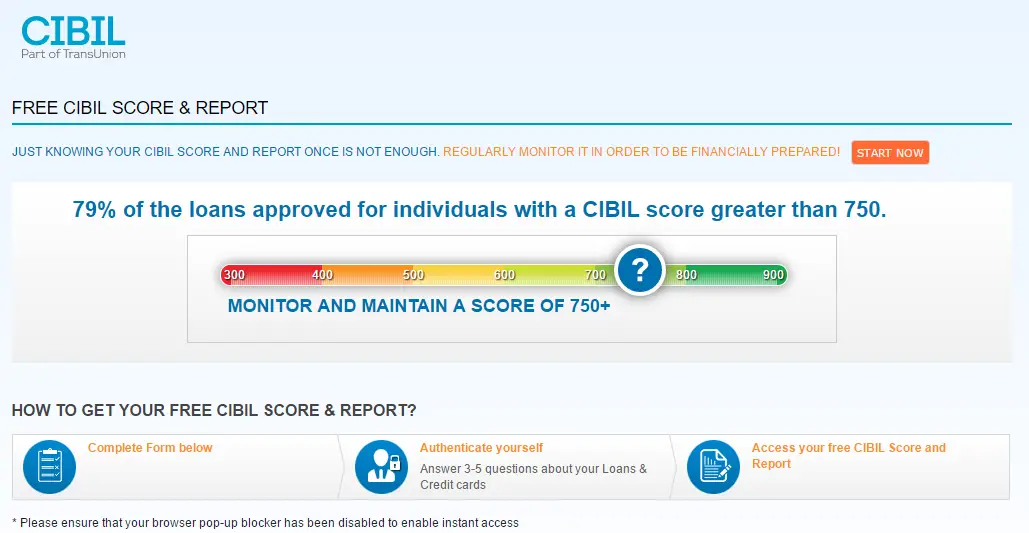

Recently Reserve Bank of India has made a free credit score report every year starting from January 2017. Earlier we need to pay Rs 550 for a Credit Information …

Retirement planning is becoming the most important financial planning in our lives due to increasing uncertainty of career and job. People are now interested in retiring early. Many of …

Now a day everybody has heard about the phrase ‘Systematic Investment Plan or SIP’. But, there is a limited view what actually SIP is. People have also doubt in …

Public Provident Fund (PPF) is a very good investment product which is used by people since a long time. It is one of the best small savings scheme by …