Recently Reserve Bank of India has made a free credit score report every year starting from January 2017. Earlier we need to pay Rs 550 for a Credit Information Report (CIR) when we request from CIBIL. The Reserve Bank of India is continuously pushing the banks to use credit score for the loans to the customers.

People are reluctant to know their Credit score as they have to pay for that. By giving access to one free report every year, the process becomes more transparent and people can also rectify their actions for a better score.

What is CIBIL Score?

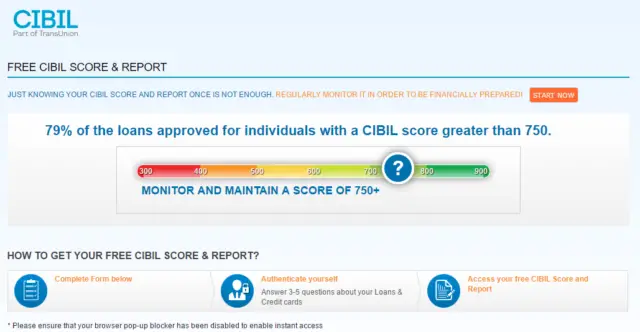

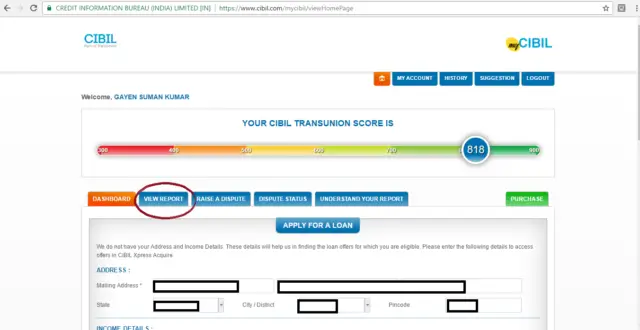

CIBIL score is a number between 300 and 900 which shows your credit worthiness to the potential lender. The financial institutions are comfortable to disburse loan or credit card to a person having a score of more than 750. The higher your credit score, higher the chances of getting a loan or credit card.

How it Impacts you?

There are three credit bureaus present in India are CIBIL, Equifax, Experian. The CIBIL is widely used by the Banks and NBFCs. When you are filing an application for a loan to a bank or NBFC, they approach one of the credit bureaus present in India. The banks and NBFCs check the credit score and report before disbursing the loan.

Generally, they follow a minimum of 750 scores as eligibility to give the loan. It is a very good practice to check the credit report at a regular interval. If you notice something inaccuracies or differences in your credit report from the actuals, you can raise a dispute claim and make it correct.

Also, you can take action to improve credit score when you know you have a low credit score and you are going to apply for a loan.

How to check CIBIL score for free?

You can follow the steps wise process as described below to check CIBIL score free:

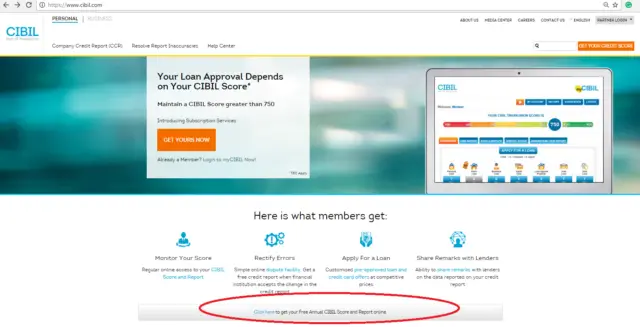

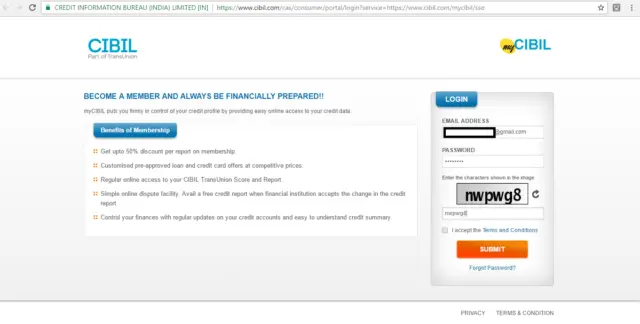

- Open the website cibil.com

- Click on the ‘Click here to get your Free Annual CIBIL Score and Report online’

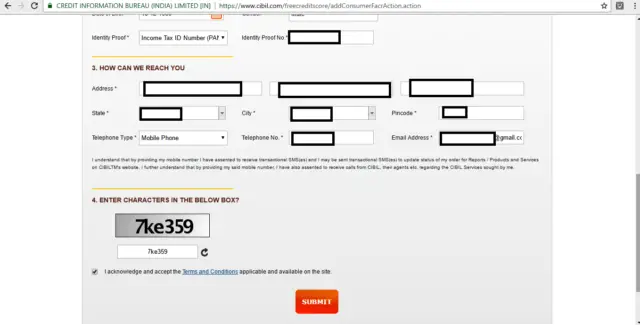

- Fill up your PAN Number, Email Id, Date of Birth etc. as required.

- Submit the address where you are presently located.

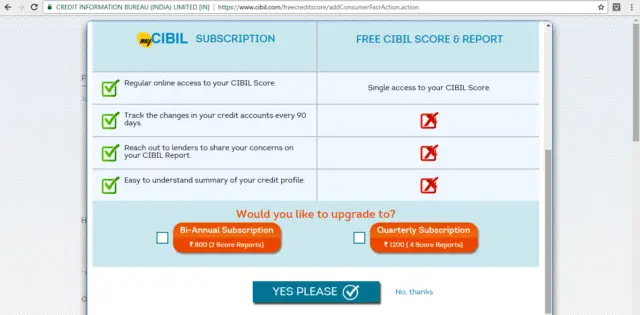

- Choose the option as free CIBIL score and Report

- Confirm your email id from the given link sent to your inbox.

- Log in again on the CIBIL website.

- Choose to view Report.

Beware or stop from below activities which can affect your CIBIL score.

- Too many credit cards and loans can lower your CIBIL score as it is a threat to the lender that borrower can take a large amount of credit.

- Never be a defaulter to a loan or credit card dues. Also, don’t delay the payment of credit card. Late payments to loan EMI or credit card dues will significantly affect the credit score.

- Don’t be too exposed to personal loans and credit card loans. These loans do not require any security and hence attracts more risk to the lender.

- Don’t increase the credit limit of your credit card unnecessarily. The bank executives are offering you to enhance the credit limit for free. Sometimes, you also agree to their proposal. Don’t agree unless you really need it. Too much credit limit can affect your credit score.

Also Read: How To Pay off Credit Card Debt in Five Smart Ways

Share the article with the world.