The time has come to file the income tax return for the Assessment Year 2019-20 (FY 2018-19). But do you know whether you have to file income tax return …

Internet is growing very fast in all aspects of our lives. Social media and online shopping are becoming very popular among the common people. People are now well familiar …

Recently when I renew my family floater health insurance policy the insurance provider asked me 20% more premium. No claim for any member who is covered under the health …

Gilt funds and Debt funds are two investment options for investors who are reluctant in taking risks. Let’s take a look at how these two options differ in terms …

Buying a term insurance online offers several benefits, including security and cheaper rates. Since there is no agent commission involved, buying a term plan online can be about 20%-40% …

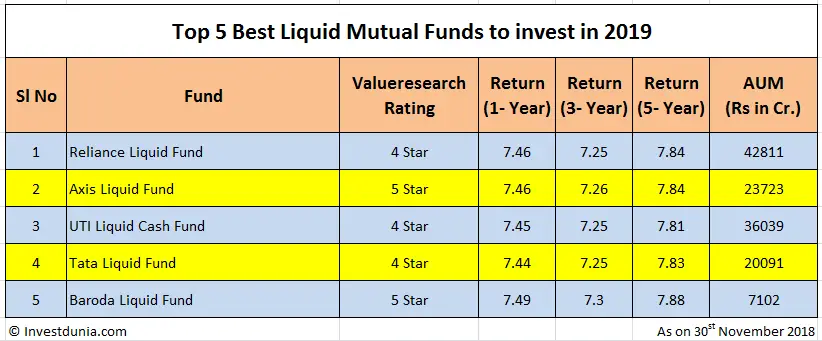

If you have some cash in your hand and you need the money in another 3 to 6 months, a liquid mutual fund is probably the best investment avenue. …

Personal loan is a very attractive form of loan and we require it many times in our lives for various reasons. We may require it for the down payment …

Healthcare cost is increasing day by day in India. The inflation for healthcare cost in India is 20% as compared to the overall inflation of 7-8%. So you need …