Sukanya Samriddhi Yojana is a scheme opened by Prime Minister Narendra Modi under Beti Bachao, Beti Padhao campaign. This small savings scheme is for the benefit of girl children in India. Hence, the terms and conditions have been set accordingly by keeping the girls’ education and marriage in mind. If you have girl child with age less than 10 years old, you can open an account in her name and take the benefit of the scheme. It is a PPF like savings scheme and power of compounding will help you to achieve the financial goal of your girl child.

Features of Sukanya Samriddhi Account:

- Parents or legal guardians can open an account in their girl child’s name if her age is less than 10 years old. Birth certificate is mandatory to show the date of birth proof.

- One account can be opened for every girl child. And any parents have maximum of two accounts in the two children’s name.

- The account can be opened by depositing Rs 1000 or more. The maximum amount of Rs 1.5 Lakh can be deposited in a year.

- The present interest rate for a Sukanya Samriddhi account is 8.1% which is slightly higher than PPF account.

- The account is matured after 21 years from the date of opening. The girl child can withdraw up to a maximum of 50% of the deposit amount after becoming 18 years old for her education or marriage.

- This account can be opened in any of the authorized banks or post offices.

- After attaining 21 years age, the girl child can close the account. If she chooses not to close the account, the account will be credited with interest for the deposit amount. There is no requirement of fresh deposit at that time.

Benefits:

The following benefits which I can easily figure out.

- The minimum amount can be deposited as low as Rs 1000 per year. After 15 years of deposit, you can have the option of not depositing but the account will fetch interest for the deposited money.

- You will get the complete tax benefit and it falls under Exempt-Exempt-Exempt category which means you will get tax deduction while investing, interest is tax free and maturity is also tax free.

- Higher interest rate than PPF and highest among the small savings schemes.

- The account can be transferred to any place within India.

- The deposit to this account can also be through online transfer.

- After 10 years, girls can contribute to her account. You as a parent should encourage to your child to contribute. This which will help to build financial habit of your child.

Also Read: Five Tips for Saving Tax by Which You can save lakh

Disadvantages:

Besides so many advantages, there are some drawbacks also.

- You have to be invested up to 21 years from the date of opening. Hence, liquidity is very less in this product.

- The scheme is available for up to 2 numbers of girl child of a guardian. You will not get the benefit if you have third girl child.

- After launching of the scheme within three years, the interest rate is down from 9.2% to 8.1%. It may happen that Government of India reduces the interest rate more and as a result, it will lose its shine to equity.

Withdrawal Timings:

Sukanya Samriddhi account was conceptualized by thinking the girls financial future. That’s why the withdrawals from this account follow strict guidelines.

- Once the account completes 5 years, you can withdraw the 50% of the deposited amount in case of compassionate background such as life-threatening diseases of the girl.

- After attaining the age of 10 years, the girl can operate the account of their own. She can also contribute to her account. At the same time, guardian can also continue to deposit.

- You have to continue at least 15 years depositing the account. If your child’s age is 5 years, you have to deposit up to 24 years age of the child.

- The girl can withdraw up to a maximum of 50% amount for her education when she becomes 18 years old. In this case, girl has to show a documentary evidence of her admission to an educational institution.

- The account is to be continued 21 years after the opening date. This is irrespective of age. So, if the girl’s age is 5 years, the account will be matured after 26 years. However, premature closure is allowed anytime after 18 years age of the girl. In that case, a disclosure has to be submitted saying that the girl child has crossed 18 years age.

Also Read: Post Office Savings Schemes – Features & Interest Rates

Which Banks Offer Sukanya Samridhhi Account?

The Sukanya Samriddhi account can be opened in the authorized banks and post offices. The following banks are authorized to open the account.

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda (BoB)

- Bank of Maharashtra (BoM)

- Canara Bank

- Bank of India (BoI)

- Central Bank of India (CBI)

- Corporation Bank

- Dena Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- State Bank of India (SBI)

- State Bank of Hyderabad (SBH)

- Indian Overseas Bank (IOB)

- Oriental Bank of Commerce (OBC)

- Punjab National Bank (PNB)

- Punjab & Sind Bank (PSB)

- Syndicate Bank

- UCO Bank

- State Bank of Bikaner & Jaipur (SBBJ)

- State Bank of Travancore (SBT)

- Union Bank of India

- United Bank of India

- Vijaya Bank

- State Bank of Patiala (SBP)

- State Bank of Mysore (SBM)

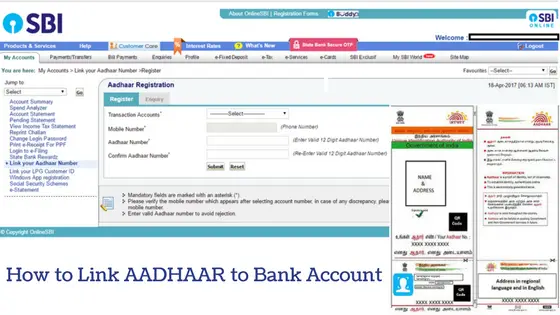

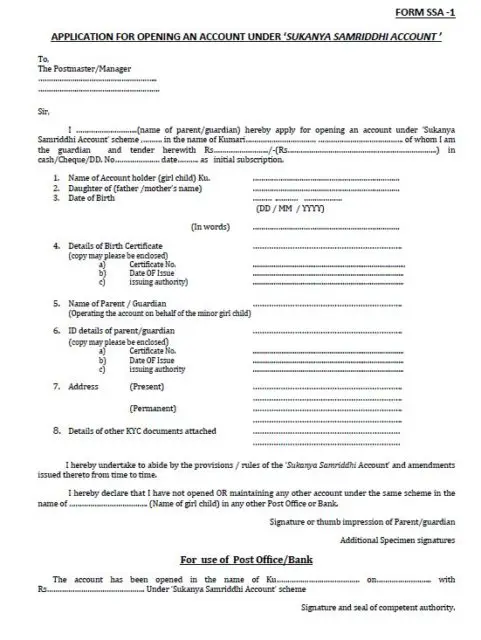

How to Open a Sukanya Samriddhi Account?

The opening form is common for all the banks and post offices. It’s one-page form and also very simple.

The other documents which you need while account opening is:

- Birth certificate of the girl child in whose name the account to be opened.

- The Identity proof such as PAN Card, Voter ID Card. ADHAAR Card, Driving License etc. of the guardian of the child.

- The Address proof such as Voter ID Card, ADHAAR Card, Driving License, Electricity Bill etc. of the guardian of the child.

Should you open a Sukanya Samriddhi Account?

It is a great product for some investment goals such as child’s education and marriage. Though equity is the best route to have long-term goals, you can invest some of the amounts in this account to minimize the risk in the equity.

If you have any thoughts, suggestions, comments please share in the comment box below.