Credit score is a number which determines the credibility to take a credit or loan. You may have heard that some of your friends or relatives have been rejected to grant a loan or a credit card due to insufficient credit score. But do you know what credit score exactly is, how the credit score is calculated, how you know your credit score etc. This article will answer all your queries including how to improve your credit score.

What is Credit Score?

As said earlier, credit score is a 3 digit number typically ranges between 300 to 900, which indicate your behavior related to credit. The credit score reflects your borrowing and repayment habits by providing information about the nature of loans (including credit cards) and repayment history. Higher the score the better are your borrowing chances. You may also bargain on the interest rate when you have a good credit score.

How the Credit score is calculated?

There are four credit information companies which can calculate credit score and authorized in India. The four companies are CIBIL TransUnion, Experian, Equifax, and High Mark. Though the calculation procedure may differ from agency to agency, the calculated score remains more or less the same.

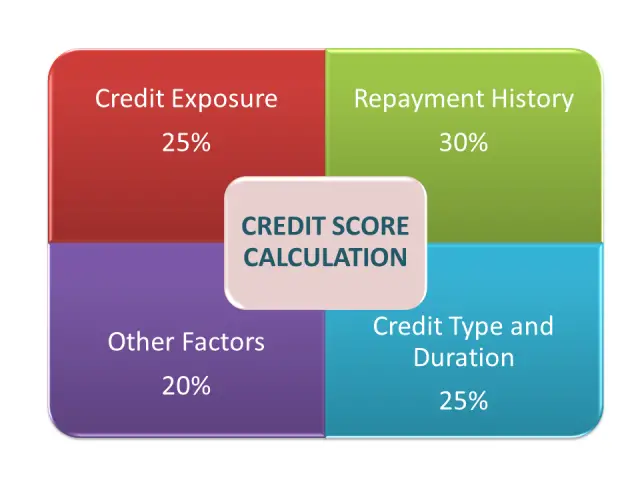

CIBIL is the first credit information company which started operation in India and most popular among the financial community. But the other agencies are also equally acceptable as they follow high standards. Now, we will look on how CIBIL is computing the credit score. The most important parameter to compute a credit score is the loan payment behavior of the individual. The CIBIL credit score is calculated based on the following factors:

- How much credit has been used by the consumer

- How many credit accounts and the duration of the due accounts

- What type of loan means secured or unsecured or credit card etc. the consumer has taken

- How many years the consumer is using credit

- What type of loan means secured or unsecured or credit card etc. the consumer has taken

- How the past credits has been repaid or the repayment history

All the above factors have weightage of 20% to 30% each depending on its importance. The higher the credit score means better chance of approving a loan and also favorable terms and conditions. CIBIL and other agencies also prepare a credit report which contains the credit score. This report along with score helps the financial institutions to decide before offering a line of credit to the consumer.

What is a Good Credit Score?

A credit score can be any number from 0 to 900. A credit score of below 300 is insufficient to decide to offer a credit or loan by any financial institution. The score between 300 to 600 is not good and mostly banks deny of giving credit. A score from 600 to 750 is a good credit score to consider. Banks will extend the credit to the lenders with good credit score. A score of more than 750 is considered as perfect to get a loan or credit card from a financial institution.

Hence, your target should be to maintain a credit score of 750+ so that when you need loan for your home or some other purpose the banks cannot deny giving you a loan.

The Importance of Credit Score:

Your credit score reflects your credit habits to your bankers and therefore it is indeed important for you to be concerned about your credit score. As such, people are now getting aware of the importance to review their credit reports regularly.

Even the regulator, SEBI, has acknowledged the need to regularly monitor the credit reports and thereby calls for one free report on an annual basis by the credit information bureaus. Reviewing your credit report indeed helps your diagnose your credit health. While your repayment record largely impacts your credit score, there are other matters impacting your credit score too.

Let us suppose that you have an option to take a secured loan for your business. However, at the same time, a new-age bank offers you a personal loan without any security at same terms, on the basis your income. You will indeed be inclined towards opting for an unsecured personal loan, but beware! This may result in adversely affecting your credit score.

What affects your Credit Score?

Is your credit score going down day by day but don’t know why? Here are some factors which is hurting your credit score.

- Late payment or ignoring of credit card bills

- Applying multiple credit cards or loans in a very short span of time.

- Having only one type of credit may effect negatively on credit score

- Late payment or ignoring the bill payments

- An enquiry of credit report from lender, banks or financial institutions lower your credit score by few points.

- The presence of too many credit cards, loans or accounts means high exposure to credit. Even if the account is not in use it will impact negatively on your credit score.

- If the credit history is present for a short time the credit score may be affected.

You may like to know How to come out from a credit card debt trap.

How to Improve your Credit Score?

As said earlier, credit score reflects the credit repayments over time and overall credit profile of a consumer. If you have less credit score and you want to improve the credit score a few points, following factors will help you.

1. Timely Repayment of EMIs/ Credit Card Dues:

Your repayment behavior or history is the most important factor for your credit information report and credit score. Your timely payment of all loan EMIs and credit card bills carries the one third weightage to the credit score.

You should always aim to pay off the credit card bills and monthly installments of your business loans/ personal loans without any delay. Many people do not pay their bills and loan EMIs in time. If you start paying your bills/ EMIs on time you can see an immediate enhancement in your credit score.

Try to pay the credit card bill 5 days before the due date because payment reflects in the credit card account after 3 days when you pay from other bank account. The habit of early paying will help you to increase the credit score.

2. Utilization of credit limit sanctioned:

Credit report not only reflects your repayment tendencies but also your debt management skills.

Avoid utilizing the credit limit to the fullest. Limit your monthly credit card bill to not more than 50% -60% of the credit limit which indicates your capability of debt management.

If you are continuously using the full credit limits and more frequently paying just the minimum amount due, the credit score will get lower and is also viewed negatively by banks and other financial institutions.

3. Check Credit Report and fix the issues:

You may know that you have a good credit history and the credit report. But sometimes it may happen that there is some misinformation or reporting error in your credit information report which drags your credit score down.

Sometimes the credit report shows your closed loan as still open, a loan which you have not taken but showing in your account due to some fraud activity. Check your credit report and bring the disputes into the notice of credit bureau. After resolving the issue your credit score may go up significantly.

Credit Report can be accessed from agencies any time by paying some nominal fees. You can also have a free credit report annually from credit agencies. Check the credit report and fix all the errors in the report.

4. Less number of loan/ credit card enquiries:

Credit agencies record each time your credit report is pulled from their website. There is a dedicated enquiry section in the credit report that lists all the loan enquiries made by you with any lender or financial institutions. This leads to a creation of the poor perception of being credit hungry, even while there may not be serious reasons for loan rejections.

Moreover, if the time span in which you have applied for loan or credit card is less there will be adverse impact on credit score.

So don’t apply for a loan or credit card within a few months. If you need to really apply spread the applications over a few months.

5. Secured Loan:

Secured loans where the security is an appreciating asset such as home loan have positive effects on your credit score where as the depreciating asset linked loans such as car loan has negative effect on credit rating. Moreover the unsecured loans such as personal loan has negative impact on credit score.

If you are a guarantor of someone’s loan who defaults on the loan repayment will affect your credit score. Many of us does not think while being a guarantor of a loan. We need to be cautious or sure about the person’s loan repayment.

How much time is required to fix credit score?

Many times I have got query that how someone can improve the credit score immediately. First of all you should know that you cannot improve the credit score by yourself. You can only work upon your credit history by strictly maintaining the repayment schedule which reflects on your credit score. The enquiries from financial institutions for credit remain two years and delinquencies remain 7-10 years in the credit report.

In an average it will take 4 -12 months to rebuild your credit score and it depends on maintain repayment schedule and lowering the credit usage compare to the actual credit you can have.

Factors do not affect the Credit Score:

There are some misconceptions about some of us that paying the utility bills not within the due date may affect the credit score. Sometimes collection agencies on behalf of telecom companies threaten the consumers about reporting the credit to credit agencies and spoil their credit score.

But this is not true. The telecom companies are not reporting the credit information to the credit agencies. The same thing applies to other utility bills such as electricity, gas connection etc. Here I am not discouraging to pay the bills but to aware the consumers from being exploited by utility companies.

The bouncing of cheque/ stop payment of cheque and bouncing of ECS cannot affect the credit score. The ECS bounce may result a delayed payment of EMI. Hence you should not default on EMI through ECS.

The inoperative savings account also cannot affect the credit score. If you have a savings bank account with no transaction it is not reported to the credit agencies. Only the credit information from a bank is reported to credit agencies. So you don’t worry about the inoperative savings bank account you have and its effect on credit score.

Conclusion:

It is always advisable to follow the good practices of paying the credits on time. You should not delay any EMIs or credit card bill. Moreover, don’t take too much exposure to the credit, only take that much required. Always check the credit score at a regular interval and try to maintain above 750. If there is some misinformation, correct it. Remember that the regular repayment of credit is the key factor to maintain a good credit score.

Share the article with others.

Hello Suman,

I went through your article, I really liked it. You have given very detail information about Credit Score. I would like to follow you regularly. Your blogs give me very nice and useful information.

You all are my motivation towards writing this blog. Please keep following Investdunia.

nice article