Thinking about money does not make your money grow, investing your money sensibly makes your money grow. A saying from a wise man that makes perfect sense in today’s competitive business scenario. We all want to invest our money and get the most out of it.

Would we be able to? That’s a tricky one because most of us do not know the ups and downs that come through in the investment market or scenario – the key would be to find out who does.

Nobody can ignore the importance of starting early to invest and continue to be invested in a regular and disciplined way. At the same time, managing your already accumulated wealth and growing it is a huge task for an individual.

The world of wealth management can be a tricky one. I realised this only after I experimented and made quite a few losses on the investment front, but this does not have to be the case for everyone who comes along. It can be quite challenging to understand where and what kind of investment would work for you but at the same time, it is equally important to know why you need to invest. It is the only way you can get your money to grow for you and that too in the quickest manner.

From the industry options, you have the equity market which is the strongest option amongst most investors. The sheer volatility broods excitement and makes it almost impossible to ignore. We all want to get that bit of excitement when it comes to trading in and out on the equity market. The catch here is that it is extremely dicey and can bring heavy downfall if not addressed the right way. Obviously, many of us are not fully aware of the kinds of highs and lows that can be predicted and that is why you should rely on a financial expert to guide you throughout on such decisions.

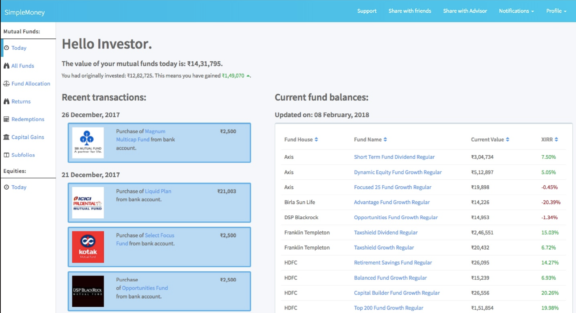

The second and safest option amongst many is to choose mutual funds which are considered the easier option instead of the equity market. The concept is pretty much the same, just that you have a more diversified approach to your investment and need to understand how the fund manager responds to each of your investment goals. It has to be approached with a lot of experience and attention.

You need to select the mutual fund according to your investment goal. Review your portfolio once or twice in a year and if some funds are not performing well, drop them from your portfolio. If you are not enough confident of judging the right fund for you, take the help of a financial advisor. An unbiased financial advisor who is a fee-only advisor can recommend you funds according to your requirement and guide you in your journey to achieve goals.

Many of us try to invest in various forums and channels without understanding the advantages that are at hand. This does bring out the best in the investment circle at times but the chances of a high list are much more. You are not aware of the risks that can come by and most importantly you are living a riskier game. It makes perfect sense to choose wealth management services if you feel you cannot choose an easy path to maintain your money. The risks that come from it are far tougher to predict and choose on the first go.

Also Read: Five Simple Money Hacks in India which Help You to Save Big

With the right expert at hand, you would get guidance on all sorts of investment. Right from the equity market, the mutual fund picks or even the realty options. That makes the choices at hand plenty and gives you so much to choose from.

When options of choosing options like this come across, you have to understand your wealth manager really well! Some of the things you have to be able to relate to are –

- Ensure that you explain your fund goals and what you want to achieve out of every investment. Are you in for the short or the long haul? How would you make a decision based on the kinds of investments you have at hand?

- It is very important for the fund manager to know which kind of investment options suit you best and also if they would make logical sense based on the timelines you have kept in mind to retrieve your money.

- Sharing all investment options and giving your expert a clear picture on the kind of risk appetite you have. There can be many volatile options to choose from and your expert should have a complete idea on what would suit you best.

At the end of the day, you are going to have tons of options to choose from and these options need to be judged and studied by an expert. With the right kind of guidance and expertise, you can make money from the money you have earned. That is the smartest way to increase your wealth and find your perfect wealth expert today.

Share the article with others.