The prime minister of India Mr. Narendra Modi banned the note of Rs 500 and Rs 1000 to curb the black money. After demonetization, the use of Digital wallets has been soared high. On the second day of demonetization, PayTM has seen a growth of seven times in traffic and doubled the average transaction value. Even PayTM has reached its revenue target before four months.

The other leading digital wallet, Mobikwik has also doubled its average transaction value. Freecharge has also witnessed the sudden growth in their average balance. Due to the lack of currency in the market, we are using the digital wallet as the medium of transaction. If you are still not using Digital Wallet, download and use it.

Also Read: Digital Wallet – Benefits and Use

The Government of India is continuously encouraging people not to use cash for its regular transactions and businesses as the cost of the printing and circulation of notes are very high. There are other issues such as non-tracking of financial transactions, black money etc. as well.

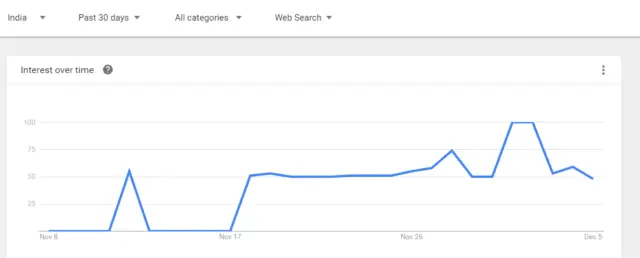

National Payments Corporation of India (NPCI) is an umbrella organization for all retail payments system. NPCI has introduced a virtual payment system called unified payment Interface (UPI) for the seamless transaction of money using the technology and smart phone. After demonetization, people are expressing their interest in using all these new technologies. Google search is also showing a steep increase in these types of search terms e.g. NPCI UPI app.

What is UPI:

UPI is a payment system by which any bank account holder can send and receive money from their smart phone with the use of virtual payment address (VPA). You don’t have to put your bank account number or debit and credit card details every time. UPI enabled app can be used if you have any bank account. UPI was launched by NPCI in April 2016 and first UPI enabled app was launched in August, 2016. Almost all leading banks have the UPI enabled app in the app store.

How it Works:

Currently, the payment or transfer of money through internet banking is a very cumbersome process. You have to put account number, IFSC code etc. for payment or transfer of money before actual payment. To reduce this cumbersome process, NPCI has introduced UPI which enables you to transfer the money from your smartphone without using all those details.

This process actually happens with the help of AADHAAR, your mobile number, and VPA. When you sign up with a UPI-based app, it will generate a virtual id of yours such as yourname@bankname.com. In case you add multiple accounts, you have to set the default account on which the money will be debited or credited unless you choose another account. It is based on immediate payment service i.e. IMPS which means it is available 24×7 throughout the year. It has push and pull facility which enables you to transfer and receive the money without giving all the bank details every time.

Moreover, the single app can handle all your bank account, if you add all your bank accounts with this app. If somebody owes money from you, you just give your virtual address to him. He will demand money through UPI app and after authorization from you the money will be deducted from your account. You can also transfer the money to his virtual address directly.

It can revolutionize the whole payment system in the day to day transactions across all over India including rural area. Though the use of smartphone and internet service is not so satisfactory in the rural area, Government of India is trying to boost the infrastructure to encourage cashless transactions.

Also Read: How to Link AADHAAR to Your Bank Account Online and Offline

Benefits of UPI:

- You can receive or transfer money to different bank accounts through single app from your smartphone

- It can be used for recharges, bill payments, over the counter payments etc.

- You need not provide all the bank account details every time.

- Bank details are nowhere saved which ensures safety and security.

- It is available 24X7 on real time basis, so no delay in payment or receiving.

- Scheduling Push and Pull payments for various purposes.

- You can raise your query through UPI app.

Limitations of UPI:

- You can send Rs 1 lakh per day with a maximum of ten numbers of transactions.

- Though most of the transactions are free, some of the interbank transactions may attract some charges in the range of Rs 5 to Rs 10 approx.

UPI vs Mobile Wallet:

With the advent of UPI, the confusion comes between the UPI and mobile wallet or digital wallet. Both are separate in nature. The mobile wallet is mostly used for payments to stores, recharges and bill payments whereas UPI is to be used for mostly on account transfers rather than the small payments. Since some of the digital wallets are quite a sometimes present in the market, giving cashback offers and evolved as a face of small payments to groceries or bill payments. They have also given wonderful user experience to the consumers.

Also Read: All About Payment Banks Which You Should Not Overlook

With the introduction of UPI, it is obvious that their position will be down but the user experience of the UPI app will be a great factor for the future winner between UPI and mobile wallet. It may also happen that the both the system will be present side by side. Here innovation may drive a handsome factor for mobile wallet companies.

Should you use UPI app:

Presently we are using NEFT, RTGS method to transfer the money to others bank account. Those are a cumbersome process and takes time. NEFT cannot happen in the holiday. UPI app makes the system easy and quick. It enables you to pay and receive instantly with some clicks of a smartphone. Using a virtual id also ensures the safety of the bank account details. Most of the banks already launched the UPI enabled apps such as PNB UPI, United UPI, Axis Pay UPI, Pockets, Chillr and many more. So just download and sign up any of the UPI apps and be cashless.

If you have any comments or observation, please write on the comments section.

Thank you for sharing such great information. It has help me in finding out more detail about Unified Payment Interface i am interested and would like to know more about this field and wanted to understand the details about Upi app