PPF is a good investment for the long term with the tax benefit. Generally, PPF is used as an investment avenue to reach retirement corpus. It is not advisable to withdraw or partially withdraw the money from PPF account. You need to have a proper contingency plan to fight with the struggles which you are facing before retirement.

Even though it is easy to say having a contingency and not to touch PPF, in reality, it would require withdrawing some quick money from other sources also. Here are PPF withdrawal rules how you can take either loan or withdraw partially from PPF account.

Loan from PPF:

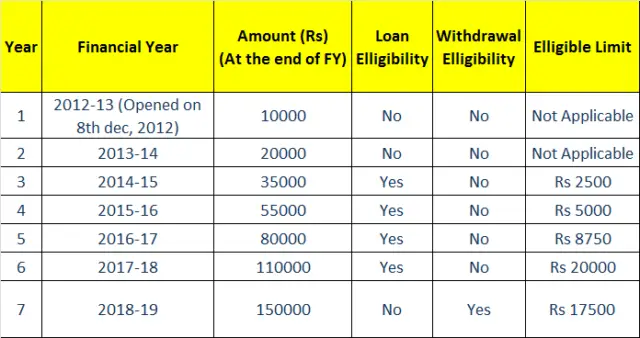

You can take the loan from PPF between 3 to 6 years of opening the account. Here, the year is considered as financial year. Suppose, you have opened an account on 8th December 2012. Hence, The FY 2012-13 is the first financial year for PPF account. You can get the loan from the third year after opening the account i.e. 2014-15. You can apply for a loan on the first day of the third financial year itself.

The loan from PPF has following aspects:

- No mortgage is required to take the loan from PPF

- You have to bear 2% more interest for the loan. Currently, PPF interest is 7.8% so the loan interest is 9.8%.

- You can easily compare by observing the loan interest is that the interest rate is much lower than the loans available from the banks.

- The loan repayment period is fixed and it is three years or 36 months.

- If the loan repayment exceeds three years, you will be charged 6% more than the interest earned on the balance on the PPF account.

- The amount of loan eligibility is 25% of the balance amount at the end of financial year which is 2 years before the financial year in which you are taking the loan.

- You can repay the loan principal by paying a lump sum or monthly installments of minimum two numbers. Remember, the repayment should be within 36 months of the loan taken.

- After paying the loan principal, you need to repay the interest on the loan in two monthly installments.

- You cannot take the second loan until you pay the full amount taken on the first loan.

- If you fail to pay the loan partial or full within 36 months of the loan disbursal, the interest of the loan is debited from the account at the end of each financial year.

- The loan from PPF account can be taken once in a financial year.

How to take the loan from PPF account:

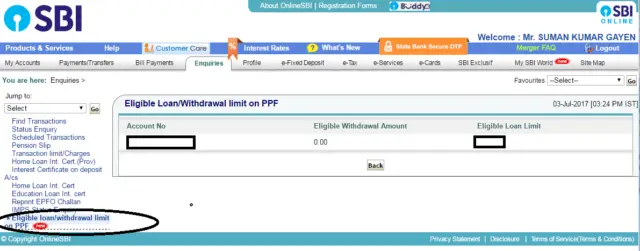

If you have PPF account with SBI and you have online banking facility, you can check your loan eligibility from PPF. There is no option of loan request through online. You have to do it offline only. If your PPF account is at the Post office, you can transfer it to your nearest bank.

- You have to download the Form-D.

- Fill up the application with the account number, loan amount, amount available etc.

- A photocopy of passbook is also to be attached with the application.

- Submit the filled up form to the bank or post office where your PPF account belongs to.

- Your loan will be processed within 7-10 working days from the date submitting the application.

Partial Withdrawal from PPF:

When you cross the sixth financial year after opening the account, you will not get the loan from the account. You have to withdraw some portion of the balance to manage your requirement. Take the above example for illustration. You have opened the PPF account on 8th December 2012. You can withdraw partially from PPF in Financial Year 2017-18.

The following points are important as applicable for the partial withdrawal from PPF.

- Only one partial withdrawal is allowed in every financial year starting from seventh financial year after opening the PPF account.

- You are eligible for partial withdrawal of minimum of the followings

- 50% of the account balance accrued till the preceding year of withdrawal

- 50% of the account balance accrued till the 4th financial year, preceding the current year of withdrawal

- You don’t have to show any reason to withdraw the amount.

- Needless to say that you don’t have to repay the amount.

- There is no income tax applicable for this withdrawal from PPF account.

Also Know: When You can Withdraw partially from PF? and When You can withdraw Partially for NPS?

How to withdraw partially from PPF:

You can withdraw the amount partially in the following steps

- Download the Form-C.

- Fill up the form with necessary details such as account no, amount you need (It should be within eligibility limit) etc.

- Enclose the Photocopy of passbook.

- Submit the filled up form and you will get money within 7-10 working days.

Some rules have been changed in 2016 for PPF:

- Earlier, you cannot close the PPF account before 15 years under any circumstances. Now, you can close the account under certain circumstances.

- You can close the account in case critical disease of the account holder or any of the family member such as the spouse, children. A medical certificate is required to be attached along with your closure application.

- You can also close the account in case of higher education of your children. Here also sufficient proof is required to substantiate the claim.

- The above closure of PPF account is applicable after completing the five financial years.

- 1% of interest will be deducted from the maturity amount if the account is closed in this way.

Conclusion:

There are ways by which you can withdraw the PPF balance for your requirement. But, is it good to withdraw from PPF account? The answer is surely a big no. The PF, PPF is the mode of long term investment and one should apply its power of compounding to achieve a retirement goal. If you withdraw the amount, it will surely postpone your goal to achieve.

You have to have a proper contingency plan to take care the risks which can come to your life. A Health insurance can take care of the health problems. A better planning can take care the need of money for your children’s’ higher education. You should only take the money from PPF account when you don’t have any other source.

Share the article. 🙂