People buy mutual funds online and offline through agents and distributors. Often, this question has come into peoples’ mind how we can redeem mutual funds units. Can it be withdrawn partially or I have to withdraw the full amount what has been accumulated so far? What will happen in the time of redemption in case I buy a direct mutual fund? Mutual fund SIP is a highly flexible product in which you can easily invest, redeem and even you can stop the further investment at any point of time. The redemption is also important which you should know at the same time when you are investing in the fund. Take care of your effective return while redemption of a mutual fund.

You can redeem the mutual fund in the following ways:

1. Offline:

Most of the investors are buying mutual funds through agents or distributors. Many of the cases, this agents or distributors are individual. When you want to redeem the fund you are not able to connect them or they are away from you. In this case, go to the AMC (Asset Management Company) website in which the fund belongs to such as go to ICICI Pru AMC if you have ICICI Pru Value Discovery Fund. Go to the relevant AMC website. Download the applicable redemption form. Fill up the form with folio no, fund name, no of unit etc. and submit to the office of AMC or Distributor.

2. Trading Account:

If you have bought the mutual fund through the trading account such as Sharekhan, ICICI Direct, Axis Direct etc. your job for the redemption of the fund is easy. Log in to the applicable website of broker and select the redeem option beside the mutual fund name. It will then ask you about the number of units you want to redeem. Select your option and money will be credited to your savings account.

Also Read: Mutual Funds Vs Stocks: Why Should You Prefer Mutual Funds Over Stocks

3. KRAs:

You can also redeem the fund through KYC Registration Agencies (KRAs) such as CAMS, Karvy etc. Fill up the redemption form with folio no, fund name, units to be redeemed and other necessary details. Go to the nearest office of CAMS/ Karvy etc. and submit the filled up form for further processing.

The money will be credited to your savings bank account which you have provided while filling up the redemption form. But be aware that all the CAMS or Karvy cannot take care the service requirement for all the AMCs. Other than CAMS there are other KRAs such as Karvy, FTAMIL, SBFS. Check your fund before going to CAMS or Karvy office.

4. Directly from AMC Website:

You can sign up directly on the AMC website with the folio details and mobile number, email id etc. You can log into the account, and redeem the units according to your preference. The redeemed money will be credited to your designated bank account already linked with the fund.

When you redeem the mutual funds, remember the following five points:

1. NAV applicable:

You must know the amount you will get when you redeem a mutual fund. The net asset value (NAV) is set after the closing of the each day trading. If you put the redemption request before 3 pm, the NAV of that day shall be applied. So, be aware of the timing while redemption of mutual fund units.

2. Linked Bank Account:

The bank account is primarily linked with the each and every fund from where you have paid during investment. Some of the above cases where I have discussed the process, the other bank account can be linked during redemption also. So, take a note while redeeming the fund and ensure that the bank account is active.

3. Exit Load:

Almost all the mutual funds attract exit load if you redeem the fund within a specific period set by the AMC. The exit load will be deducted from the redemption money. Then the balance amount will be credited to the bank account. In some cases, the taxes are also applicable when you redeem mutual funds. The difference between the redemption value and investment value is called capital gain. This capital gain attracts tax depending on its tenure. Before redeeming the fund, also calculate the applicable taxes and exit load.

4. Time to Credit of Money:

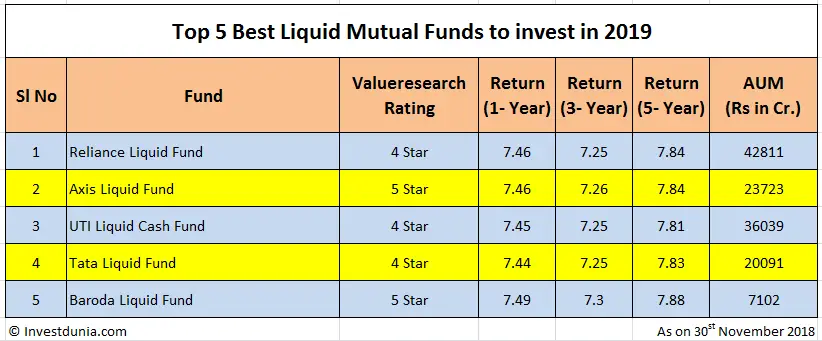

The time required to process the redemption request varies for different AMCs. Generally, AMCs are taking three working days to process a request for redemption. This means you can expect the fund in your bank account after 3 working days of requesting for redeeming the mutual fund.

5. Lock in Period:

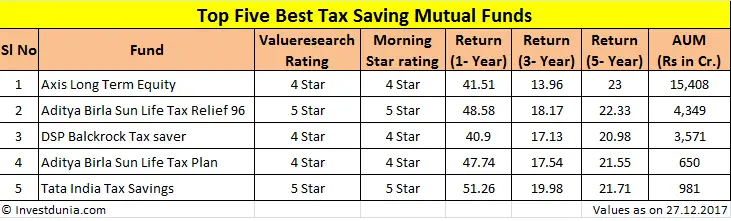

Equity-linked saving scheme (ELSS) or tax saving mutual funds have a three-year lock-in period. You cannot redeem a fund within three years of investing. Also remember, every transaction in SIP is considered as a fresh transaction and treated as the applicable investment date of the money. You have to wait three years from that investment date for redemption of the applicable units which was invested.

Conclusion:

Out of the above procedures, the best way to redeem a mutual fund is obviously online. It is hassle free and you can do it sitting at home. Register or sign up in AMC website or Relevant KRA website according to your convenience to redeem the mutual fund easily when required.