The finance minister introduced the Long-term capital gain tax on direct equity and mutual fund in the budget for FY 2018-19. Since then the insurance companies started to campaign for the benefit of ULIPs on tax point of view. People are busy in searching the financial products or alternative investment avenue by which they can avoid the long-term capital gain tax.

In this article, I will compare ULIP Vs Mutual fund vis a vis explore the better investment avenue between these two products.

What is ULIP?

What is Mutual Fund?

ULIP Vs Mutual Fund:

#1 Costs Structure:

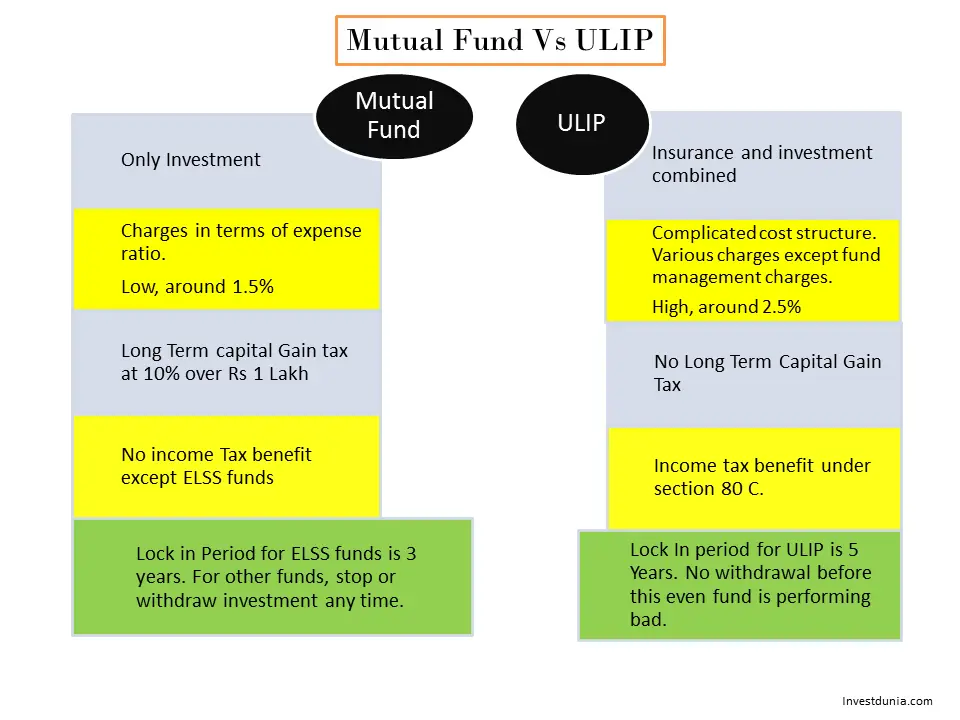

Compare to ULIPs, mutual funds are easier to understand. It has NAV which is considering the total expense ratio. The expense to a mutual fund is levied over the years.

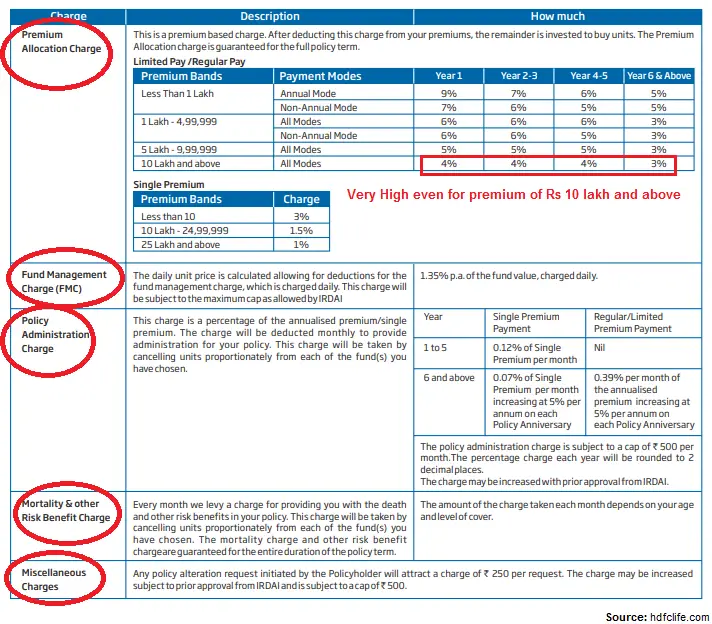

a. Premium Allocation Charge

b. Fund Management Charges

c. Policy Administration Charges

d. Mortality & other risk-benefit charges

e. Miscellaneous Charge

Any administrative and other charges which have been introduced after the policy start date by the insurance company.

f. Partial Withdrawal Charge

If you request a partial withdrawal from the existing units fees will be charged for the request processing. When you request it through web portal the charge can be less for some insurance company.

g. Switching Charge

A ULIP gives you the opportunity of changing the fund allocation once or twice every year depending on the policy and this is free of cost. If you want to change the fund allocation more than specified times the policyholder will be charged.

h. Premium Redirection

The premiums are set based on the fund allocation at the time of policy buy. When you request for a different fund allocation, the existing allocation has to be changed as per the new allocation to a different fund. This charge is called as premium redirection charges.

i. Discontinuance

This charge is levied when you decide to discontinue with the premium. Generally, after 5th year the discontinuance charge is NIL.

Now-a-days there are various online ULIPs which has very less charges available. HDFC click 2 Invest has fund management charges of 1.35% and low mortality charges. This fund management charge is almost same as the expense ratio of a direct mutual fund. Here mortality charge is the difference creator between ULIP and mutual fund which creates ULIP as a costlier product.

#2 Taxation:

The comparison between ULIP and mutual fund is widely spreading in the market due to the introduction of Long-term capital gain tax of equity mutual funds in the budget.

The Long-term capital gain from an equity mutual fund is now taxed at 10% over 1 lakh in a financial year. But the gains from a ULIP are tax-free as it is an insurance product.

The short-term capital gain always bears the tax of 15%. The debt mutual funds are having short term and long term capital gain tax. But the ULIPs do not bear any tax on short term as well long term.

The taxability of ULIP has made it advantageous over mutual fund.

#3 Returns:

The ULIPs are a combination of investment and insurance and the mutual funds are pure investment products.

Let’s say Rs 1 Lakh is to be invested for 5 years to tax saving mutual fund as well as ULIP.

If we invest Rs 1 lakh in ULIP, the insurance coverage is 10 times of annual premium means Rs 10 Lakh. Considering the return of a ULIP at 8% per annum it will be Rs 6,33,592.

For insurance of Rs 10 Lakhs, we need to subtract Rs 3000 for term plan. In this case, the effective investment to a mutual fund is Rs 97,000 per year.

Now after 5 years, the money will grow at Rs 6,14,585 considering 8% per annum. Here the Long-term capital gain is Rs 1,29,585.

You have to pay 10.4% of LTCG Tax over the capital gain of Rs 1 lakh in a year. So, here the LTCG tax arrives at Rs 3077 and maturity value is Rs 6,11,508.

For the mutual fund, the effective return is coming around 6.8% post-LTCG Tax.

Also Read: 6 Best Small Cap Mutual Funds to Invest in 2018

The premium allocation charges drastically reduce after 10th year which helps to grow your ULIP investment. Here I have considered 8% return for ULIP as well as Mutual fund. As the mutual funds have low expense ratio compare to the fund management charges and other charges of ULIP the return would be less for ULIPs than mutual funds.

As mentioned earlier, HDFC Click 2 Invest has fund management charge of only 1.35% and low mortality charges. These funds can be a good competitor of mutual funds.

#4 Flexibility:

Flexibility is the biggest issue for a ULIP. You buy ULIP for a long term which will mature after 10-20 years. You will not have so many options of choosing the fund. There are some funds from which you have to choose.

There are no such restrictions for a mutual fund investor. You will have a large number of options. You can easily shift from worse performing mutual fund to a better one.

Moreover, the mutual funds are more transparent than the ULIPs. The cost structure of ULIP is very complicated which is difficult to understand for a common investor. But the charges and return of mutual fund is simple and can be understood easily by a common investor.

You can redeem a mutual fund any time except the tax saving mutual fund which has a lock-in of 3 years whereas you cannot redeem a ULIP for a period of 5 years because a ULIP has 5 year lock-in period.

#5 Liquidity:

Both the investments i.e. ULIP and equity mutual fund are long-term saving options. You should not withdraw the investment in mid-way. But if you need money you can easily withdraw partially from mutual fund.

The ULIP has 5 year lock-in period which will restrict you to withdraw partially. You can withdraw fund from ULIP after 5 years of the policy.

What Should I do?

From the above, it can be identified that the biggest disadvantage of ULIP is choosing of funds. You have limited options of choosing the fund for a ULIP. Even if the funds are not performing well you have to continue with that funds for at least 5 years.

The mutual funds are not having such problems. There are a large number of mutual funds with different options which you can easily choose and drop based on their performance.

Also Read: Difference between ULIP and SIP-Which is the Best

Moreover, the combination of insurance and investment does not suffice the purpose of any investors. It is always better to differentiate the insurance from the investment.

Only gain from ULIP over a mutual fund is 10% LTCG Tax. But if you stuck with a poor performing ULIP it may cause you more harm. So, in my view, it is better to use the flexibility and return of mutual funds and stay invested in mutual funds without worrying about LTCG tax.

Share the article with others. 🙂

Hi,this is very good article I was looking for this from long time.