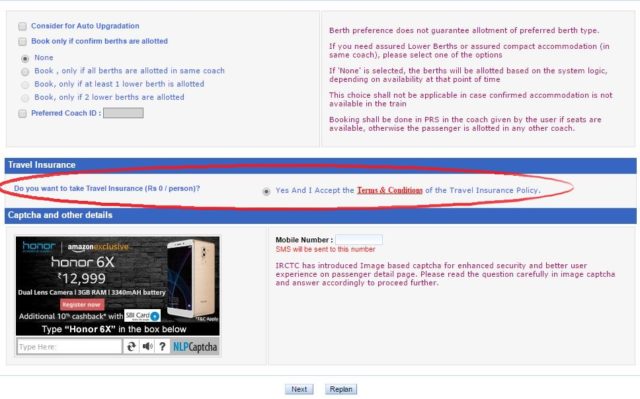

Recently, when I was a booking a train ticket found the sentence ‘Do you Want Travel Insurance’. After booking the ticket, one email consisting of travel policy document reached to my inbox.

After that, I started to enquire about this travel insurance. We have seen an extra price is to be added to the air ticket for the travel insurance. Now, it is also applicable for Indian Railway and specifically tickets booked through IRCTC.

We will look into the features, benefits of this IRCTC travel insurance. As we all know the importance of life insurance, this travel insurance is also important.

What is travel insurance?

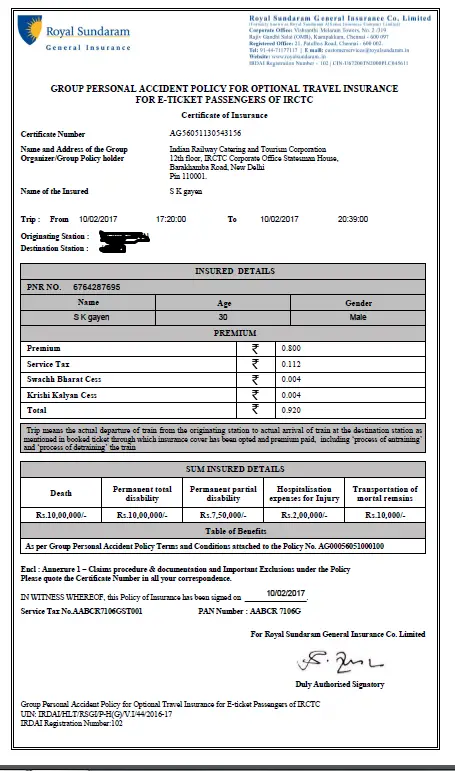

Travel insurance is the insurance coverage when the person is in travel and this coverage is for life and any medical emergencies. The insurance is covered by a general insurance company. It will cover in case of train accident like collision, derailment etc. and terrorist attack, violence, robbery etc. The following three insurance companies have been appointed for the insurance.

- ICICI Lombard General Insurance Company Limited

- Royal Sundaram General Insurance Co. Limited and

- Shriram General Insurance Company

Features & Benefits:

The insurance covers the death or permanent total disability benefit of Rs 10 lakhs, permanent partial disability of Rs 7.5 lakhs. It also covers hospitalization cost of Rs 2 lakhs due to injury and Rs 10000 for transportation of mortal remains.

The insurance is now free for all tickets booked through IRCTC. Earlier IRCTC used to charge Rs 0.92 for each ticket.

Also Read: What to Take Care Before You Buy Car Insurance Online

This insurance is applicable for all classes of travel in a train.

The insurance is applicable for all passengers booked under single PNR no.

The policy settlement time is very less i.e. 15 days from the claim submission.

Claim Procedure:

The insured person or nominee or legal heir should file the claim within four months from the date of occurrence. All the proofs including policy details have to be furnished to the insurance company. The documentation is clearly specified in the policy guidelines in case of various claims.

Terms & conditions:

- The policy is valid from the time when the train departs to the time when the train arrived at the final station.

- The accidental falling of any passenger from a train carrying passengers is also applicable for this insurance.

- The insurance has to be claimed within four months from the date of occurrence. The registered nominee or legal heir of the insured person can lodge the claim.

- The insurance benefit shall be paid within 15 days from the date of claim.

- All the insurance benefits shall be payable in INR only.

- The scheme is applicable for Indian Citizens only. This is not applicable for foreign citizens.

- Customers receive the information of policy through SMS, email etc.

- After the booking, the nominee details to be filled up in the respective insurance company website. If you don’t fill up the nomination details, the legal heirs are applicable in place of a nominee in case of any claim.

Share the article with the world. If you have any comments to add, please comment on the below comment box.