Most of us have a bank account that keeps our money safe. But does that mean all our funds, including idle cash, be parked in a savings account? What if there is a better alternative that can give higher returns than a bank account and is almost as safe? Liquid funds can be an ideal investment avenue that can provide you with the liquidity and flexibility you need.

For new investors who do not know what is liquid fund, these are a type of debt funds that invest in money-market securities. These include certificate of deposits, treasury bills, commercial papers, short-term bonds and more.

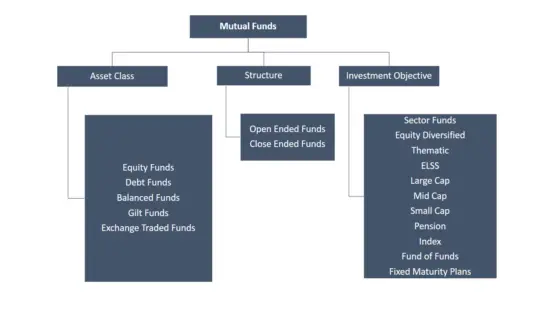

Read and know the types of mutual funds which are available for investing.

Now that we know liquid funds meaning, let us look into the benefits of including liquid mutual funds in your portfolio.

Higher Returns:

On average, the money in your savings account fetches you 4% interest per annum. Some banks may voluntarily choose to offer a higher rate of up to 6% to attract more consumers. However, liquid fund returns can be as high as 7% to 8% on average. If you compare the post-tax returns of both these options, liquid funds can be a relatively better option than a bank account.

Taxation:

Interest from a savings account is eligible for a deduction under Section 80TTA up to Rs. 10,000. Any income earned over the limit is taxable as per your income slab rate. For an investor who falls in the highest tax bracket, this could mean 30.9% including surcharge.

For an investor in the 30% tax bracket, liquid funds make more sense. Even though dividend income earned on liquid funds is tax-free, it is subject to a dividend distribution tax of 29.12%. This turns out to be slightly more tax-efficient in the long run. As far as the tax on liquid funds is concerned, if you hold the funds for more than 3 years, you could be eligible for long term capital gain tax at 20% with indexation benefit. However, if you hold them for less than 3 years, you would have to pay tax as per your income tax bracket.

Also Read: Capital gain tax on Mutual Funds.

Contingency Planning:

Financial planners recommend building a contingency fund for 3 to 6 months of your expenses. You can achieve this by investing in a liquid fund. You can start investing via Systematic Investment Plans (SIPs) in liquid funds till the time the corpus reaches a level you wish to accumulate.

You can also use short-term liquid funds as a parking area whenever you wish to start investing in equity funds. You could let the money lie in liquid funds and earn decent yields, till you decide whether you must withdraw or deploy into equity mutual funds. Ultra-short-term bond funds are known to offer returns as high as 8.5% to 9% on an annualised basis.

Conclusion:

It is a wise idea to have liquid funds in your portfolio. Once you know how to invest in liquid funds via SIPs, you can build a contingency fund to prepare for unforeseen emergencies.

Liked the article. Share it with others.