-

Healthy Lifestyle:

We all know that health is wealth. And this sentence holds well when you come to the health insurance premium. If you are healthy you are less prone to diseases. This is recognized by all the insurance companies and may give you premium discounts. So take some time out every day from your busy schedule and do exercise which will keep you fit and healthy. Also stay away from any bad habits such as smoking, drinking or chewing tobacco which increases your premium on health insurance.

-

Start at Young Age:

The health insurance premium depends on the age of the insurer. As the age increase, you become more prone to bad health and different ailments. The insurance premium also increases as the health risk increases. Therefore, purchasing a health insurance at young age shall be beneficial for you to lower the premium.

Moreover, you need to wait for 24-48 months for certain treatments from the issuance of the first insurance policy.

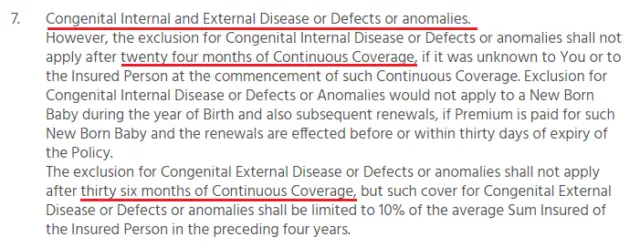

Here is an example of a waiting period for New India Mediclaim Policy.

Health Insurance Waiting period

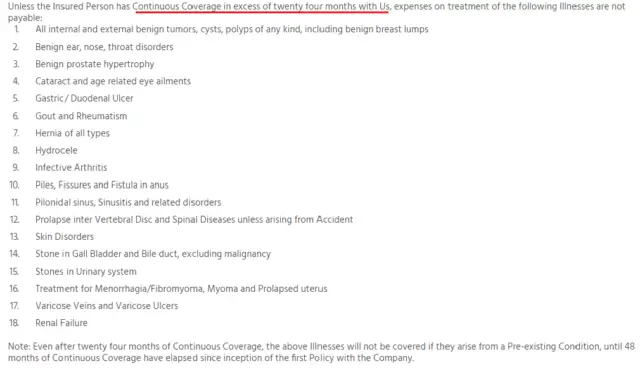

There are other cases also where you cannot claim within a certain period.

New India Mediclaim Policy

Also Read: Benefit of Savings Early – Know Power of Compounding

-

Avail No Claim Bonus/ Premium Discount:

If you don’t claim during a particular policy year you will be entitled to be benefited by No claim bonus. When you renew the insurance the certain percentage of coverage is added to your no claim bonus in the insurance. Suppose you have a cover of Rs 3 lakhs and the insurance company has facilities of giving no claim bonus of 5% of cover then you will get Rs 15,000 as no claim bonus with the same premium.

Some insurance companies are not giving the ‘no claim bonus’. Instead of giving no claim bonus they benefit you by lowering the next year renewal premium. So, don’t forget to ask your premium discount when you are renewing your health insurance.

-

Opt for Voluntary Co-payment:

When an insured person opts for a health insurance policy where he or she pays in proportion to the hospital bill is called as voluntary co-pay. If the insurance is for 20% voluntary co-pay which means 20% of the hospitalization cost is to be borne by the patient. Suppose, the hospital bill is Rs 40,000 the patient pays Rs 8000 and the insurance company pays Rs 32000.

As the insurance company pays less every time, obviously the premium for insurance will be less. The new India mediclaim policy gives the 15% discount on premium when you opt for 20% voluntary co-pay in insurance coverage.

If you have primary insurance from your employer and you know that the insurance bought by you shall be used as secondary, you can easily think of reducing the premiums by use of voluntary co-pay.

-

Use Super top up Policy:

If your existing health insurance falls short of your requirement, you can take the coverage via super top up health insurance policy. A super top-up health insurance premium is cheap compared to the primary insurance. Even you can purchase super top-up health insurance from a different insurer where you have primary health insurance.

Conclusion:

The insurance premium is increasing every year as insurance claim goes up day by day. You have to take care of health insurance with optimum premium so that your other financial goals are not jeopardized. You can take the help of above tips and reduce your health insurance premiums effectively.

Are you searching for the best health insurance for your family. Here is the list of 5 best Health Insurance for your family.

If you like the article share it with others. 🙂