Healthcare cost is increasing day by day in India. The inflation for healthcare cost in India is 20% as compared to the overall inflation of 7-8%. So you need to save enough to meet the healthcare expenses throughout your life. Else you can buy health insurance which can protect you from hospitalization expenses. There are two kinds of health insurance policy, individual and family floater.

The individual health insurance plans are for a single person and family floater health insurance plan cover the whole family’s medical expenses up to the sum assured limit. I have shortlisted 5 best health insurance plans for the family floater category.

Unhealthy food habit and lifestyle has made our health uncertain. If you have good health today there is no certainty of good health tomorrow. We need to prepare for any unexpected health issues in the future. At the same time finance is also important to meet the expenses. Rising medical cost can destruct all your finances. If you are not insured to cover your medical charges it may happen that one hospitalization can eat all your savings and jeopardizing other financial goals.

What is Family Floater Health Insurance Policy?

A family floater health insurance policy covers all the family members in a single policy. This type of health insurance costs less compared to the individual health insurance policy. The coverage is applicable up to the maximum limit in a year for all the members of the family. The probability of getting sick of all the family members in a year is less which makes sense to have a family floater health insurance policy.

If you buy a family floater policy of coverage Rs 5 lakhs for you, your spouse and 2 children, you can spend maximum Rs 5 lakh in a policy year for the treatment of one or maximum 4 members. Suppose in a policy year, Rs 2 lakh has been used by one member, the other members can use the rest Rs 3 lakh in that policy year.

Key Factors of a Family Floater Health Insurance Policy:

The following key factors are to be considered for choosing the best family floater health insurance policy.

Hospitalization Cover

Hospitalization cover is the amount up to which you will get reimbursement of hospitalization expenses. Now, what is the right amount of cover that you should take? Many people ask me the question. Ideally speaking, I also don’t know the exact amount. Based on the history and expenses profile of others, my suggestion is to take the cover of minimum 5 lakhs rupees for a family of 3-4 members. If you think the amount needs to be higher at any point of the time go for a super top-up policy.

Premium

An insurance premium is the most important parameter we generally look after while selecting a health insurance policy. The premium is less for a family floater health insurance compared to the premium for an individual health insurance policy. Sometimes we fix an insurance cover only based on the premium we pay. But we should take care whole lot of other factors also before buying health insurance.

Also Read: How to reduce your health insurance premium

Co-Payment

When the entire hospitalization cost is not spent by the health insurance cover and you have to pay some percentage of expenses is called co payment. The co payment can be 10%-20% according to the policy. The policies with co pay obviously need a lower premium.

Ceiling Amount

Some companies have certain ceiling amount over various types of expenses such as bed charges etc. If the ceiling amount for bed charges is Rs 2500 and the patient is admitted in a bed of charge of Rs 3000, the balance Rs 500 is to be paid by the patient.

This is applicable not only to the bed charge but also for other charges like doctors consultation, medical tests, surgery costs etc. Proportionately those charges also have to be borne by the patient. My suggestion shall be of buying insurance with no room rent capping.

Critical Illness

If you decide to buy a rider of critical illness over your health insurance policy, check the names of the diseases to be covered under the insurance policy. Many times some clauses are present in the policy document to excuse the insurer not to pay the insured amount.

Minimum Stay

To become eligible to claim under a health insurance policy, you need to stay a minimum some hours at the hospital. This is usually 24 hours. However, for some cases such as accidents or certain specified day care procedures or treatments are exempted.

Waiting Period

Some health insurance policies have a waiting period for pre-existing diseases or medical conditions. Suppose somebody has high sugar level the expenses for treatment of diseases due to high sugar level cannot be covered under the insurance. Some insurance companies have as long as 3-4 years as the waiting period for pre-existing diseases obviously the shorter is the period better the insurance.

If you have already bought a bad policy and you have negative experience with the insurer you can change the insurance company with full benefit as if you are continuing the old policy. Want to know how can it be done?

Pre and Post hospitalization Facility

Expenses during a certain period before and after hospitalization is covered under the health insurance policy. The pre-hospitalization period is counted from the admission date in the hospital and the post-hospitalization period is counted from the discharge date. Generally, the insurance covers 30 days of pre-hospitalization and 60 days of the post-hospitalization period under any claim.

Cashless Benefit

The insurance companies have tie-ups with many hospitals through third party administrators (TPA) where the insurance companies directly pay the amount to the hospital. Some expenses which are not covered by insurance companies or beyond the sub-limit has to be settled by insured with the hospital directly.

So before buying, Check the numbers of hospitals or name of the hospitals with which the insurance companies have the tie-ups. If you get the treatment from non-networked hospitals you have to pay the bills first and then claim from the insurance company.

Hospital Network

The insurance companies have tie ups with the hospitals for faster claim settlement and benefitting the customer with cashless claim process. The wider the hospital network you will have better opportunities for treatment without much headache on claim process.

Maximum Age Covered

Insurance companies cover up to a certain age of lifespan. Some insurance companies cover up to 60 years and some insurance companies cover up to 70 years of age. The more age they cover the better is the insurance policy.

Tax Benefit on Health Insurance Policy:

The income tax benefit of a health insurance policy is that you can claim a deduction for the premium paid under section 80D.

You can claim up to Rs 25,000 as the deduction for a financial year. The premium can be paid for a health insurance policy for yourself, spouse and children.

Moreover, if you are paying for your parents you get the tax deduction of Rs 25,000 in a financial year and the amount becomes Rs 30000 when your parents are a senior citizen.

Here is the Top 5 Best family floater Health Insurance Policy:

# Max Bupa Heart Beat Health Insurance Policy:

Max Bupa Heart Beat is one of the health insurance policies which have the option of 2-year policy tenure which means you can buy this health insurance policy at a stretch for 2 years. Also, the premium is less for two years compared to the policy covered for one year.

This health insurance has the option of comprehensive medical cover from 5lakhs to 50 lakhs for hospitalization expenses. It also covers the medical expenses of 60 days before the hospitalization and 90 days after the hospitalization. The policy covers the alternative treatment procedures such as Homeopathy, Unani, Ayurveda etc.

The maternity benefit is applicable under this policy provided you and your spouse both are covered under the same policy and with a waiting period of two years. Moreover, the newborn baby is covered as an insured person from birth without any additional premium till the next policy year, if the maternity claim is admissible under the policy.

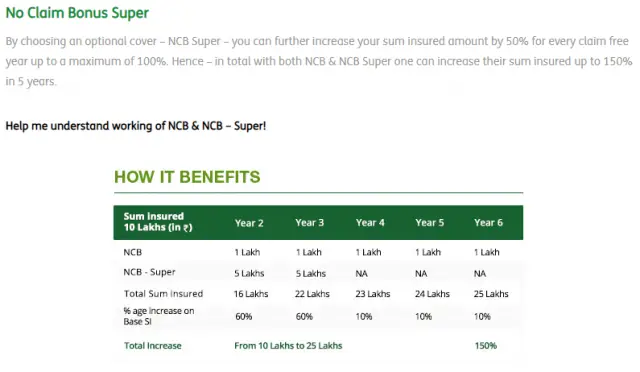

There is no upper age for enrolment for the Max Bupa Heart Beat health insurance policy. The no claim bonus s applicable with an addition of 10% sum assured in every year with a maximum up to 100% of base sum insured.

Benefits:

Max Bupa health insurance company does not have any third party service providers (TPA). The company has dedicated customer service department which processes the claim directly.

Max Bupa health insurance is giving the opportunity of assured policy renewal for life. You don’t have to think of policy renewal as the age increases.

Drawbacks:

Dental and Oral treatments are not covered under this health insurance policy.

Mental and Psychiatric conditions are not covered under this insurance.

Selection of the hospital at least before 72 hours of hospitalization for a planned visit to the hospital.

# ICICI Lombard Complete Health Insurance Policy:

ICICI Lombard complete health insurance policy is a very popular health insurance policy in India which covers yourself, spouse, children, parents and siblings. This policy covers the hospitalisation cost including room charges, doctors’ fee, medicine etc. it also covers the medical expenses for pre hospitalisation of 30 days and post hospitalisation of 60 days.

The various day care procedures do not require 24 hours hospitalisation to claim. Pre-existing diseases are covered under this insurance policy but with a minimum waiting period of 2-4 years depending on the ailment.

The timing of cashless approval is very important when a patient is hospitalized suddenly due to accident or other emergencies. You can get cashless approval within 4 hours of hospitalisation with ICICI Lombard’s complete health insurance plan. Moreover ICICI Lombard has a network of 3600+ hospitals in the country which gives you the freedom of choosing the nearest hospital from your location.

The policy provides you the benefit of life long renewability. Additional sum assured of 10% is added as no claim bonus for every claim free year up to maximum 50%. Policy period can be chosen 1 or 2 years based on the various plans offered.

The alternative treatments are valid for this insurance such as Homeopathy, Unani etc.

No medical test will be required for insurance cover below the age of 46 years and sum insured up to Rs 10 lakhs.

Out Patient treatment cover, maternity benefit and new born baby cover can be added to the main policy as an option. You can also select co pay as an option to reduce your premium for the policy.

Drawback:

The policy does not cover any claim except accident within 30 days of policy start date.

# Religare Health Insurance Policy:

Religare’s “care” health insurance policy comes with an individual as well as family floater category. The policy covers lifelong. If you enroll yourself in this health insurance policy you don’t have to think of renewing the policy at upper age. Once you renew the policy every year you get the insurance coverage.

The policy does not have any upper age limit for enrolment also. If you are thinking of your old age parents who still do not have health insurance due to the age factor can buy this health insurance policy.

It covers 30 days pre-hospitalization and 60 days post hospitalization expenses. This feature reimburses the cost of various investigations, tests, medicines etc. The policy also covers the cost of transport of patient by ambulance and sometimes air ambulance also, if suggested by a doctor.

There is no capping in room rent. The entire expenses for hospital room is covered by the policy and sometimes a private room can also be taken if the doctor recommends.

Annual health check up for every member under the insurance is covered under this Religare ‘Care’ health insurance policy.

This health insurance policy also covers the medical expenses which are incurred by the organ donor in case of an organ transplant surgery.

You can take a second opinion which is reimbursable by the health insurance provider if you are uncertain about your ongoing diagnosis. The alternative treatment processes such as Ayurveda, Unani, Siddha or Homeopathy is also covered in this health insurance policy.

No claim bonus is applicable in next year coverage by increasing it up to 10% and it can be accumulated up to consecutive 5th year and by 50% of sum assured.

# Apollo Munich Optima Restore Health insurance Policy:

Apollo munich Optima restore is one of most poular ans best selling healthinsurance plans in India. It has some uniques features:

- The best feature of this health insurance plan is that the sum assured is restored when you exhaust the entire sum assured for a future claim on account of different illness in the same policy year.

- The policy covers the 2 months of pre hospitalization expenses and 6 months of post hospitalization expenses.

- Noclaim bonus for two consecutive years makes the sum assured double. It means you have bought a plan of rs 5 lakhs cover and don’t claim for consecutive two years the health insurance coverage will be 10 Lakhs after two years.

- If you are fitness freak and always remain active and healthy, the policy rewards you with a discount in premium. it’s a unique feature to fitness enthusiasts.

The other features are as follows:

- Lifelong renewal of policy to remain insured.

- No capping on hospital room rent or sub limits

- Cashless treatment across 4000 hospitals located in kore than 800 cities

- No loading on preiums if the claim is made in a policy year.

- 2 year policy term option which attract less premium

Exclusions:

Any claim made for the treatment within first 30 days of plicy except accidental injury.

Waiting period is 3 years for pre existing diseases.

2 years of exclusion for specific diseases like cataract, hernia, hysterectomy, joint replacement etc.

# Star family health Optima Insurance Policy:

Star comprehensive family insurance plan is one of the few insurance policies which covers dental and opthalmic treatmentson OPD basis.

It has other features and benefits:

- No cap on room rent or other treatment costs.

- 100% sum assured will be restored automatically when when you exhaust with 100% cover.

- The policy covers the maternity claims as well as new born baby from 16th

- The expenses of pre-hospitalization of 60 days and post hospitalization of 90 days is covered under this health insurance policy.

- You get the free health check up every claim free year.

- The sum assured is increased when you renew the policy without a claim in a year.

- This health insurance policy also covers the cost of the second opinion and air ambulance facility, if recommended by a doctor. Air ambulance charges up to 10% sum assured is covered under the policy.

- The expenses of an organ donor is covered under this policy in case organ donation.

- The start health insurance has no third-party administrator. It processes the claim direct in-house.

- A strong network of 8800+ hospitals across India for faster claim settlement.

Drawbacks:

The policy enrolment age is maximum 65 years of age. After 65 years ae only existing polcy can be renewed.

20% co pay for each and every claim for persons above 60 years at entry level and their subsequent renewals.

Ore existing diseases are covered after the waiting period of 48 months of continuous insurance without any break.

Conclusion:

In my view, Max Bupa heart Beat health insurance Policy is the best to choose as a family floater policy becuase of its great feature with attractive premium.

What is your view on the best health insurance? Don’t hesitate to share in the comment box and let me know your view.

If you like the article share it with others.