In today’s’ circumstances, health insurance is having the utmost importance in anyone’s life. Health Insurance is an insurance that covers your medical expenses. Generally, all health insurance providers cover the hospitalization expenses but some of the insurance products cover OPD expenses also.

I think one question which is asked by everybody probably i.e. what the ideal coverage of health insurance is, one should have. At the present days, I think if anyone has some major diseases it can exhaust the entire savings of a middle-class family. So better to have a good lifestyle which can passively help you to be healthy and without a disease.

Apart from that get a good health insurance coverage for our uncertain future. Buying a health insurance is the start of financial planning.

Also Read: Which Life Insurance Policy to Buy

Step by Step Guide – How Should a 25 Year Youth Invest in India

The following nine points to remember while buying health insurance policy either for yourself or an entire family.

-

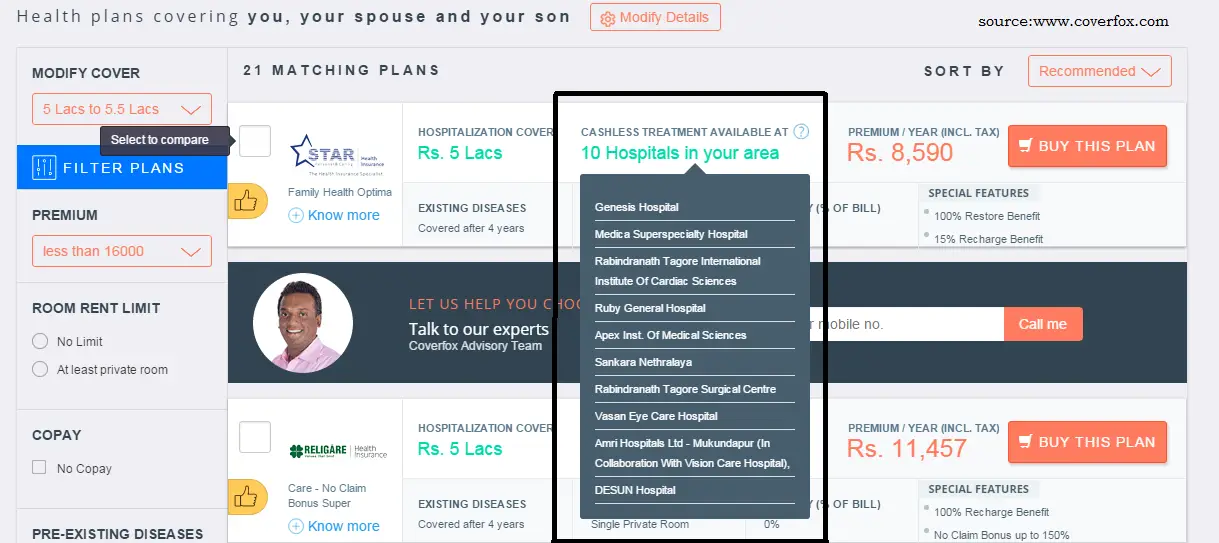

Hospitalization Cover

Hospitalization cover is the amount up to which you will get reimbursement of hospitalization expenses. Now, what is the right amount of cover that you should take? My suggestion is to take the cover of minimum 5 lakhs rupees for a family of 3 members. If you think the amount needs to be higher at any point of the time go for a super top-up policy.

-

Ceiling Amount

Some companies have certain ceiling amount over various types of expenses such as bed charges etc. If the ceiling amount for bed charges is Rs 2500 and the patient is admitted in a bed of charge of Rs 3000, the balance Rs 500 is to be paid by the patient. This is applicable not only to the bed charge but also for other charges like doctors consultation, medical tests, surgery costs etc. Proportionately those charges also have to be borne by the patient. My suggestion shall be of buying insurance with no room rent capping.

-

Types:

There are two types of health insurance policy is generally available in the insurance market. Individual and family floater health insurance policy. Any person can buy health insurance policy as an individual or with the family members like spouse, children, parents etc.

.

The second type is called as family floater policy. However, it is better to buy individual insurance for parents because of high premium due to their age if they are included in the family floater policy.

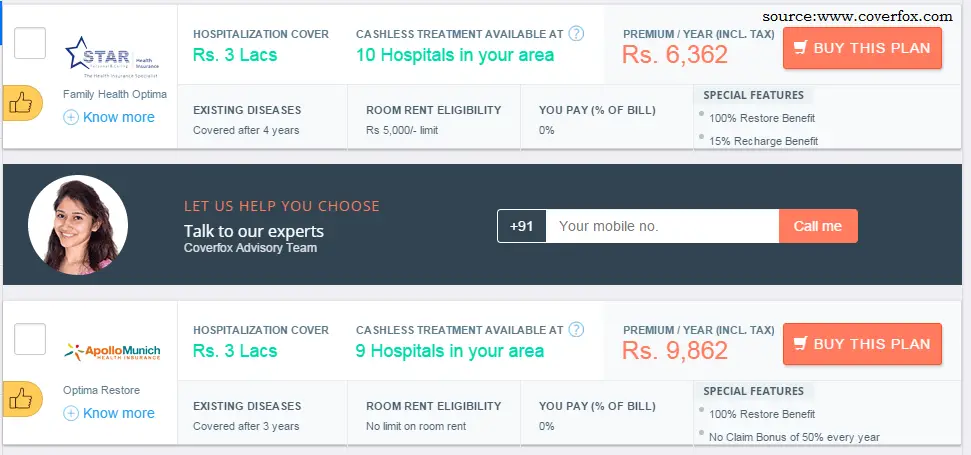

For a 30 year male, the premium is Rs 4500. The same policy costs about Rs 6400 for a 30 year male along with his spouse of 30 years and a son of 1-year-old. in this case the family floater policy is more beneficial.

-

Claim Settlement:

Fast and easy process of claim settlement are the two factors which are to be kept in mind. Besides Claim settlement ratio is also very important. The four public sector companies namely National Insurance, New India Assurance, Oriental Insurance and united India insurance are the toppers in the claim settlement ratio as per the annual report 2013-14 of IRDA.

-

Critical Illness

if you decide to buy a rider of critical illness over your health insurance policy, check the names of the diseases to be covered under the insurance policy. Many times some clauses are present in the policy document to excuse the insurer not to pay the insured amount.

-

Minimum Stay

To become eligible to claim under a health insurance policy, you need to stay a minimum some hours at the hospital. This is usually 24 hours. However, for some cases such as accidents or certain specified day care procedures or treatments are exempted.

-

Pre and Post hospitalization facility

Expenses during a certain period before and after hospitalization is covered under the health insurance policy. The pre-hospitalization period is counted from the admission date in the hospital and the post-hospitalization period is counted from the discharge date. Generally, the insurance covers 30 days of pre-hospitalization and 60 days of the post-hospitalization period under any claim.

-

Cashless benefit

The insurance companies have tie-ups with many hospitals through third party administrators (TPA) where the insurance companies directly pay the amount to the hospital. Some expenses which are not covered by insurance companies or beyond the sub-limit has to be settled by insured with the hospital directly. So before buying, Check the numbers of hospitals or name of the hospitals with which the insurance companies have the tie-ups. If you get the treatment from non-networked hospitals you have to pay the bills first and then claim from the insurance company.

-

The cost of preventive health checkup:

Some insurance companies are including the cost of health checkup once a year with the insurance.

Before buying the insurance, read the terms and conditions carefully to understand the options.

Also Read: Top 5 Tips to Save Money on Health Insurance Premium

Hope, the above points which you will consider choosing the Best health insurance policy. There is no right time to buy the health insurance. Even if you are healthy, young or you have a policy by your employer, please consider of buying a health insurance on your own.

Share the article with the world.

Comprehensive article which has touched all the main points which are required to compare health insurance plans. There is a website called Turtlemint, wherein one can enter their details and get a match score of the health insurance plan which suits the best.

Thanks for the information.