You need some quick money. Your credit score is low and you are not getting a formal loan from any financial organisation. What will you do? This is a very common scenario not for one or two but for many. In one of my article, I have written on some alternative ways of getting a loan when your credit score is low. In this article, we will discuss another way of borrowing which is through peer to peer lending sites.

Borrow Money Online:

Presently, people are approaching banks, NBFCs for a loan. The interest rate is low when the risk is less. Those who have the sound credit score and good repayment history are being offered loans by financial institutions. The process of getting a loan is also cumbersome. To offer a formal loan to creditworthy borrowers and making a process easy and quick, the peer to peer lending concept has been started with the help of technology. The person who has some surplus money can easily help out the person who needs the money with the help of these lending sites.

Do you want to check your credit score for free? Here is how you can check.

There is no tedious process to follow for borrowing as well as lending. If you want to be a borrower you need to put some personal information such as PAN, Address, social profile etc. They will check your profile, verify and approve. After approval, you can list your requirement of money including the purpose for which you want the money. Lenders can see the requirement and offer you the full or partial loan.

Borrowers can receive offers from multiple lenders and one lender can offer the loan to multiple borrowers to diversify the investment of the lender and minimizing the risk.

Also Read: How to take loan against LIC policy online

Perspective as an Investor:

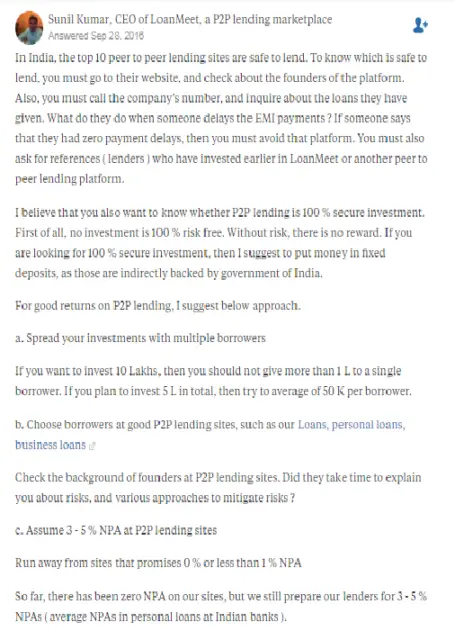

If you want to invest in an alternative investing method, you can try these p2p lending sites as an investment platform. The typical return is 15%-20% by lending money to different borrowers. You should assess the risk of lending money before you give the money from the borrowers’ profile. You can diversify your investment by lending money to different borrowers with different risk profiles.

The lender will receive the money monthly which consists of principal and interest both. So there will be regular cash flows to your account.

Perspective as a Borrower:

Peer to peer lending is also one of the media of taking a loan when you are in the need of money. You can think of personal loan from banks and NBFCs. The process is easy and lengthy for a formal loan from those institutions. Moreover, if somebody lacks a sound credit history, they are denied of taking a loan. Credit card loan is having a very high-interest rate. In this circumstance, peer to peer lending can be useful.

In most cases, the aggregators or p2p lending sites are very small in size with low overheads which determines the transaction fee or processing fee less.

The interest rate is not so high such as credit card loan. The loan is easily processed and a minimal fee for the services makes it more accessible to the borrowers.

Also Read: How To Pay off Credit Card Debt in Five Smart Ways

Is Peer to peer lending legal in India?

Peer to peer lending is in a very early stage in India. They are just started a few years back. Right now, there is no regulation for the peer to peer lending. Recently Reserve Bank of India (RBI) has said that it will come up with rules and regulations to regulate the sectors within few weeks.

The lending sites are to be registered as non-banking financial institutions or NBFC. Once the rules are out, I shall update the article.

Best Peer to Peer Lending Sites in India:

There are numerous websites which are started to promote peer to peer lending in India. I have searched extensively on the internet and prepared the following list. If I have missed out any site, you just comment so that I can include them in the future. If anybody knows about any newly launched site, please bring it to my notice. I shall be happy to include them on this list.

Faircent started in 2014 and it is one of the oldest start-ups in the field of peer to peer lending business. Mr. Rajat Gandhi who has 20+ years of experience is the CEO and founder of this company.

It has been awarded as Start-up of the year in 2016 by Silicon India. They are giving personal loan starting from 12% interest rates. Also, investors can have as high as 30% return as it claims in the website.

Lendbox is also a start-up based in New Delhi. It is very transparent in its process. You can check ‘How it Works’ section to know more about the site.

Lendenclub is one of the fastest growing peer to peer lending sites in India. Mr. Bhavin patel is the CEO and Co-founder who has also rich experience in credit risk, financial operations, fund raising etc.

It was started in late 2015 to increase financial inclusion by bringing access to the credit to the common man.

i-lend was started to give more access to the credit to the borrowers as well as better option of investing who has surplus money.

Cashkumar was founded by the alumnus of IITs and IIMs. In addition to peer to peer lending, the borrowers can get loan from different banks and NBFCs also.

Credy is the peer to peer lending platform where AADHAAR is the must. It is using financial analytics platform for authentication.

Peerlend is a start-up based in Hyderabad. It is continuously working towards quick and hassle-free personal loan to individuals efficiently.

India money mart is an online marketplace or platform which brings the borrowers and lenders to enable a transaction between them on their own terms and conditions.

Fundhouse is using funsight analytics platform which is designed in-house for authentication of borrowers and extending the credit. It charges zero penalties if you prepay the loan.

Loanmeet is a peer to peer lending platform which is aiming to provide personal and business loans to all individuals and businesses from Tier-1, Tier-2 and Tier-3 cities.

Any time loan is an app by which the borrowers can easily borrow and the process is very quick. It has been selected in a mentorship program by Yes Fintech.

Quickcredit is a peer to peer lending marketplace which provides instant, flexible, short-term cash loans to borrowers and high returns to the investors.

It is probably the newest platform in this segment. It was started in October 2016. They are removing the friction in the borrowing process with the use of robust technology.

How safe is Peer to Peer Lending?

Every investment has a risk and p2p lending is also not an exception. Lending through the p2p lending sites consists of some risks. You can diversify your investment with multiple borrowers in this case.

A beautiful answer in Quora from Mr. Sunil Kumar of Loanmeet as follows:

Conclusion:

From the above, we can easily interpret that peer to peer lending is very easy and reasonable from a borrower as well as lenders’ perspective. The success of this sector depends on the verification process which is followed by the companies and thus ensuring no fraud. It is too early to comment.

We need to watch how the companies are growing and the model is evolved over a period of time. As the RBI is stepped into regulating this sector, we can easily believe that p2p lending sites will be a safer place to borrow as well as invest in future.

If you have used these sites for borrowing or lending please share your views and experiences.