Category: INCOME TAX

What is the best income tax saving option for salaried employees in FY 2018-19? The FY 2018-19 has already been started and you need to plan your income tax …

The finance minister re-introduced the long-term capital gain (LTCG) tax in the budget for the financial year 2018-19. It is proposed that investors have to pay 10% Long term …

Are you searching for Best income tax savings options? You should take care of your tax savings at the beginning of the financial year whether you are a salaried, …

We are on the verge of completing another financial year 2017-18. We need to invest money to save on income taxes. Salaried persons have to submit their actual investments …

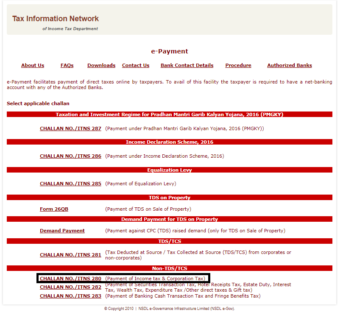

As the name suggests the advance tax means the income tax which is to be paid in advance. If you have income tax liability of Rs 10000 or more …

You are filing the income tax return and while checking the 26AS tax credit statement. Then you see that there is income from fixed deposits and others but you …

The time has come to file the income tax return for the Assessment Year 2017-18. But do you know whether you have to file income tax return or not? …

Suddenly on 27th April, 2017, one of my friends has got an SMS stating to submit FATCA self-declaration form to Central record keeping Agency (CRA) else account will be …