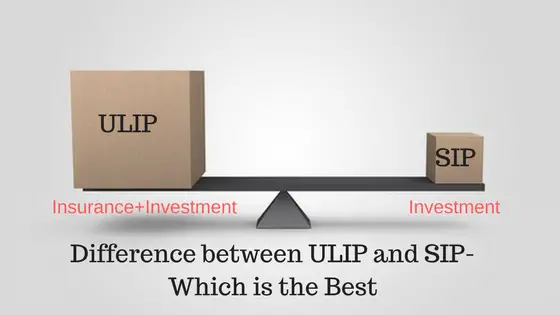

I saw some insurance agents are convincing customers about the investment while you are insured. This combining of insurance and investment is applicable for Endowment insurance as well as ULIP. Endowment insurances give you a return 6-7% where as a ULIP can give you a better return more than that in a longer term as it is exposed to equity.The insurance advisors are telling customers that they will get a high return as mutual fund SIP with being insured. They consciously hide the risk exposure due to ULIP and its charges. Here we will discuss the difference between ULIP and SIP. Those who still don’t know what type of insurance you should buy I will recommend you to read one article ‘Which Life Insurance Policy to buy’.

What is ULIP?

Unit Linked Insurance Policy (ULIP) is an investment cum insurance product in which the return is market linked. The return from the investment is not guaranteed like endowment insurances. These policies invest in any of the asset class such as equity, debt, gold, government bonds etc. Here part of the policy premium goes to the insurance cover and part of the premium goes for the investment purpose.

What is SIP?

Systematic Investment Plan (SIP) is a method of investing. It is not a financial product. The term ‘SIP’ got popularity when it has been linked to the mutual fund. We will mean SIP as mutual fund SIP in this article.

When you accumulate the money in a mutual fund systematically means monthly, quarterly, yearly is called as SIP. The investment in a mutual fund via SIP is a very good way of accumulating wealth and reach your financial goals. The return of SIP is attractive when you stay invested for a longer term.

Also Read: SIP Vs RD: Which is better for Investment?

Lock-In Period:

ULIP has lock-in period of five years. If you don’t continue paying the premium in the next year, the charges will be deducted from your already invested amount. So, continue with your premium of ULIP policy. Moreover, there will be income tax consideration if you stop or surrender the policy before five years. We will discuss in detail in the next paragraph.

ELSS has a three-year lock in period. The every investment through SIP in an ELSS fund has been considered as a fresh investment and a separate lock in of 3 years from the invested date. If you have continued 3-year SIP in an ELSS fund and stopped there and want to withdraw the entire amount you have to wait for another 3 years which means a complete of 6 years.

Tax Benefit:

You can get the tax benefit under section 80C of income tax for the premium for ULIPs which you pay. Here, the premium should be less than 10% of the sum assured if it is bought after 01st April 2012. The premium may be less than 20% of sum assured in case it is invested before 01st April 2012. The premiums are to be continued in the subsequent years to avail the tax benefit.

The maturity from ULIP is also tax-free if the above percentage criteria of premium are matched. You have to pay tax on entire maturity amount if the criterion of premium percentage is not matched. The applicable tax is as per the tax slab of an individual.

If you surrender the policy before five years, you will have to add the premium which you have paid earlier in your income and it will be accordingly taxed.

Also Read: Income Tax Planning for Salaried Employees

The ELSS funds are the only category of a mutual fund on which your investment can get the tax benefit. There is no tax reversal in case of ELSS fund. You cannot surrender ELSS policy during the lock in period. You can stop paying the SIP in any time.

The investments under ELSS has Long Term capital Gain Tax. The tax is at 10% on the capital gain it it crosses Rs 1 Lakh in a financial year.

If you are interested to know the detailed comparison between ULIP and mutual fund I would recomend you to read other article ULIP Vs Mutual fund What is better after LTCG Tax.

Charges:

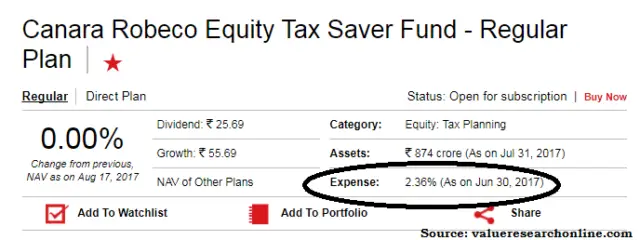

The charges of ULIPs are higher than the fund management charges for ELSS. The premium allocation charges are very high during the initial years of investment in ULIP. These charges are getting reduced as the year continues. As the charges are getting reduced the effective invested amount is getting increases. That’s why ULIPs maximize the return if you continue it more than 10 years. There are other charges such as fund management fee, policy administration charges etc. I have come across a fantastic article how ULIP charges will reduce your return from the investment on freefincal.

ELSS funds have fund management charges in terms of expense ratio. The expense ratio of an ELSS fund is typically 2%-3%. If you invest directly in the mutual fund the expense ratio will be even less and ultimately you will get a better return.

Switching Option:

The ULIP invest the premium in various funds such as equity, debt etc. You can change these funds of investment according to your requirement. During early stages of life when your risk taking capability is high so you can allocate your asset more to equity and less to bond funds. As you grow older and decreases the risk taking capability fi your asset more to the bonds and debt funds than equity funds.

In case of ELSS, there is no option of switching your investment. You have to keep your investment for a three year period. You can only withdraw the money after completing three years from the date of investment.

Conclusion:

It is advised by many investment gurus that never combine the insurance with investment. Both should be separate. Buy insurance to cover the future risk while you are accumulating wealth for your future goals. So always prefer to have a pure insurance cover.

A term insurance of adequate cover can serve the purpose. You can select a mutual fund or other products for investment according to your goal, time to achieve the goal and risk taking capability.

Share the article with others. 🙂