PAN card is the most important document to identify all the financial transactions in India. PAN is the short form of Permanent Account Number that is the ten alphanumeric issued by the Income-tax department. This is most useful to fill the income tax returns and almost in every financial transactions.

PAN is considered as the major document that gives identity and helps to get all the benefits from the government. It helps the government to track the income of the person, and they know the tax details. The pan card is the valid document that is issued to all the Indian citizens, NRIs, OCI and PIO. Minor and underage also get the benefit of a pan card.

Benefits of PAN Card:

1. Income Tax return filing:

Pan card is compulsory to file income tax returns. Any individual and company should have a valid pan card number to file income tax returns without the pan card, it is difficult to get the benefit of income tax returns.

2. Provides the Identity Benefit:

PAN Card provides the valid identity proof to anyone. Whether you are a student, professional, industrialist, business person and farmer. It is valid and approved by the government of India. We have various identity proofs by the Government of India like Aadhaar card, voter card. PAN card is also a trusted valid identity card to any individual. You can produce anywhere as an identity proof like banks, schools and other institutions.

3. Beneficial to open a Bank Account:

If you have a valid Pan Card number then you can open a bank account easily. It gives multiple benefits to the bank. You can open an online bank account if you have a pan card. Pan card gives many financial benefits to the account holders. It is easy to open various types of bank accounts like saving, fixed deposit accounts with a pan card.

4. Sale and Purchase the land and revenue:

You need to require a valid PAN to purchase or sell the land and properties. The government made compulsory use of PAN card to know the assets and income source of anyone who is purchasing or selling the land and properties. If you deal with selling and purchasing land so it is necessary to have a valid PAN card that will help to deal with all types of financial-related functions.

5. Salaried Person:

The pan card gives benefit to the salaried professionals that file their income tax returns. Companies deduct TDS for their employees and deposit to the IT department. Salaried professionals do not need to know their income returns. The TDS certificate issued by the company is traced automatically by the income tax department due to their pan card. Pan Card is a unique number and all the financial transactions are easily traced by the income tax department.

Also Read: How to link PAN Card with Aadhaar

6. Starting a New Business:

If you are planning to start a business then a valid pan card helps you get all the required certificates like GST numbers, Professional Tax registration, TDS number and license to start the business. Whenever a new business starts the various types of the certificate are necessary to run a business smoothly. The income tax department easily traces the transaction held in the business. This is required to open a current account for business.

7. Helpful for Saving:

Saving is a great habit to secure your future. You will get all the saving benefits of mutual funds, Savings accounts, Demat accounts, fixed deposit and post office savings etc. Savings are the most important part of our life. If we don’t save for our future then we face many difficulties. The income tax department easily traces the saving records and estimates the tax benefits.

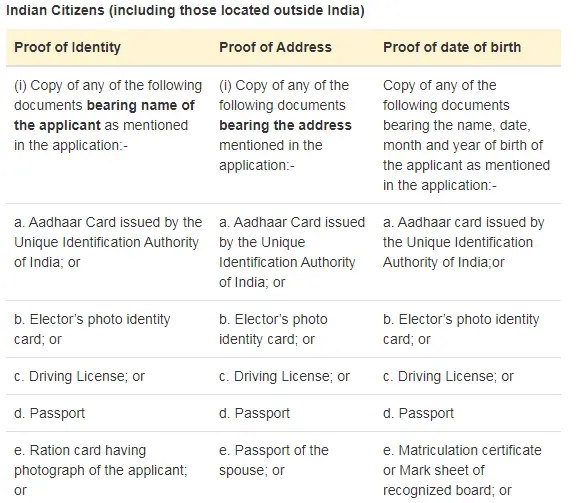

Who can apply for the PAN card:

Anyone who is above the age of 18 years can apply the pan card for themselves and their minors. The applicant must be a citizen of India and have valid proof of their identity. A valid address proof, identity proof and date of birth proof are required to apply for a pan card. Generally, the Aadhaar card gives the three benefits of identity, address and Date of birth proof. Most of the people apply with Aadhaar card, and it gives all the benefits to applicants.

To know the full list of document click here.

How to apply for the PAN card in India:

The income tax department provides the pan cards through NSDL and UTIITSL. Instant pan card applies with minimum cost online. A valid aadhaar card is required with an updated mobile number. You can apply for an e pan card that is valid as a physical pan card. It is an instant process to get a pan card number.

The requirement to apply for online PAN card:

- A Valid Aadhaar card that does not link with any other PAN

- Mobile number should be registered with Aadhaar card

- Complete Date of Birth in the Aadhaar card

- Does not hold any other PAN card

Procedure to apply for PAN card:

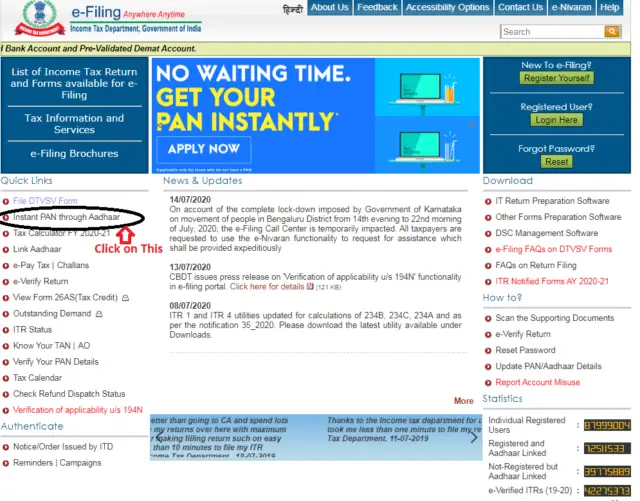

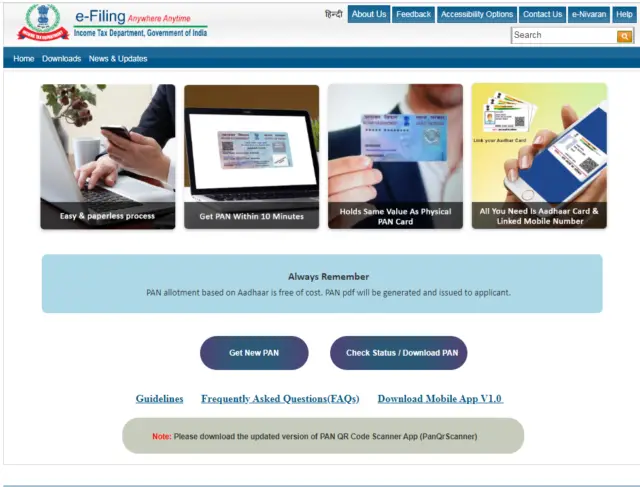

- Visit the E-filing site of income tax and click the instant pan through Aadhaar

- Click on Get new PAN. Fill the Aadhaar number and proceed

- You get an OTP on your register mobile number

- Submit the OTP

- After submitting an acknowledgement number will be generated

- Keep it secure the acknowledgement number, it will use in future

- You will be updated by a massage and email in your registered email id.

Download instant E-PAN

After completing the registration process, you need to follow the below steps to check the e-pan status. Go to the “instant pan through Aadhaar” link on the e-filing website of income tax and check if the status pan is allotted or not. If the pan is allotted then the download option will appear, you can download the pdf file.

You can also apply through NSDL and UTIITSL, they are also providing E-Pan cards and physical services.

Apply for E PAN card through NSDL:

- First of all, go to the NSDL website

- Click on the new pan card option, Select category and fill you with all information. Alternately you can go directly with this link.

- After submitting the form, you will get a token number then click to continue

- A new form will open, you will see three options

- Submit digitally through E-KYC and E-Sign (Paperless)

- Submit Scan image through E-Sign

- Physically submit document

- Choose the first one, e-KYC option

- After selecting the E-KYC option, you need to feel up your Aadhaar card number and other details.

- In the next step, you have to enter the area code, AO type, Range code and AO number of your area.

- Select the document for address proof, identity proof and Date of Birth proof.

- Aadhaar verified online with a valid OTP

- After verification, you need to pay the fees approximately 110 rupees

You will be notified via mail or massage the process of pan card. The acknowledgement number helps to track the pan card status.

Apply for E PAN card through UTIITSL:

The UTI Infrastructure technology and services limited is a government-authorized company and it provides all the financial services. You can also apply for an E-pan card from the UTI website.

You can apply for a PAN card with an Aadhaar card that has a verified mobile number.

Just follow these steps to apply for the pan card

- Go to the UTI website

- Click on “for pan card”. Click for directly going to the application page.

- Select the pan card as an Indian citizen or NRI.

- Then apply for a new pan card (Form 49A)

- After that, a new window open, select the digital mode option

- Select Aadhaar based E-KYC option and select both option physical pan and e-pan card

- Submit and a reference number generated

- Fill your detail and aadhaar number

- Your address, Date of birth and identity automatically captures from aadhaar card.

- An OTP generate to verify your identity

- Pay the payment

- You will receive an acknowledgement number that will help to track the pan card process.

These are the three ways that can help you to get an e pan card easily. You can choose any one method to get an e pan card.

Benefits of E-PAN card:

- E-pan cards are digitally signed pan cards issued by the income tax department. The QR code helps to find the complete details of the pan cardholder.

- It is an easy and time-saving method to get an e- pan in a few days.

- Charges are minimum to get E-PAN card

Validity of E-PAN:

It is valid and authentic. It is approved by the income tax department. This is paperless and free of cost

E-KYC Benefits:

- This is the easy method, you don’t need to acquire all the documents, it is the paperless process. They don’t need to upload the photo, identity proof and date of birth certificate. You can get a physical and online pan card.

- Easily approved: e-Pan cards easily approved by the income tax department. The process takes little time compared to a physical pan card. Due to being digitally approved via aadhaar card, it’s easy to process. The physical cards need more time. Somewhere it takes 1 to 3 months to generate a physical pan card.

- Does not give stress: The e-KYC process is easy and does not give stress to the applicant. The applicant does not need to check their status online regularly. Anyone can get their e-pan within a week. The physical pan approval takes more time. Sometimes we just wait for the approval and at last, they refuse to process further.

- No need to go to the income tax office: There is no need to go to the income tax office to check the status of the application and have all the reasons to be denied. In the physical process, a photo can delay your application and they demand another photo or application to take action further.

- Saves time and money both: The online process saves our time and money both. The agents demanded 300 to 500 applications and they didn’t guarantee the application. Sometimes the applications are rejected due to various reasons and we have to resubmit the application with another 500 rupees. It is a lengthy process and takes more time. Whereas the online process is easy and takes only just a few days to provide the e- PAN card. The charges are minimum, and you do not need to spend any extra money on a pan card.

- No need to send documents: in the physical method the agents require to provide the photocopy of aadhaar and recent photos of the applicant. In some cases, you have to courier your document to agents or the income tax department. In online e-KYC applications, the applicant does not need to submit their documents. The aadhaar based e-KYC updates all the information automatically.

- Aadhaar approved pan card: In the online process, the aadhaar plays an important role. If you don’t have an aadhaar card then you don’t apply for an online pan card. It makes it simple to apply for an e pan card. Aadhaar cards are an excellent way to apply for a pan card online.

Checklist before you apply for E PAN:

Make sure your aadhaar should be linked to your mobile number. The mobile number must be yours not of any other family members. If you did not update your mobile number with Aadhaar so you should update it immediately.

Linking mobile numbers with Aadhaar provides many benefits to you. You can get many benefits with your Aadhaar number. You can open a bank account, withdraw provident fund and many more online services. In above all the process you need a valid Aadhaar card that should be updated with your latest mobile number.

Also Read: How to change mobile number for Aadhaar Card

Conclusion:

E-PAN cards are easily approved by the government. The Government Issue only in E PAN cards to any individual. This makes it easy for the income tax department to trace all the revenue sources of any person.

These three methods are easy and safest but the best one is getting an E-PAN through an income tax website. The approval is easy and takes less time compared to others. So you should always apply for an online PAN card, it saves your time and money both.

If you like the article share it with others. Share your experiences while applying E PAN in the comment box.