Retirement planning is an important aspect of financial planning. Maximum saving of working life goes for the financial security of retired life. It is very difficult for common investors to calculate the future need of steady income by which they will be able to survive. This article will help you how to do retirement planning by yourself step by step.You can do your retirement planning by following the below mentioned simple steps:

- Calculating the present expenses

- Factor the expenses with the inflation factor

- How Much money is required at the time of retirement

- Calculate the amount of money to be saved to achieve the goal

- How to invest the money

Now, we will go step by step of retirement planning. We will take you through an example which will help you to understand better. Mr. X is of 30 years old and he wants to retire at the age of 60 years. He has two children and has simple goals such as meeting his children’s’ higher education expenses and marriage expenses and obviously the retirement of himself. We will discuss here his retirement goal only. You can repeat the calculation for other goals also.

# How to do Retirement Planning – Step by Step Guide

#1. Calculating the present expenses:

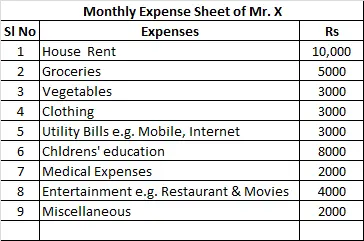

First, you draw a table. Fill one column of the table with the nature of expenses and the other column with the money you have spent for that purpose. Sum them up and you will get the total monthly expense of your family.

From the above table, we know that Mr. X has monthly expenses of Rs 40,000.

Hence, Total yearly expense: (Rs 40,000×12) = Rs 4,80,000

You may consider any other expenses which you think it may appear in your case.

Here some of the expenses which are present now will not be there during retired life. In the same way, some of the cost head will increase due to old age.

As an example, the child’s education will not be there during retired life and the medical cost will increase at that time.

You can tweak the figures according to your requirement and calculate the present expenses.

Are you not able to figure out your monthly expenses? You can take help the expense tracker apps for two, three months and check your expense category wise.

#2. Factoring the expense with Inflation:

The expenses what we have calculated is the present expenses. The price of all the things is increasing day by day or in another way the value of money is decreasing. It is termed as inflation. At Rs 100 what you are able to buy today you cannot buy the same thing after 10 years. You need to calculate the value of present expenses at the time of retirement.

In the case of Mr. X it is after 30 years when he will retire from the service.

We have seen that in recent years inflation is continuously decreasing. In 2016 inflation rate is 5%. (Source: Inlfation.eu). We will consider inflation rate as 6% in our calculation.

However, if you want to be more conservative you can take the inflation rate as greater than 6%. I don’t think the requirement of assuming more than 6% as it will be an exaggeration and not a realistic assumption.

#3. How Much money required at the time of retirement:

Now, coming to the retirement expenses, the present yearly expenses is to be converted to future expense during retirement. We assume that the present standard of living is maintained during retirement.

Yearly expenses during retirement=Present Expense x (1+Inflation Rate) ^ Number of years left for retirement.

Now calculating the retirement fund for Mr. X = 4,80,000 x (1+6%) ^ 30 = Rs 27,56,876

The above money i.e. Rs 27,56,876 is the yearly requirement of Mr. X during the retirement.

We have not taken the inflation during retirement years (60 years age to death) for ease of calculation.

#4. Calculate the money to be saved to achieve the Goal:

In the previous step, you have found out the yearly requirement of corpus during the retired life. The money should be invested in such a way that you get the monthly/ yearly income as per your requirement.

The retirement corpus will be invested in an annuity product which will give you 7% (assumed) return. You will continue to receive the money until death and the invested amount will be handed over to the nominee.

Hence, to get yearly income, you need the corpus = Expense/Interest during retirement

In case of Mr. X the corpus required: Rs 27,56,876/7% = Rs 3.94 Cr

There are many pension plan in the market by which you can invest monthly and during retirement, it will convert to annuity plan and gives you the monthly income as the pension.

You can calculate the return for a fixed number of periods also. Suppose, your expected life is 80 years. So you can buy the annuity for 20 years. (The difference between death age and retirement year). Though it is not a good idea to predict the death you can calculate considering an age of your choice.

To calculate this, you have to use a simple formula in Excel.

Present value of annuity = PV(RATE,NPER,PMT,[FV],[TYPE])

Where

RATE – Yearly interest rate (Consider 7%)

NPER – Duration of withdrawal of pension (20 years in this case)

PMT – Yearly pension (Rs 27,56,876)

FV[Optional] – Future Value of an investment. If omitted it is assumed to be zero.

TYPE [Optional] – 0 means payable at the end of the period and 1 means payable at the beginning of the period. We will consider 1 as we need at the start of the year.

Hence, the present value which is required to buy the annuity – Rs 3.13 Cr

We will take Rs 3.94 Cr as the retirement corpus to save in the next steps of our calculation.

#5. How to save the required Money:

You have found out corpus to be required at the time of retirement. For Mr. X it is at 60 years age.

You need to calculate the monthly savings by which you can reach the goal at the specified time. Mr. X has 30 years in his hand to save Rs 3.94 Cr. (You can calculate considering Rs 3.13 Cr or any other figure)

Using the Excel formula

Monthly Savings= PMT (RATE,NPER,PV,FV,[TYPE]

Where

RATE – Monthly interest rate (1%)

NPER – Tenure for Investment (consider 360 months as deposit frequency is monthly basis)

PV – present value, if any (leave blank if you don’t have)

FV – Future value (Amount need to be saved)

TYPE [Optional] – 0 for the end of the period and 1 for the beginning of the period.

Hence, Mr. X has to save =PMT (1%,360,,39400000,1) = Rs 11,162

If you take 10% as the yearly rate of return, the monthly saving would be Rs 17,285.

Also you can tweak the tenure and interest rate to fit the calculation for you.

In the first case, we have considered 1% rate of return per month which means 12% per year. Is it high? In my view, Mr. X should allocate his asset based on his age. As the age is 30, the thumb rule says 70% asset should be in equity and 30% should be in debt.

Now considering, 15% return on equity and 6% in debt the rate of return is coming around 12.3%. Hence our consideration of 12% is on the safer side.

In this regard, note that I have not accounted the changing asset allocation for ease of calculation.

It is clear from the above fact that 70% should be invested in equity and balance 30% should be invested in debt products.

So, if you want to invest Rs 10,000 monthly towards your retirement planning, Rs 7000 is to be saved in direct equity or equity mutual fund and 30% is to be saved in debt products such as PPF, bank fixed deposits, recurring deposits etc.

A systematic investment plan to an equity Mutual fund is a good way to start for investing for retirement planning. Monthly savings into the PPF account will serve the purpose of investing in debt. You can also consider VPF option if you are salaried and already have EPF account with your employer.

In this regard, I want to emphasize one factor is that start early to invest. The money saved in the early years of your life will make a huge difference in your corpus.

In our example, if Mr. X would have been started from 25 years age he had to save Rs 6065 only to achieve the retirement fund. If we consider in another way, that he started from 25 years age with the Rs 11,162 he would have been landed with retirement fund of Rs 6.1 cr which is much more than Rs 3.94 Cr

Conclusion:

I am quite confident that now you can do your own calculation for retirement. The calculation is not the only important thing to do. You need to act accordingly to achieve the goal also. So start investing if you have not started yet as you know start investing early can make your job easy. If you have already started investing identify the investments which will be used for your retirement savings.

You may be interested in Best investment plan for monthly income without risk.

Happy Investing! Share the article. 🙂