Post Office MIS:

The Post office monthly Savings scheme is the widely used monthly income scheme in India. You invest as the lump sum and take monthly income from the investment. The minimum investment is Rs 1500 and maximum investment is Rs 4,50,000. If you are holding the account jointly, you can invest up to Rs 9,00,000. This is open to all the citizens of any age. The current interest rate for the post office savings scheme is 7.5%.

There is no tax benefit in this scheme while investing as well as the income from the investment.

Suppose, you are planning to invest of Rs 450000 in the Post office monthly savings scheme. The interest for the investment in a year is Rs 33750. Hence, monthly you will get Rs 2812.5 in your savings bank account held with the post office.

The maturity period of this scheme is 6 years from the investment. You cannot pre mature your deposit within the first year. If you pre-mature the deposit within 1-3 years, a penalty of 2% shall be deducted from the deposit amount. A penalty of 1% on deposit amount shall be charged if the deposit is broken after 3 years.

Also Know: Post Office Savings Schemes – Features & Interest Rates

Bank Fixed Deposit:

Bank fixed deposits are the safest product to invest. It fetches a guaranteed rate of return which is fixed during the investment.

Bank monthly income fixed deposit is the product by which you will get interest every month on your fixed deposit held with the bank. The fixed deposit is linked to a savings account and the interest earned is credited to the savings bank account every month.

Some of the banks have minimum and maximum limit for this type of account. You can take the interest payout option as quarterly, half yearly and yearly also. The liquidity of the bank fixed deposit is high as you can always break the deposit and withdraw the whole money.

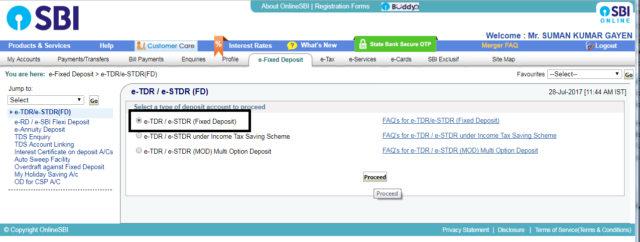

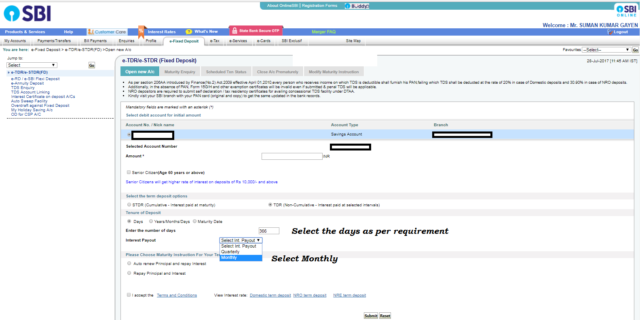

You can invest in monthly income fixed deposit right now if you have internet banking facility. I have checked for SBI and the facility is available in internet banking login.

- Go to Onlinesbi and log in.

- Click on e-fixed deposit

- Select the interest payout option as monthly

- Click on submit

Senior Citizen Savings Scheme:

Senior Citizen savings scheme (SCSS) is a small savings scheme for the senior citizens of 60 years age and above in India. If you have superannuated from the service and between 55 to 60 years age can avail the facility of this account. This facility is available through a network of Post offices and designated banks.

The deposit amount should be in multiple of Rs 1000 and maximum of Rs 15 lakhs can be invested in one account. The tenure of deposit is 5 years and it can be extended to 3 years more. The present interest rates for senior citizen savings account is 8.3% (July 2017 to September 2017).

The investment to this scheme is tax-free under section 80C of income tax. You can also withdraw the money by pre-maturing the deposit. You can withdraw the money after one year by paying a penalty of 1.5% of the deposit amount and after two years by paying a penalty of 1% of the deposit amount. The interest amount from the account can be credited into the savings account. The interest rate is calculated annually and credited to the savings bank quarterly.

Annuity from Insurance companies:

An annuity is an investment product by which you can receive monthly income for rest of the life or for a stipulated duration. Annuities are mostly sold by Insurance companies. Annuities are of two types, deferred annuity, and immediate annuity.

The deferred annuity is the investment product in which you accumulate the money and then the money is used to buy an annuity when you require the monthly income. NPS and APY are the examples of a deferred annuity.

The immediate annuity is the investment plan in which you pay the lump sum and get monthly pension immediately after the investment.

An annuity plan can give you monthly pension throughout the life. Now a day the interest rates are decreasing day by day. There is no risk of reinvesting the money into a lower interest product and hence, you need not worry about the lower income. There is no limit on maximum investment what you can do in this product.

Also Read: Should You Invest in Pradhan Mantri Vaya Vandana Yojana (PMVVY)

You cannot withdraw the capital which is invested in annuity plan. This is the greatest disadvantage of the product. You cannot pre mature the invested amount and you have to continue with the monthly income even if you don’t have the requirement.

Conclusion:

From any of the above products, you can easily have monthly income by investing the lump sum. Senior citizens savings scheme is the only product which is only for senior citizens. Other investments can be done by the people of any of the age group for a regular income.

Share the article.