I have recently experienced negative views on using credit cards from one of my friends. He is telling that he has stopped using a credit card as he finds that it creates most of the nuances in the personal finance. Those who are disciplined and control their expense, the regular using of a credit card has unlocked a significant value to them. I have also found using a credit card is very useful in my financial journey and there are tons of reasons to use a credit card.

That’s why I want to write the advantages of using a credit card. I feel you can also be benefited by using a credit card properly.

-

Contingency Amount:

The credit card can be used a source of contingency amount when you have an emergency of money. If you have some medical emergency or accident you need some quick cash. This is required to pay the hospital bills or some other miscellaneous purposes. You can spend through the credit card in those days without much hassle.

I personally have once been benefited in case of a medical emergency of my friend. I did not have liquid to pay the bill at the time. The credit card has saved me and later my friend has repaid the credit card bill.

-

Interest-free Period:

A credit card can give you a 50 days interest-free credit period. If you buy a product at the start of the billing cycle today you can pay the bill after 50 days. You cannot get any interest free credit by some other products.

Suppose, you are planning to buy a LED TV which has the price of Rs 50,000. You have used a credit card a bought the TV on the first day of the billing cycle of the credit card. Now you are paying the bill after 50 days. Considering 4% interest of the money which is in your savings account will fetch you an interest of Rs 270 approx. You can save small amount when you purchase any high-value item by deferring the actual payment by using a credit card.

-

Offers & Discounts:

Most of the credit cards are bundled with various offers and discounts. You can get the discount or cash back when you shop through online and offline in partner stores. There are various offers and discounts are going on round the year for booking a flight ticket and paying the utility bills. In this way, you spend less money for the same amount of value.

You can also get the benefit of free insurance from some of the credit card providers.

Are you convinced to apply for a credit card?

if yes please read the article Five Important Things To Know Before Applying For a Credit Card and if the answer is no continue reading this article.

-

Reward Points:

The credit card issuing banks offer reward points on each and every transaction of a credit card. This is one extra direct benefit you can have other than the interest-free period. Some card offers 4 points per Rs 100 spending.

You can accumulate the reward points and redeem with gift vouchers, discount coupons, gifts etc. as per the availability in reward catalogue of the bank. You can donate the same value of the reward points also to a charitable organisation or NGO.

Also Read: Best Citibank Credit Cards India 2018: Benefits & Review

-

Building a Credit History:

Banks are comfortable with giving a loan who has a good credit history. If you are not exposed to credit till now you can start thinking about it. When you pay the credit card bills in time obviously your credit score will be improved. A sound credit score of 750+ is required for getting a loan to be approved.

You can access your free credit score once in every year. Check your free credit score with CIBIL today. You can start using a credit card and paying the bills in time will be useful for improving your credit score obviously.

-

EMI Facility:

You can easily convert a large spending into equated monthly installment (EMI) of your choice. This type of loan fetches lower interest compared to other loans and very easy on processing.

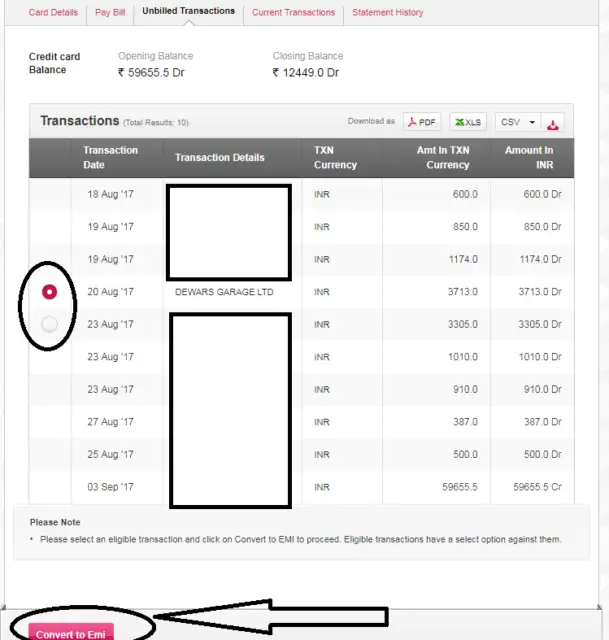

Suppose you buy a product with some price. If the transaction is higher than a specified limit set by the bank you can have the option of paying it in EMI. Axis Bank has a minimum limit of Rs 3000 to have EMI option on a transaction. If I log in to my account I can see the statement and beside the transaction, there is an option as ‘Convert to EMI’. If you click on it the money is to be converted to EMI. But remember processing fee and interest will be charged for this service.

-

Analysis of Expense:

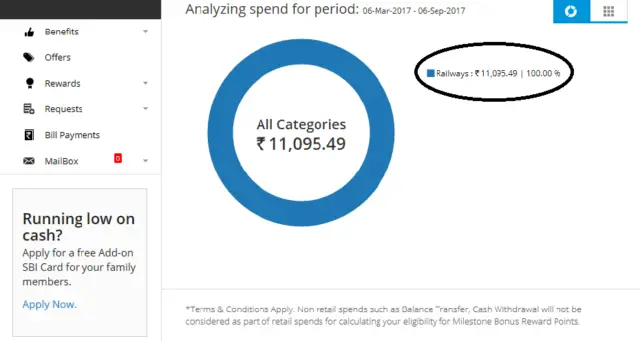

As you are able to see the credit card statement, you can easily analyse your expense. You can make your budget or track whether you are maintaining your budget or not? Most of the credit card providers have also the facility of showing the spending pattern in the statement as well as online. You can analyse when you log in to your credit card account.

Using a credit card is a good way of tracking my expenses. I use a credit card and pay for all my regular expenses from it. I can easily track my monthly overall expenses as well as how much I have spent on what. BY easily tracking the expenses where I have spent more I try to curb that expense in the future.

The below screenshot is from SBI IRCTC card and I have used that card for railway ticket booking only.

-

Security:

If someone fraudulently uses your card, call the customer care of the bank. In most of the cases, you will not be responsible for any charges of your card if it has been stolen.

I have never experienced this issue but I have got feedback from my friends about the fraudulent use. He has reported the bank after seeing that the card is used by someone else and it was stolen. He blocked the card quickly and bank was completely supportive and did not charge him the transacted amount.

-

Convenience:

When you use a credit card, you don’t have to carry cash with you. A credit card is always good because it is easy to handle and you can carry easily without much worry. If you travel abroad, you don’t have to think about the currency conversion.

Some international credit card does not even charge the foreign transaction fee. If you are a regular traveler to different countries this will be worthwhile for you.

-

Short Term Loan:

You can easily get Short term loan from credit card provider. The sweet part is you don’t need to do any paperwork for applying for the loan. A personal loan is taken by many of us for different reasons.

If you have a credit card approach to your bank for a short duration loan with less than one year repayment period. Bargain with the bank and try to fix the interest rate at par with the personal loan.

Conclusion:

The using of a credit card is extremely rewarding when you use it with properly being within your limit. The ease of paying with a credit card is the starting of overuse of the card. When you overused the credit card and spent beyond your repayment capability the problem starts.

Many people have been bogged down by spending more on a credit card and later unable to repay the entire amount.

A credit card debt trap is one of the difficulty to be escaped. It is always advised to use the credit card within your mean or capacity to repay. You can use an expense tracker app to be within the budget. If you are disciplined and extremely serious with your finances use a credit card responsibly.

You can use an expense tracker app to be within the budget. If you are disciplined and extremely serious about your finances use a credit card responsibly.

Please share your opinion about using a credit card.

Purchasing online products on EMI is the most lucrative benefit that credit card offers. Thanks for such informative post

nice article dear…………

Thanks..