Arbitrage fund is a type of mutual fund which generates value for the investor with the differences of price across the markets. Typically an equity mutual fund buys a stock and sells a stock in the same market when it grows to a higher price. The arbitrage funds buy stocks from a market and sell in another market and makes profit. The returns are dependent on the volatility of the underlying asset. Here We will know how arbitrage funds work, taxation, whether you should invest or not and 5 best arbitrage funds to invest.

How Arbitrage Funds Work

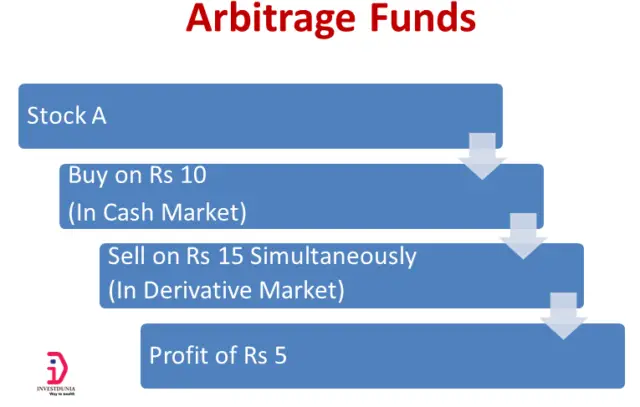

Arbitrage funds buy and sell the stocks in the different exchanges or markets. Suppose the price of stock A in the cash market Rs 10 and derivatives market is Rs 15. The fund manager buy the stock in cash market and sell in the derivatives market to make a profit of Rs 5. As the price difference is very less across the markets, the fund managers need to trade on higher volume to make a good profit.

The derivatives market is the different from cash market as it deals with future contracts and options. The future contracts of stocks reflect the value of the anticipated price of the stock in the future. In the cash market the price of the stock is the present value of the stock.

When a stock is bullish in nature and market is expecting a higher value of the stock, the price of the stock in the future market is high. Fund managers buy the stock from the cash market and sell in the future market.

In the same way, when a stock is bearish the price of the stock in the future market is less. Fund managers buy the stock in the derivative market and sell the stock in the cash market to make profit.

At the end of derivative contract price is to converge for both the market. As an Example Stock A is bought at cash market at Rs 100 and future contract sold at Rs 105. Now if the stock’s price is Rs 107 at the end of contract fund manager gets a profit of Rs 7 from cash market and Rs 2 loss from future. Hence a net profit of Rs 5 is made from this trade.

Arbitrage Funds Risk

As the arbitrage funds are making money due to the price differences in the different market they are less risky. When the market is volatile the opportunity is more. Hence the return from arbitrage fund is also better in time of market volatility.

When the market is stable and the arbitrage opportunities are less the return from the fund is also less. Generally an arbitrage fund can invest in bonds and securities not more than 35% as the total portfolio. So when the arbitrage opportunities are less these funds may give you a return less than liquid fund also. Moreover considering the failure of Franklin Ultra short term bond fund you have to be careful about the investment to the bonds by the fund.

The redemption of Arbitrage funds take 3-5 days which means it needs 3-5 days to credit the money to your bank account after you put the redemption request.

Taxation:

The arbitrage funds are becoming attractive to investors due to its tax benefit. These funds are giving return as short term debt funds or liquid funds. But the tax treatments of these funds are similar to equity funds.

If you sell or redeem the fund after one year of buying the fund it is called as long term capital gain. As the long term capital gain tax is nil for an equity fund up to Rs 1 lakh (10% for more than Rs 1 lakh), the arbitrage fund also have same tax benefit.

The fund attracts short term capital gain tax when it is sold within one year of buying the fund. Short term capital gain is taxed at flat 15%.

As this is giving a return similar to debt funds and tax treatment like equity funds the arbitrage gives a clear advantage in terms of return on investment.

If you are on highest tax bracket go for arbitrage fund which is beneficial considering post tax return.

Also Read: How to Calculate Capital Gain Tax on Stocks, Mutual Fund

5 Best Arbitrage Funds to Invest

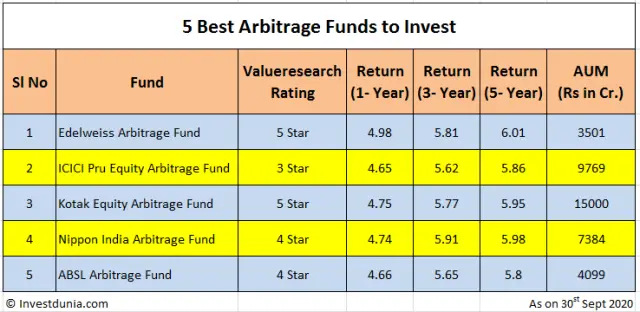

I have searched the last 5 year returns of arbitrage funds on value research. The Top 5 arbitrage funds are the followings:

- Edelweiss Arbitrage Fund

- ICICI Prudential Equity Arbitrage Fund

- Kotak Equity Advantage Fund

- Nippon India arbitrage Advantage Fund

- Aditya Birla Sun Life Arbitrage Fund

Most of the funds have been launched in 2007 and 2008. Most of the funds have expense ratio of less than 1% and a sound track record of past performance.

The 5 year return of all the funds is in line with debt funds and around 6%. All the funds are available to invest directly also. You will get more benefit when you invest in a direct mutual fund.

Take an example of ICICI Prudential Equity Arbitrage Fund whose expense ratio for direct fund is 0.45% vs 0.98% in case of regular fund. The 3 year return of this fund is 6.2% for direct plans and 5.6% for regular plans. So you have clear advantage of 0.6% more return for a direct fund investment.

Final Words

The return from arbitrage funds very much dependent on market volatility. Sometimes it is difficult to get return as the market is less volatile. Hence 6 months to 1 year span is good for investing in the arbitrage funds.

Moreover, fixed deposit is good for a very short period of time and for the individuals who are in 5% tax bracket. Person in the 30% tax bracket may invest in in arbitrage funds and to have a better post tax return.

Liked the article. Share it with others.