As you have completed another beautiful year and starting of a new year, it is the time to introspect your decisions which you have taken in this year. It is not only to review the past decisions but also to get rid of the mistakes and take a fresh look at better future and prospects.

Habits cannot be created in one day. You have to practice good behavior regularly to make it a habit. Similarly, you can build some financial habits to save money. In this regard, I would suggest you read a book Rich Dad Poor Dad which can be an eye opener for your financial habits.

In this article, you will find some good financial habits which one should foster and some bad habits which one should get rid of. Another important point you have to remember is to start early. An early start can help you to achieve your financial goal very easy. You can save Rs 5 lakh in 15 years by investing very small amount i.e. Rs 1050 per month. If you want to save the same amount in 10 years, you have to invest Rs 300 extra per month.

Also Read: How to be rich-Six must things to Practice

Following Eight Habits which you should foster:

-

Disciplined Investing:

Discipline is the key factor for creating wealth. If you are disciplined about investing, you can create a good amount of wealth even if you have less income. Systematic investment Plan (SIP) is the key wealth creator because of its discipline. A mere amount Rs 1000 investment per month in an equity mutual fund in Birla Sun Life Tax Relief 96 fund for 20 years can build your wealth Up to Rs 32 lakh.

So, start early and take the advantage of time and be invested regularly. In these 20 years, the fund has witnessed so many bumps in the market, but only the time discipline pays off at the end.

Also Read: Benefit of Savings Early – Know Power of Compounding

-

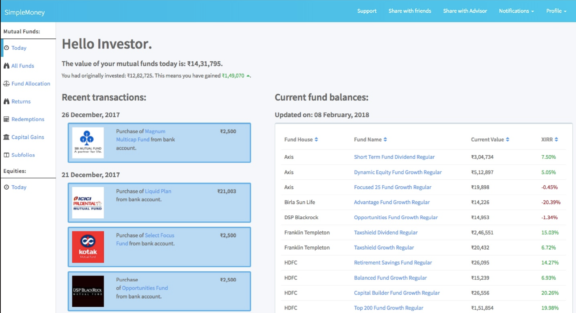

Review your Portfolio:

In the busy schedule of yours, it is very difficult to track all your investment regularly. Investment is not only the putting money in a good fund and rest but also to nurture it whether it is giving desired output or not. Make your investment according to your goal and fix a timeline for that. If your investment goal is a project and that project should have fixed timeline. A project with no deadline means no project.

You have to review your portfolio performance at least once a year to reach the objective. If some funds or stocks are not performing well, take a decision of dropping it. Make fresh investment or switch the funds else the combination of both options.

-

Be within budget:

Presently, young earners are more inclined to spending rather than saving. It is very difficult to restrict your wish towards having a car or a costly mobile. But it will be a great habit if you actually suppressed these costly wishes. For that try to differ your buying. Realise the actual need and then take the decision of buying. There is no point of buying a costly mobile when you have to use it for the call and some basic apps.

First, you figure out the actual requirement and then decide to buy according to your requirement. Don’t jump over to the discounts and installments. You will not only spend more but also you may be trapped into costly credit card dues. So, always try to be within your budget and avoid unnecessary spending. If you find it difficult to be within the budget you can take the help these smartphone apps.

-

Exit when Required:

The exit from an investment is as important as the entry to an investment. We all are searching for the good investment option. After investing, we forget about the investment. Though investment creates more wealth in the longer horizon, it is really necessary to review and drop if its performance is not satisfactory. Take the help of stop loss option for stocks. Set the target as 10% or 20% in which you can bear the loss. Don’t wait by expecting that stock will be rebound even if it is dropping abysmally.

-

No Credit Card dues:

Credit card is a good thing when you are using it within your control. If you use it for buying something and forget to pay the bill in time, it will be costly. Even if you are able to pay the partial due, you will end up with paying interest on the full billed amount. Don’t use the credit card unless it is really necessary. Use the credit card to that extent up to which you have the balance to pay the credit card bill. And also remember not to roll up the credit card bill and get into a costly debt trap.

Also Read: How a Credit Card can ruin your Finance and How to Protect it

6. Build an Emergency Fund:

An emergency fund is required in case of job loss or medical emergency. It is always advised to have six-month income as an emergency fund. You should also remember that money should ideally not to be in a savings account. A normal savings account can fetch 4% interest which is very low. The emergency fund is to be easily liquidated. The money can be parked in a savings account which gives a return of 6%-7% interest. You may invest the money in a liquid mutual fund which gives you slightly better return than the savings account i.e. 9%-10%. The sweep in account can also be a good option for the purpose.

Also Read: Contingency Amount – Where to park

7. Pay Bills in time:

Always pay bills for telephone, gas, electricity in time. If you miss the date of paying these bills you have to pay the fine which is not very less compared to the bill amount. You can use reminders, budget apps or auto pay option of the credit card if you find it difficult to track the bills. The biller option in the net banking can also be useful for this purpose.

8. Leave your bad Habits:

Bad habits like smoking the cigarette and chewing tobacco are one of the great causes of expense. It has indirect spending also. You are spending money on buying the cigarettes. At the same time, you are paying more premiums towards your life insurance and health insurance. If you get rid of this habit, you can save money directly and indirectly both.

The above eight habits which you should always foster to save more and I am sure that some of these you are already applying in your life. You need to follow it more and more. I suggest you read an article about passive income if you want some extra money without leaving your job.

Share the article with the world. 🙂