Employee Provident Fund Organisation (EPFO) is continuously working for the betterment of the services provided to subscribers. Universal Account number (UAN) was launched to attack the problem of multiple PF account of a subscriber.

The EPF subscribers have one UAN irrespective of their number of employers. This has also eased the process of process of PF withdrawal. UAN is required to be linked with AADHAAR to get the EPFO services easy.

The seeding of AADHAAR number with UAN is mandatory for online claim submission. Here is how to link AADHAAR with UAN and PF account online.

The linking of AADHAAR with PAN is also mandatory for all tax return filers. Here is how you can link AADHAAR with PAN with 3 simple ways.

Employee Provident Fund (EPF):

EPF is the retirement benefit scheme for salaried individuals. Many of us are heavily dependent on EPF for retirement corpus. The automatic deduction from salary you get has made it a very popular product for long-term savings.

Moreover, you get the contribution from employer (Know more on the contribution rate of EPF). Hence a large portion of savings is going into EPFO. You should be aware of the latest development in EPFO so that you don’t have to face difficulties while transferring or withdrawing the EPF.

UAN:

UAN is a 12 digit number allotted by EPFO for EPF subscriber. The UAN is one unique number to one subscriber even if he has multiple PF accounts. Those who have multiple PF accounts need to combine all the accounts under single UAN.

It also made the transferring of PF accounts from one employer to another employer extremely simple. Even you can withdraw your PF with UAN easily.

Seeing the utility of UAN it is beneficial to update it with AADHAAR and use the seamless services from EPFO.

How to link UAN with AADHAAR

There are two ways by which you can link existing UAN with AADHAAR number. If you don’t have UAN until now contact your employer.

-

Using E-KYC Portal of EPFO

You can link the AADHAAR number with UAN using e KYC portal of EPFO. You have got your UAN but still not activated it? UAN needs to be activated before you link with AADHAAR. Follow the steps to link AADHAAR.

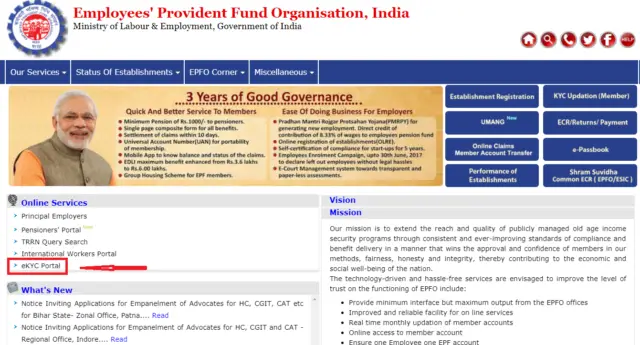

- Visit Employees’ Provident Fund Organisation website

- Click on e-KYC Portal

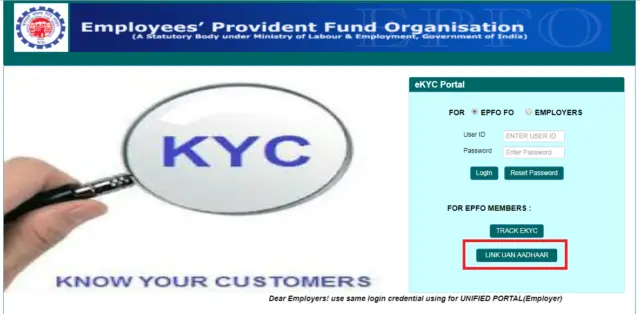

- Click on Link UAN AADHAAR for EPFO members.

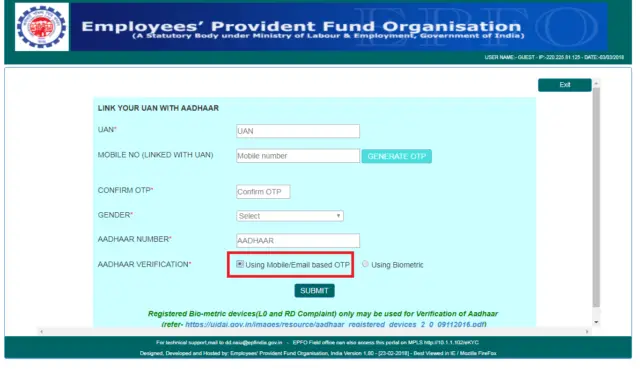

- Put your UAN and mobile number

- Confirm the OTP what you have received in your mobile number.

- Put the AADHAAR number

- Choose the option of AADHAAR verification, OTP or Biometric

- If you choose OTP option the mobile number should be linked with AADHAAR

- Click on submit and you get the OTP on your mobile linked with AADHAAR

- Confirm the OTP and your linking of AADHAAR with UAN is complete.

- If you choose biometric option use the registered biometric devices only.

-

Using UMANG App:

EPFO has introduced the facility of linking the UAN with AADHAAR via UMANG app. Here is the step by step for linking.

- Download the UMANG app if you did not install yet.

- Input your UAN

- An OTP will be sent to the UAN registered mobile number

- Confirm the OTP

- After verification of OTP, put AADHAAR details

- An OTP will be sent to AADHAAR registered mobile number

- After OTP verification, AADHAAR will be linked with UAN

Conclusion:

The EPFO is continuously exploring the ways how the services can be made easy to subscribers including the claim settlement and transferring the PF account etc. They have also set the claim settlement period for 5 days. The processes have become easier by linking the AADHAAR with UAN.

Share the article.