NPS has been evolved as a good financial product for retirement planning. The government is trying to make it more attractive by giving extra tax benefits to the investors. Now,it is announced that 60% of the total maturity amount is tax-free.

As you are already aware of the financial planning steps, you have to do the planning for your retirement also from the very beginning of the career. Although, there are various instruments to save tax are available in the market, NPS is one of the attractive products for financial planning for the retired life. Those who are self-sufficient and can manage their money well they may avoid the pension plans.

Are you struggling of planning your retirement corpus? Follow these simple steps and you can do it on your own.

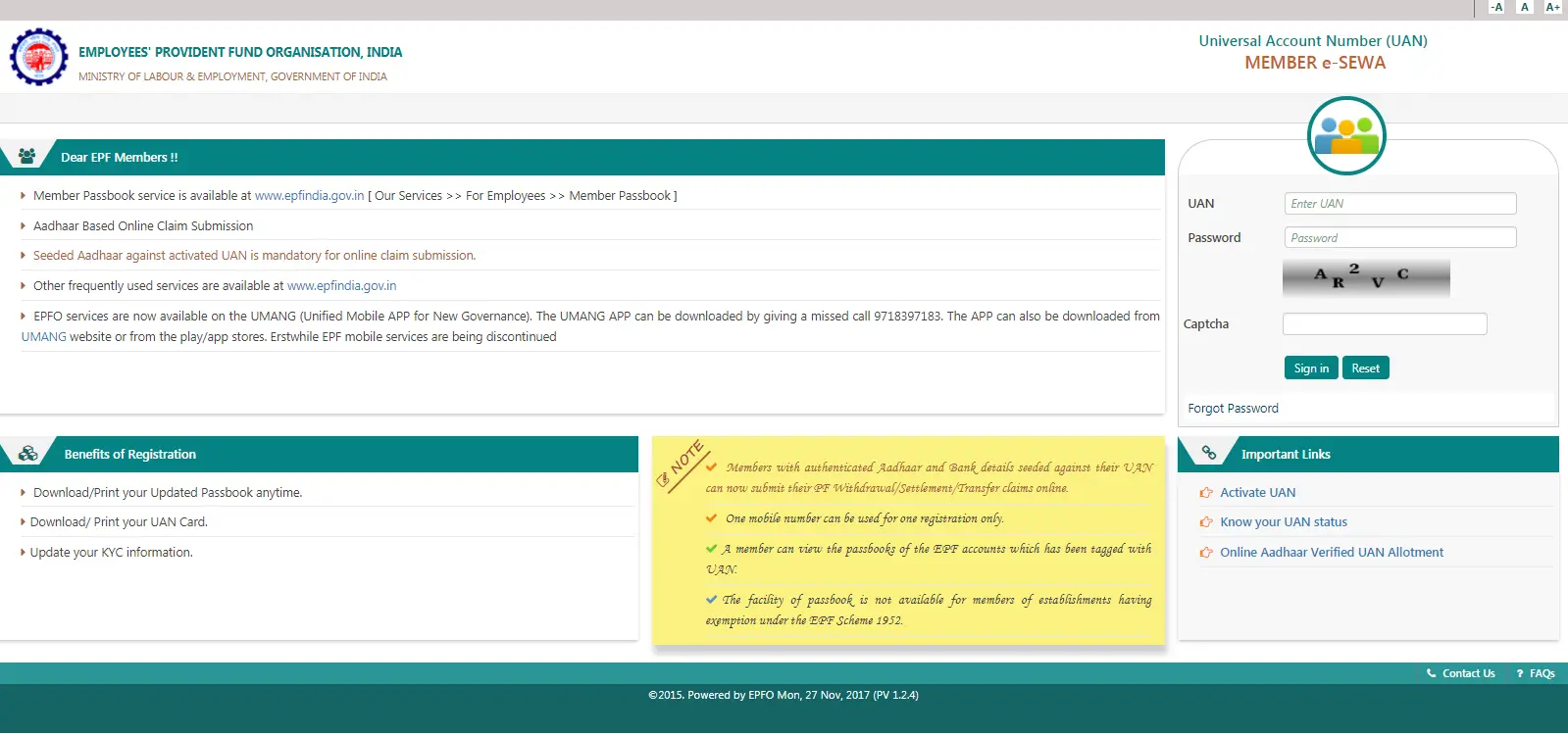

What is NPS:

Tier-I account:

This is the non-withdrawable permanent retirement account into which the accumulations are deposited and invested as per the option of the subscriber.

Tier-II account:

This is a voluntary withdrawable account which is allowed only when there is an active Tier I account in the name of the subscriber. The withdrawals are permitted from this account as per the needs of the subscriber as and when claimed.

Tax Benefit:

The 40% of the maturity amount is to be invested in an annuity plan. The income from the annuity plan is still taxable at the slab rate.

Also Read: ELSS or PPF – Where to Invest for Tax Saving

Returns from NPS

So now the question is, should one open an NPS account to avail the additional 50,000 tax deduction?

Suppose, You invested 50,000 a year in NPS for the next 30 years and get a return of 10%. You will get Rs. 86.64 Lakhs before taxes.

You have total maturity amount as tax-free. So you have the maturity amount at the retirement age is Rs 86.64 Lakhs.

In the other way, assuming you are in the highest tax bracket i.e. 30% and you have left with Rs 35,000 for investment.

Now, you invest this in an equity mutual fund for 30 Years at 12% return (Min). You will get Rs. 89. 87 Lakhs.

Even paying the 30% income tax and investing in equity mutual funds, you will be able to beat NPS return.

Should you invest?

The NPS is a good product because of its low expense, equity exposure, disciplined investing for the retirement from the beginning. At the same time, it has created some negative points such as

- It has a very long lock-in period. If you start investing at 30 years age, you have to wait for another 30 years for maturity and that too is not the full extent because 40% is to be put in an annuity. Poor liquidity is the biggest issue which NPS is dealing with though there is an option of partial withdrawal.

- If you are planning to retire early you cannot withdraw the money up to 60 years age. In the present job scenario can you guarantee about your job so long? I am not.

- The annuity products are giving 5-7% return during the retirement age. That amount is again taxable. Even if you are gaining more, the low interest of annuity is restricting you from taking the benefit.

Also Read: Features and How to Apply Atal Pension Yojana Online

NPS Vs PPF: What Should You Select for Retirement Planning

Hence, please do not Invest in National Pension Scheme to save Tax only. However, if PFRDA withdraws the mandatory limitation of saving the maturity into an annuity fund, NPS will be an attractive retirement scheme due to its lower expense and equity exposure.

However, Those who are not very interested in managing their money at the old age and want to depend on the NPS to have a regular or monthly pension in their hand they can consider the NPS as an investment option. You want to open NPS account and don’t know how to do. Here is the guide to open an NPS account.

Share the article with the world.