A substantial part of the effort for financial planning goes to the retirement planning. The most critical part of financial planning is the planning for retirement. People are taking this as most important due to its long-term nature. As we cannot visualise the distant future, we end up with the wrong estimation. We feel good by fantasizing the retirement life in a country home or in a spacious bungalow with all the old age amenities etc. To make it real, we need to act from now.

It is always advised to start the saving for retirement from your very first income. Allocate your investments properly. Take the equity route via Systematic Investment Plans (SIP) of Mutual Funds. Even after managing your money up to the retirement age it can be very difficult for you to manage at the old age and drawing a pension for your regular expenses easily. This can be eliminated through National Pension System (NPS). This article will tell you how to open an NPS account.

The biggest advantage of the NPS is that you can spend your retired life with the monthly pension with the help of National Pension System (NPS). The government of India (GOI) has introduced NPS in 2014. Since then, GOI has taken many steps to project it more attractive towards the investors. With this NPS, GOI also wants social security for the aged persons those who don’t have a formal pension from their employer.

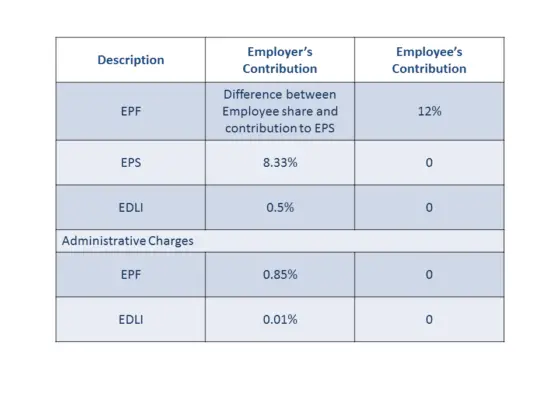

Though Employee Provident Fund (EPF) is a good retirement investment option, one can opt for NPS also apart from EPF. As the interest rate of EPF is decreasing it would be a wise choice to have some fund on NPS where equity exposure is more to have good retirement corpus.

NPS is slowly becoming a good investment for the private sector employees and professionals who do not have a formal pension after their retirement. GOI is also using NPS for the pension of the government employees. If you want to know the benefits, comparison with mutual funds read NPS: Should you invest or not? Those who don’t want to go to this entire nitty gritty can opt for NPS.

Presently you can open an NPS account online also and complete the total procedure within 30 minutes maximum. Here is how to open an NPS account.

Also Read: Best Pension Plans in India and What Should you Choose for Your Retirement

Offline Process to open an NPS account:

- Download the Subscriber Registration form

- Fill up the relevant details like Name, Date of Birth, and Gender, PAN no etc. and attach photographs.

- Enclose Know Your Customer (KYC) documents

- Once the form is filled, submit the form to the nearest Point of Presence (POP) – SP (Service Provider). To see the nearest POP, click here.

- After the account is opened, you will receive a “Welcome Kit” with unique Permanent Retirement Account Number (PRAN) Card and the complete information which you have provided in the Subscriber Registration form.

Online Process to open an NPS account:

You can open NPS account either by bank account and PAN no or ADHAAR number

- Open the link

- You have to be ready with your mail id and mobile with you for registration

- The information is to be filled up same as offline mode.

- If you are opening the NPS account with PAN and bank account, PRAN will be available subject to KYC verification by the banks. Total of 23 banks are listed which agree to verify the KYC for NPS.

- Scan and Upload your photograph and signature. It is not mandatory if you try with ADHAAR.

- Make online payment a minimum Rs 500.

- After the account is opened, you will receive a “Welcome Kit” with unique Permanent Retirement Account Number (PRAN) Card and the complete information which you have provided in the Subscriber Registration form. You will also get internet pin and telephone pin within 15 days of application.

Recently Pension fund Regulatory Development Authority has launched an app for easy access to the NPS account.

List of Pension Funds:

- LIC Pension Fund Limited

- SBI Pension Funds Pvt. Ltd

- UTI Retirement Solutions Ltd

- HDFC Pension Management Co. Ltd.

- ICICI Prudential Pension Fund Management Co. Ltd.

- Kotak Mahindra Pension Fund Ltd.

- LIC Pension Fund Ltd.

- Reliance Capital Pension Fund Ltd.

- SBI Pension Funds Pvt. Ltd

- UTI Retirement Solutions Ltd

- Birla Sun Life Pension Management Ltd(Yet to commence Business)

Compare the performance of above funds and decide your investment.

Therefore, open an NPS account and start saving for your happy retired life. 🙂